Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 02, 2015

Bond ETFs remain unfazed amid market volatility

The recent volatility in bond markets led some investors to flee fixed income ETFs, but the asset class has a track record of remaining resilient in the face of outflows and price volatility

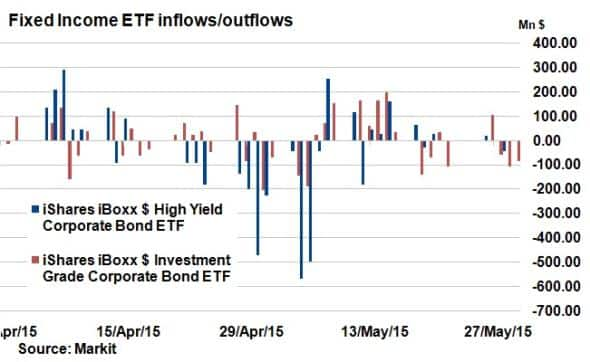

- The iShares iBoxx $ ETFs saw over $1bn of outflows in the opening days of May

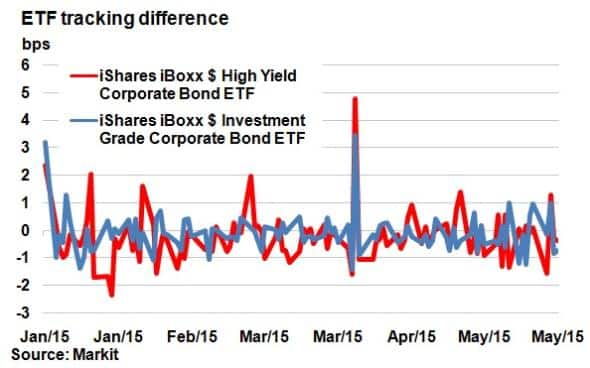

- These two ETFs never deviated by more than 1.5bps from their NAVs over recent outflows

- Bid ask spreads in the two funds have proved resilient to the recent bond volatility

Fixed income ETFs have continually attracted investor money year after year, providing a convenient way to access attractive returns in OTC bond markets, both high yield (HY) and investment grade (IG).

The largest HY ETF by AUM, the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), has grown from $4.88bn to $15.44bn in AUM over the last five years, marking a 200%+ increase. Similar growth has been seen on the IG side, with the biggest IG ETF, the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), expanding from $12.29bn to $21.7bn AUM.

But the surge in demand for bond ETFs has also raised questions around liquidity and ability of ETFs to unwind underlying bond positions during bouts of market volatility. Since the financial crisis, trading volumes have fallen and depth has deteriorated as regulation has forced market makers to hold fewer bonds in their inventories. Highly leveraged HY issuers also face the prospect of higher rates in the future, which handled badly could lead to a sharp selloff.

Market volatility

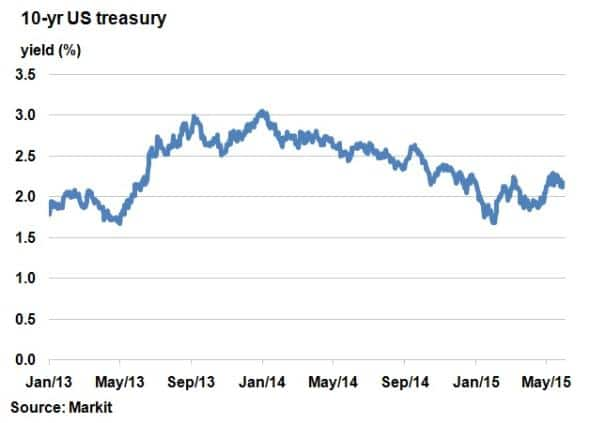

The question of whether fixed income ETFs can weather sharp selloffs in their underlying bonds has been tested on several occasions since the financial crisis. The most prominent example was 2013's "taper tantrum' following the US Federal Reserve's indication that it would be unwinding its third QE programme, led to a period of heightened volatility. Treasury bonds, which drive US dollar denominated corporate credit, saw 10-yr yields rise from 1.72% to 2.96% between May and September 2013.

Smaller selloffs were also recorded towards the end of 2013 and at the start of 2015. The most recent occurred towards the end of this April, when 10-yr yields rose 30bps in just a few weeks. With a Fed rate hike potentially imminent, this recent example of heightened volatility in bond markets may provide an indication of things to come.

Selloff after volatility

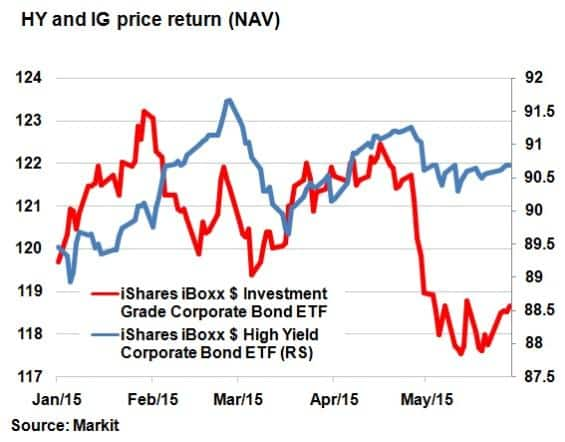

The recent selloff in mid-April to mid-May hit returns on IG credit, unwinding previously made gains year to date. On a price return basis, the LQD's NAV fell around 4%. Conversely HYG, which was less sensitive to underlying interest rates, held up.

LQD and HYG weren't immune to this recent bout of volatility, with over $1bn exiting the iShares iBoxx $ High Yield Corporate Bond ETF on May 5th - 6th.

No liquidity crunch

Despite fears over a possible liquidity crunch, LQD and HYG proved resilient in the face of both large outflows and price pressure. Indeed, daily tracking difference of the funds from their underlying assets never deviated more than 1.5bps from the underlying net asset value.

Liquidity in LQD and HYG themselves also remained plentiful, with the bid-ask spread remaining tight during the recent volatility. HYG's bid ask spread remained tightly anchored at the 1bps mark, while the LQD traded within its recent averages. In contrast, during 2013's "taper tantrum', bid-ask spreads widened to 7bps for LQD and 3bps for HYG.

The figures bode well for investors fearful that ETF liquidity might dry up amid bouts of underlying bond volatility. With uncertainty around interest rates rises later this year, if past performance is anything to go by, corporate bond ETFs will remain robust.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-Credit-Bond-ETFs-remain-unfazed-amid-market-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-Credit-Bond-ETFs-remain-unfazed-amid-market-volatility.html&text=Bond+ETFs+remain+unfazed+amid+market+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-Credit-Bond-ETFs-remain-unfazed-amid-market-volatility.html","enabled":true},{"name":"email","url":"?subject=Bond ETFs remain unfazed amid market volatility&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-Credit-Bond-ETFs-remain-unfazed-amid-market-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bond+ETFs+remain+unfazed+amid+market+volatility http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-Credit-Bond-ETFs-remain-unfazed-amid-market-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}