Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 02, 2015

Media sector CDS bond basis tightens in August

Oil & gas credits continued to exhibit the widest positive basis, while media names saw their negative basis tighten.

- 78 Markit CDX NA IG constituents trade with a CDS-bond basis greater +/- 50bps

- Barrick Gold saw its basis move from positive to negative as the price of gold rebounded

- Four of the top ten credits that exhibited tightening in the positive direction were media companies

The CDS bond basis captures the relative value between a cash bond and CDS contract of the same credit entity. Loosely defined, it is the difference between a bond's swap spread and its CDS spread.

CDS bond basis = CDS spread - cash bond spread

Fluctuations in the basis give rise to arbitrage trading opportunities, since theoretically the basis should be zero. To take advantage of these opportunities a positive basis would involve selling the cash bond (pay spread) and concurrently selling protection (receive spread) on the same credit entity. Likewise a negative basis trade would involve buying the bond (receive spread) and simultaneously buying protection (pay spread) on the same credit.

An analysis of the most liquid US investment grade five year CDS which makes up the 125 constituents of the Markit CDX NA IG and their corresponding reference bonds show many discrepancies which could be arbitraged away. This analysis is based on the actual CDS bond basis (mid) as calculated by Markit's Bond Pricing service.

Using a 50bps threshold, there are currently two entities trading with a positive basis, down from four in July. On the negative side, there are more possibilities in the CDX NA IG, with 76 names, up 17bps since July 22nd.

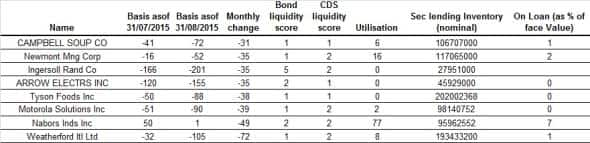

Biggest monthly movers

Media names dominated the list which saw the biggest monthly change in basis on the positive side. Time Warner, 21st Century Fox, CBS Corp and Viacom all saw their cash bond spread increase at a greater pace than the CDS spread. The media sector has come under scrutiny over the past month amid the possibility of slowing international demand.

Among names which saw the biggest monthly move on the negative side, Nabors, an offshore driller, wiped out its basis over the past month. Its basis tightened from 50bps to -1bps.

Positive basis

As of the end of August, there are only seven entities that exhibit a positive basis, down from ten last month. Barrick Gold, the largest global gold miner, dropped off this list. Its basis was 41bps on July 22nd but reversed to -20bps as of August 31st. In particular there was sustained pressure on the price of gold mid-July as levels hit five year lows and investors duly sought protection through CDS.

All seven of the names with a positive basis belong to the oil & gas sector. Freeport, Teck and Transocean remain the three credits with the widest positive basis, 90bps, 60bps and 26bps, respectively. Volatility in the price of oil has continued into the month of August and CDS levels remain wide as investors remain cautious.

In terms of taking advantage of the positive basis trade, Freeport's cash bond currently does not sit in a lending programme tracked by Markit Securities Finance. So in practical terms it would be difficult to short. Transocean's $154m bond is nearly fully utilised (already out on loan), while Teck's five year cash bond is only 44% utilised, but is up from 36% last month as arbitragers took advantage of the spread.

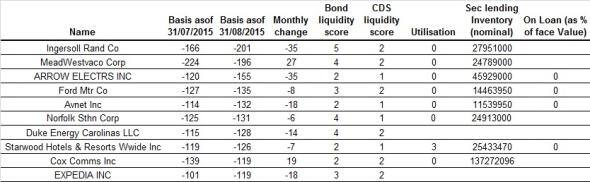

Negative basis

Most names in the Markit CDX NA IG index trade on a negative basis. This follows the historic trend in the US over the past few years and is mainly driven by low interest rates as many reference bonds trade above par. CDS sellers guarantee a par amount, usually 100, and will therefore settle for a lower spread in a case of default.

While shorting the reference bond is not as straightforward with positive basis trades, going long and taking advantage of the negative basis trade may prove to be just as difficult. Ingersoll Rand, a diversified industrial conglomerate, now has a negative basis of 200bps, the widest on the list, having widened 35bps in August. It has a liquidity score of 5, the lowest possible score according to Markit's Bond Pricing service, indicating that the bond is very thinly quoted.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092015-Credit-Media-sector-CDS-bond-basis-tightens-in-August.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092015-Credit-Media-sector-CDS-bond-basis-tightens-in-August.html&text=Media+sector+CDS+bond+basis+tightens+in+August","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092015-Credit-Media-sector-CDS-bond-basis-tightens-in-August.html","enabled":true},{"name":"email","url":"?subject=Media sector CDS bond basis tightens in August&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092015-Credit-Media-sector-CDS-bond-basis-tightens-in-August.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Media+sector+CDS+bond+basis+tightens+in+August http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092015-Credit-Media-sector-CDS-bond-basis-tightens-in-August.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}