Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 03, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings in the coming week

- Retailers make up majority of heavily shorted stocks announcing earnings

- Greenbrier is the most shorted non retail stock in North America

- Wirecard sees heavy short interest leading up to earnings

North America

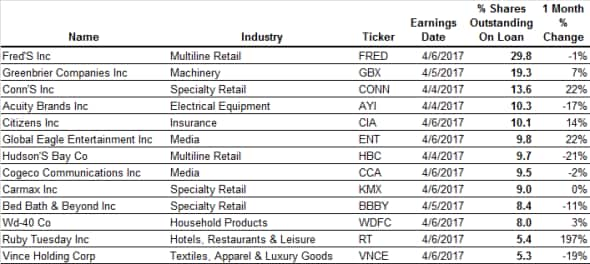

The relatively subdued earnings activity in coming week hasn't precluded short sellers from playing their favorite trade of the year so far as retailers and other consumer-focused stocks make up over half of the 13 companies seeing heavy short interest.

Pharmacy operator Fred's is by far the most shorted firm announcing earnings this week as it has just under 30% of its shares out on loan to short sellers. Recent movements in Fred's shares have been driven by its ongoing efforts to purchase over 800 stores that Walgreens is looking to divest as part of its merger with Rite Aid. Shareholders were initially bullish on the deal's prospects as Fred shares nearly doubled in the days immediately following its announcement. This euphoria has since worn off somewhat as over half of the post deal surge has worn off. Short sellers believe that the slide in Fred's shares could run further as that as demand to borrow Fred's shares is now represents an all-time high for the firm.

White goods retailer Conn's is another firm which has seen a resurgent short base in recent weeks as demand to borrow its shares has more than doubled in the last three months to the current 14% of shares outstanding.

Shorting among retailers hasn't all been one direction however as Hudson's Bay, who operates Saks Fifth Avenue, and Bed Bath & Beyond have both seen short sellers cover over 10% of their positions in the month leading up to earnings.

Looking beyond retail stocks, we see strong demand to borrow shares in railroad car manufacturer Greenbrier which is the second most borrowed stock announcing earnings this week. A large part of this borrow is likely to be driven by arbitrageurs looking to hedge their exposure to the company's outstanding convertible bonds which make up a significant portion of Greenbrier's capital structure.

Europe

European short sellers also have a relatively subdued week ahead of them when it comes to earning activity as only two firms with any meaningful short interest are due to release results.

The most significant of this week's short targets is German payment processor Wirecard which has 17% of its shares out on loan. Wirecard was the target of an activist short campaign last year which alleged the firm of fraud and bad bookkeeping. The firm has strongly denied these accusations and the market seems to be siding with management as evidenced by the fact that Wirecard shares are now trading at an all-time high. The continuing strong demand to borrow Wirecard shares indicates that not all sceptics have been placated although the firm has seen some covering in recent days which could indicate that this scepticism is starting to wear off.

The other firm seeing significant demand to borrow in Europe is Austrian real estate developer Immofinanz which has 7% of its shares out on loan.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03042017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03042017-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03042017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03042017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03042017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}