Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 03, 2015

Betting against peer to peer lending

Peer to peer lending has been lauded as a new dawn for consumer loans, but short sellers are yet to be convinced of the industry's prospective success.

- Lending Club now has more than 10% of its shares out on loan

- Unsecured loan firms World Acceptance and First Cash have also seen shorting activity

- Newly listed Springleaf has had better success, with rising share price and low short interest

Peer to peer lending has been hailed as a possible disruptive force within financial services for its potential to cut banks out of the loop and let individual lenders work directly with end borrowers. This new approach has seen a rush of investment into firms which link lenders and borrowers, both in both developing and more established markets.

Peer to peer lenders appeal to investors as they sit in between the end users without committing capital. Although the industry currently makes up less than a tenth of 1% od all loans , the aggregate loan volumes have grown by over 15 times over the last four years. The ability to capture a fast growing market in a capital-light way is an attractive prospect, much like the offerings of Uber and AirBnB in the taxi and hospitality markets.

But while the field is relatively new and exciting, shares in the small crop of current entrants have so far failed to live up to expectations

Lending Club

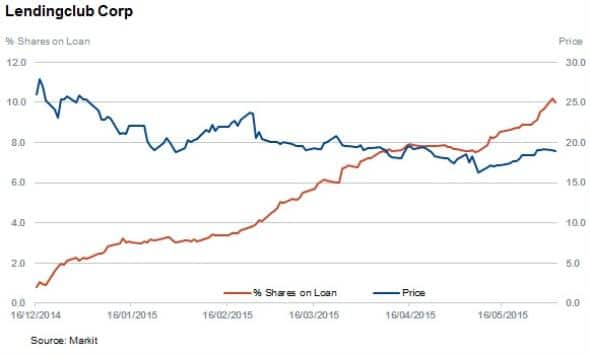

Lending Club is the only major listed western firm in the peer to peer space. The company listed with much fanfare in December last year and its shares surged by nearly two thirds on its trading debut which valued the company at $8.5bn. While the company has beat investor expectations, its IPO proved to be the high water mark for its shares, which have fallen by a quarter from their listing highs.

Short sellers have been eagerly playing the recent struggles, as over 10% of Lending Club shares are now out on loan. This represents around 80% of the available shares, making Lending Club one of the most shorted recent IPOs.

This strong appetite to short Lending Club may be due to the fact that the firm now trades with a forward PE ratio north of 150, despite its recent price fall.

Short sellers also in established firms

While short sellers have been active in the peer to peer space, conventional issuers of unsecured loans whose business could be negatively impacted by competition from cheaper peer to peer loans have also seen significant shorting activity.

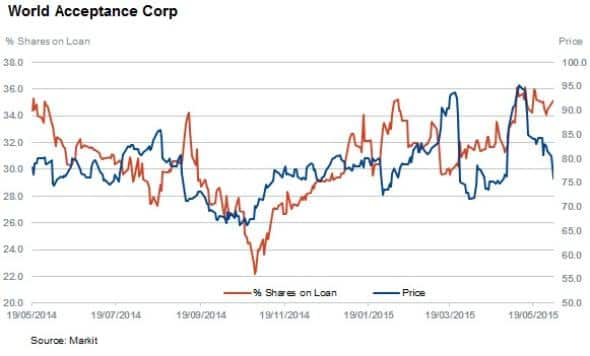

World Acceptance Corp is the most shorted firm in this space with over 35% of its shares out on loan, making it the third most shorted constituent of the Russell 2000. These positions proved to be well timed as it shares fell significantly yesterday after its ceo announced his retirement. Shorting activity has also been spurred on by the firm's ongoing investigation by the US consumer watchdog.

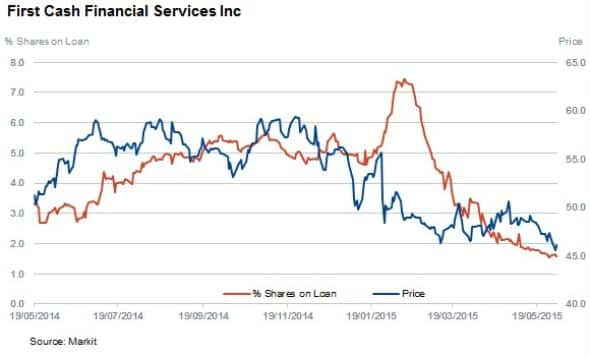

First Cash Financial is another successful short in the unsecured loans space, recently registering a three year high in short interest in February when over 7% of its shares were out on loan. While shorts have since closed out their positions, its shares have failed to recover and are now trading at a two and a half year low.

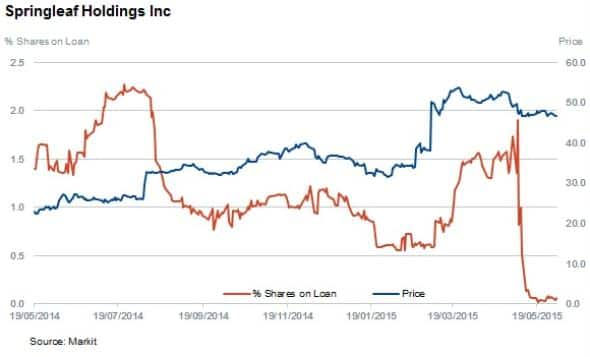

But not all news coming out of the sector is negative as recently listed personal lender Springleaf has as seen its shares more than double from its IPO in October 2013, which has sent shorts covering.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-equities-betting-against-peer-to-peer-lending.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-equities-betting-against-peer-to-peer-lending.html&text=Betting+against+peer+to+peer+lending","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-equities-betting-against-peer-to-peer-lending.html","enabled":true},{"name":"email","url":"?subject=Betting against peer to peer lending&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-equities-betting-against-peer-to-peer-lending.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Betting+against+peer+to+peer+lending http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-equities-betting-against-peer-to-peer-lending.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}