Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 03, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week.

- Short interest jumps shoots up a third in rocket engine maker Aerojet

- Shorts target German sugar producer as currencies continue to impact soft commodities

- Japanese anime and consumer electronic retailer among the most shorted in Apac

North America

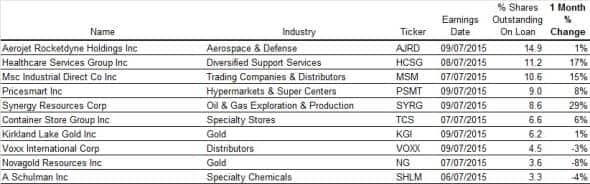

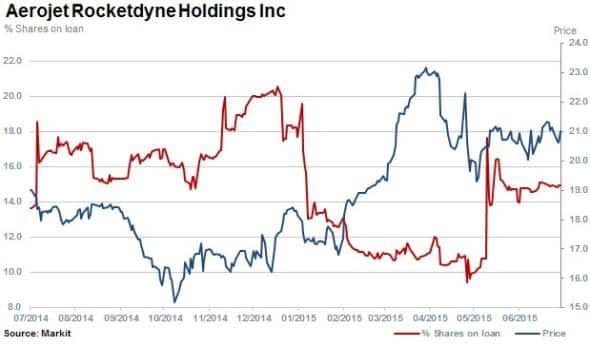

Most shorted in North America ahead of earnings this week is Aerojet, manufacturer of propulsion systems for the aerospace, defence and space industries. Since the company posted a first quarter loss, missing analyst expectations, shares outstanding on loan have increased by a third to 15% while shares have fallen by 9%.

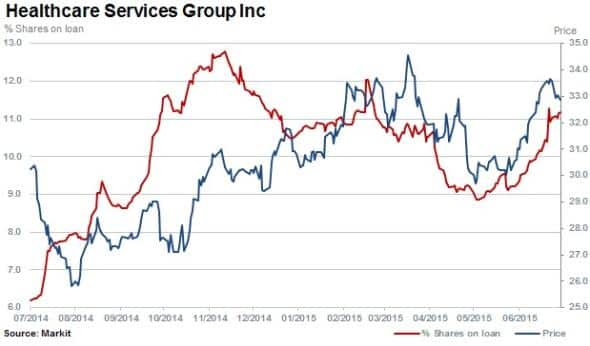

Second most shorted is Healthcare Services Group with 11% of shares outstanding on loan. Short interest in the firm has increased 22% since the beginning of May while shares have rallied 9%. The company provides housekeeping, laundry and nutrition services to the healthcare industry and could benefit from recent reforms.

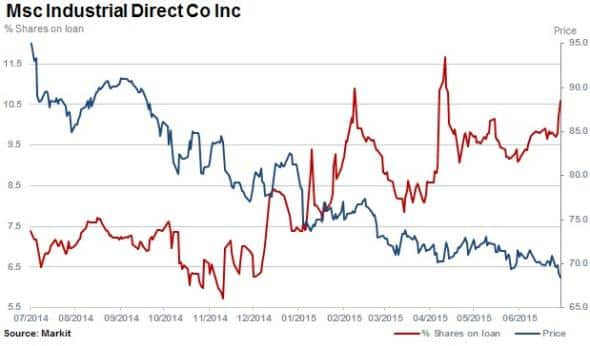

Msc industrial direct has 10.6% of shares outstanding on loan and short sellers have continued to hold positions through a 12 month decline in the share price, sinking 28% in total. The company supplies industrial tools and supplies in the US and has struggled against falling oil prices affecting activity and softer export demand due to the stronger dollar.

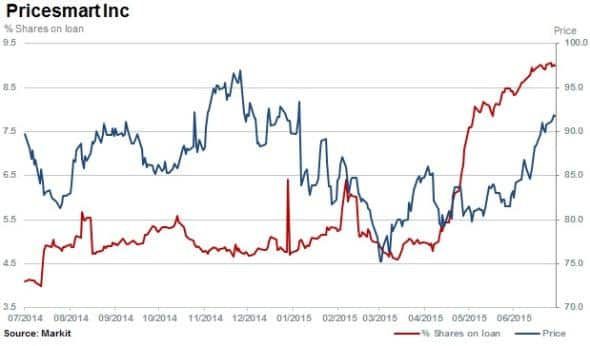

The strong dollar also impacted Pricesmart's second quarter earnings, released in April with additional impact from the devaluation in the Colombian peso. The company operates retail membership warehouse clubs in Latin America, the Caribbean and the US. The stock has climbed almost 10% since falling after the last earnings release but the rise has attracted short sellers, with shares outstanding on loan climbing over 80% to reach 9%.

Western Europe

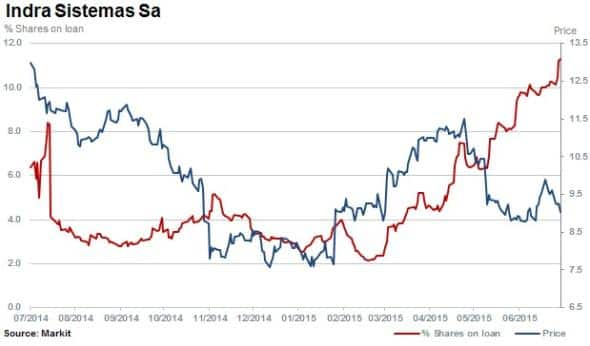

Europe sees only one firm with more than 10% of shares outstanding on loan ahead of earnings - Spanish IT consulting group Indra Sistemas. The firm currently has 11% of shares outstanding on loan, up 80% since the company's last earnings release in early May.

Sales for the firm have flat lined since 2012, with the group posting a full year loss in 2014. Despite posting a first quarter loss of EUR 0.09 in 2015 (versus consensus forecasts of positive EUR 0.15), analysts expect positive earnings for the second quarter of EUR 0.11.

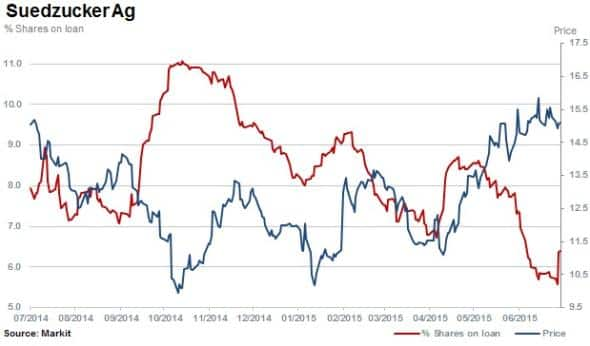

Sugar producer and distributor Suedzucker has seen a 12% spike in short interest in the last week. Shares outstanding on loan have increased to 6.5% but are down a quarter since the beginning of May while the stock has risen 12%. Sugar markets have been impacted by the dollar's strong run in producing countries, however recent euro weakness may have offset these effects for the German based firm.

Asia Pacific

Japanese consumer electronics retailer Bic Camera is the most shorted stock in Apac ahead of earnings with 7% of shares outstanding on loan. The stock is up 101% year to date while consensus full year forecasts expect sales and earnings to be largely in line with the previous year's levels.

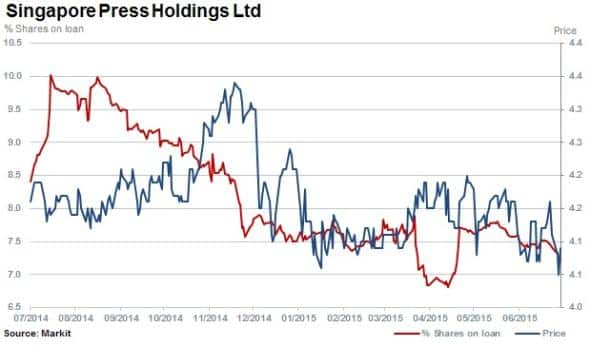

Short sellers' interest in Singapore Press is waning as shares outstanding on loan seem to have peaked in August 2014, slightly above 10%. Short sellers have since covered positions by a third while the stock has moved sideways over the last year.

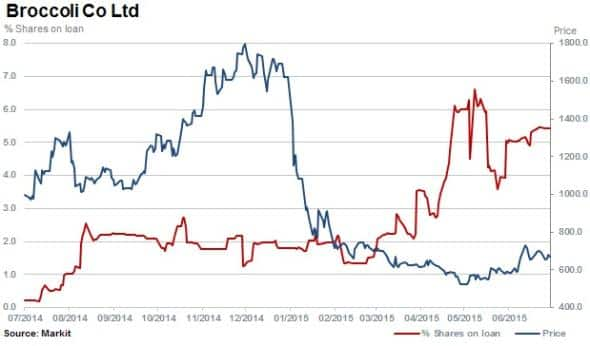

Tokyo based Broccoli Co owns a chain of retail stores, through which it produces and retails anime, manga, music, figurines, animation, card games, music and video content. The stock has plummeted 60% year to date with shares outstanding on loan rising to 5.4%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}