Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 03, 2016

EM bond investors choose liquidity over yield

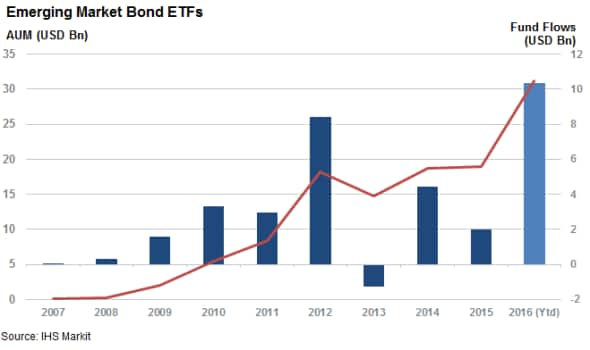

Emerging market bond ETFs are seeing their strongest inflows on record but investors are steering towards lower yielding and more liquid dollar denominated funds.

- Hard currency EM bond ETFs gathered 70% of the record setting $10bn by EM bond ETFs

- Hard currency bonds much more liquid than their locally listed peers according to Markit EVB

- Liquidity seen in hard currency bonds also evidenced in tighter bid ask spreads for their ETFs

Emerging market bonds ETFs are the high conviction trade of the year so far. Not even a coup from one of the most active issuers has dented investor appetite for these relatively high yielding bonds as emerging market bond ETFs saw their best inflow month ever in July, pushing the ytd inflows past $10bn mark for the first time ever.

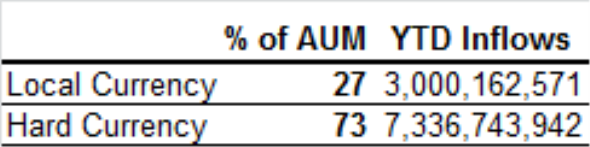

In the ever evolving trade-off between yield and liquidity however, it seems that investors riding the emerging market bond ETF wave have chosen the latter. This preference for the liquidity is evidenced by the fact that products that investing relatively lower yielding hard currency denominated bonds, such as US dollars, but which carry much less currency risk and liquidity constraints, have seen a 70% share of the record $10.3bn that has been invested into the asset class.

Local currency funds have also proved popular. However, the fact that over two thirds of investors are willing to pass up on the 1.43% of extra yield currently offered by the asset class, as gauged by the current difference in weighted average yield to maturity between the iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB) and the VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (EMLC), the largest US listed hard and local currency funds respectively, shows that yield isn't everything.

Hard currency bonds much more liquid

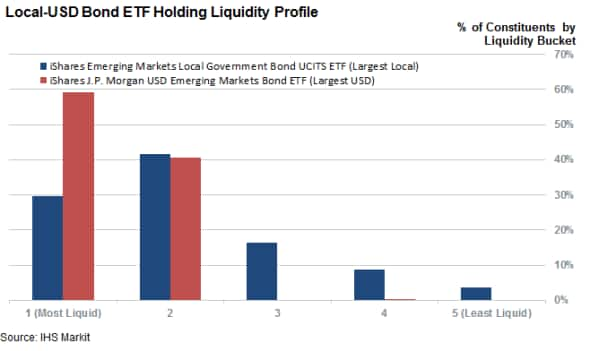

On top of the obvious currency risk carried by locally denominated emerging market bonds the cautious appetite for the asset class could also be the fact that bonds issued in local currencies tend to be much less liquid than their hard currency peers. The components of the iShares Emerging Markets Local Government Bond UCITS ETF (IEML), the largest locally listed fund, have seen an average of 3.1 quotes in over the last 10 trading days according to Markit Evaluated Bond data, which is a quarter of the 13 average quotes seen in the components of its EMB peer.

This liquidity profile is also evidenced in the EVB liquidity scores. Whereas all but one of the components of the EMB earn the two most liquid EVB liquidity scores, the components of the IEML have over a quarter of their components in the three least liquid liquidity categories.

Liquidity reflected in lower bid ask spreads

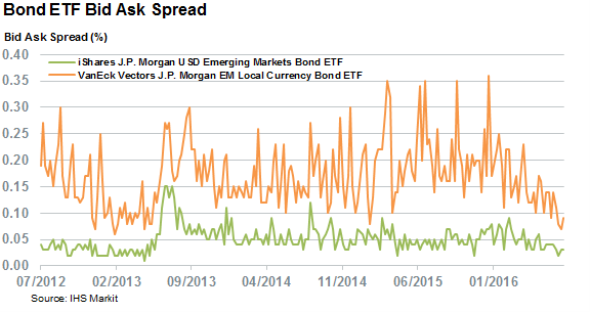

The weaker liquidity profile of locally listed bonds is also evidenced in the cost investors have to incur when trading in and out of the asset class. The bid ask spread of the EMLC is nine bps, which is three times higher than its dollar denominated EMB peer.

Perhaps most worrying for investors is the fact that the bid ask spread of the EMLC has surged ahead in times of market stress, such as the recent commodities rout, while the EMB's bid ask spread has been much less volatile.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-credit-em-bond-investors-choose-liquidity-over-yield.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-credit-em-bond-investors-choose-liquidity-over-yield.html&text=EM+bond+investors+choose+liquidity+over+yield","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-credit-em-bond-investors-choose-liquidity-over-yield.html","enabled":true},{"name":"email","url":"?subject=EM bond investors choose liquidity over yield&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-credit-em-bond-investors-choose-liquidity-over-yield.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=EM+bond+investors+choose+liquidity+over+yield http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-credit-em-bond-investors-choose-liquidity-over-yield.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}