Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 03, 2016

European equity volumes battle through the first half

Cash equity trading volumes reported by brokers contributing to Markit MSA were roughly flat in the first half of the year compared to the same period in 2015; encouraging news for the industry.

- The Markit MSA database registered "5.8trn of trades

- Bank of America overtook Morgan Stanley as the largest European cash equities trader

- ETF secondary market volumes fell 8% despite recent strong inflows

Read the full report with broker rankings.

The first half of the year proved to be a volatile one for European equities, with China, commodities, and Brexit all fuelling equity price movements. This heightened level of volatility translated in an increase in trading volumes across the region, according to the aggregate volumes reported to Markit's MSA database which registered "5.8trn of trades from the 21 contributing brokers.

While that number represents a 2% fall from the same period in 2015, its worth noting that European equities, as gauged by the Stoxx 600 index, traded on average 14% lower year on year over the first six months of the year so the figures represent an increase in turnover in real terms.

Volumes were flat in Western and Eastern markets while the Nordics registered a healthy 12% increase in year on year trading volumes.

The trend has continued in the beginning of the second half of the year given that the 6% fall in volume reported over July trails the 14% year on year fall seen in the Stoxx 600 index.

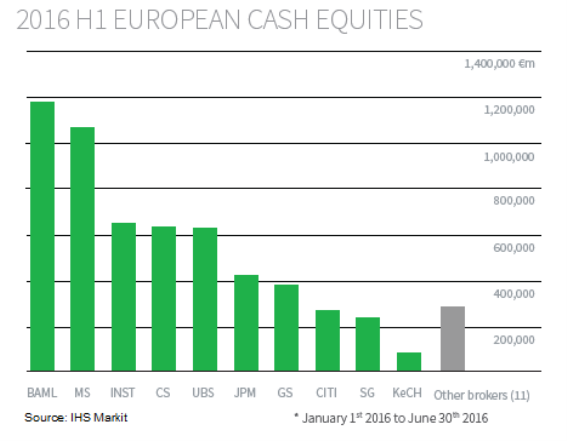

BAML tops ranking

The volatility witnessed in the market has also shaken up the top league table where Bank of America Merrill Lynch (BAML) leads for the first time.The US broker's contributed volume for the first half of the year was over 30% higher than in the first six months of the year compared to the same period last year. This very strong increase in reported volume, by far and away the largest among the ten largest contributing brokers, was led by a 50% increase in the bank's trading activity in DAX constituents and a 47% increase in CAC trading.

BAML's spot at the top of the league table has come at the expense of fellow US broker Morgan Stanley, which reported a 5% drop in aggregate volumes. The two largest banks are still leagues ahead of third placed Instinet, which reported a third less aggregate trading activity than its second placed peer.

Further down the league table, Credit Suisse overtook UBS in a tight race for fifth place while JP Morgan reported an 8% increase in executed volume which saw it overtake Goldman Sachs in seventh place.

ETF volumes fall

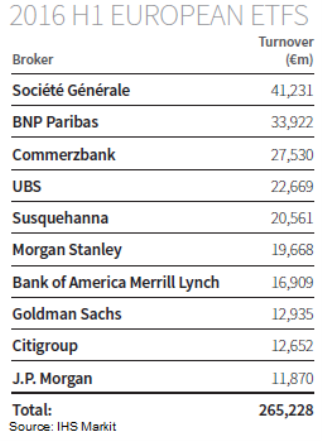

ETF trading volumes, which had proved buoyant over last year, were relatively less resilient to the market's headwinds as brokers reported an 8% fall in executed business in the first half. This runs against the run of form for the asset class as European listed ETFs have continued to see strong inflows in the opening two quarters of which has taken their AUM to a record high $533bn.

Equity products led the fall in volumes traded with a 13% fall in aggregate volumes which was balanced somewhat by a 32% jump in commodity ETFs. Fixed income funds, which have seen record inflows, didn't see a material jump in secondary market trading activity as the volume reported by contributing brokers was flat in the first half of the year.

iShares products saw the most secondary market activity as they gathered 43% of all reported trading activity. Trading in iShares products helped Soci"t" G"n"rale keep its spot at the top of the broker's league table.

This analysis accompanies a summary of European cash equity and ETF trading for H1 2016 using Markit's suite of equity products. Markit MSA covers an estimated 70% of all cash equity trading in Europe across traditional exchanges, multi-lateral trading facilities and over-the-counter markets. Trade data is sourced directly fromcontributing brokersand represents what was actually traded, differentiating it from other surveys that rely on indications of interest or trade adverts.

Simon Colvin, Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-equities-european-equity-volumes-battle-through-the-first-half.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-equities-european-equity-volumes-battle-through-the-first-half.html&text=European+equity+volumes+battle+through+the+first+half","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-equities-european-equity-volumes-battle-through-the-first-half.html","enabled":true},{"name":"email","url":"?subject=European equity volumes battle through the first half&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-equities-european-equity-volumes-battle-through-the-first-half.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+equity+volumes+battle+through+the+first+half http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-equities-european-equity-volumes-battle-through-the-first-half.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}