Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Dec 03, 2015

ETF investors fled ahead of Draghi disappointment

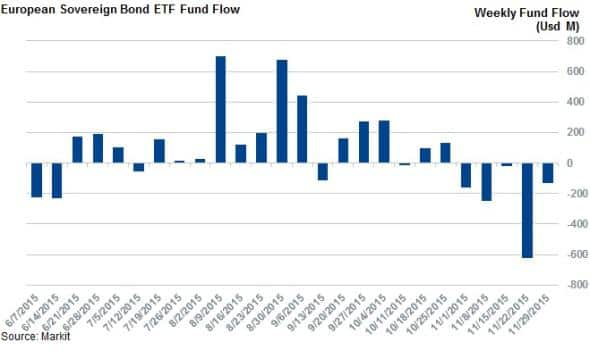

Today's ECB announcement saw euro sovereign bonds sell off significantly, but European ETF investors had already been divesting away from the asset class in the run-up to the announcement.

- 10-yr bunds lost 90bps while 10 year Italian bonds lost 2% after ECB news

- ETF investors had actively been selling off European sovereign funds in the last five weeks

- iShares Euro Government Bond 3-5yr led outflows as investors withdrew 18% of AUM

The ECB disappointed the market today when it failed to materially lift its quantitative easing program. While the eurozone's rate setting body did cut the already all-time low deposit rate by a further 10bps, this was not enough to avoid a large selloff in the region's bonds which sent yields off the recent lows seen earlier in the week.

This selloff sent benchmark 10 year bund yields over 10 bps higher points while lower rated periphery bonds fared even worse as the 10 year Italian bonds saw their yields widen by over 22bps. In terms of price return, this selloff means that holders of 10 year German and Italian bonds are now sitting on a 0.9% and 2% loss respectively since the release of the ECB's policy update.

ETF investors miss most

While the market had actively been bidding up eurozone sovereign debt in the last few weeks it appears that a growing portion of investors were uneasy about the trade, as eurozone sovereign bond ETFs had been selling off in the weeks leading up to today's developments. 150 such funds have seen net outflows in each of the last five weeks reaching a cumulative outflow of $1.18bn.

These ETF outflows had been growing as last week saw investors withdraw the most funds from the asset class at any time in the last six months.

While only representing roughly 3% of the assets managed by these funds, the outflow

is significant as it shows growing uneasiness about the asset class even though the market was gearing up for more QE driven rally.

The fund leading the outflows over this period was the iShares Euro Government Bond 3-5yr UCITS ETF which has seen investors withdraw $294m since the start of November, roughly a fifth of its AUM. While investors selling off missed out on the fund's pre-meeting anticipation driven rally, the sceptics have been vindicated as the fund is down by 0.47% in the wake of the afternoon's sell-off.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Credit-ETF-investors-fled-ahead-of-Draghi-disappointment.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Credit-ETF-investors-fled-ahead-of-Draghi-disappointment.html&text=ETF+investors+fled+ahead+of+Draghi+disappointment","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Credit-ETF-investors-fled-ahead-of-Draghi-disappointment.html","enabled":true},{"name":"email","url":"?subject=ETF investors fled ahead of Draghi disappointment&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Credit-ETF-investors-fled-ahead-of-Draghi-disappointment.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ETF+investors+fled+ahead+of+Draghi+disappointment http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Credit-ETF-investors-fled-ahead-of-Draghi-disappointment.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}