Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 04, 2014

Most shorted ahead of earnings

We look at how short sellers are behaving towards companies announcing earnings in the week to come:

- Alcoa has seen demand to borrow fall by a third ahead of earnings

- In Europe, UK listed Wh Smith leads the way with over 9% of shares out on loan

- Japanese retailer make up the bulk of the heavily shorted Asian shares ahead of earnings

North American earnings

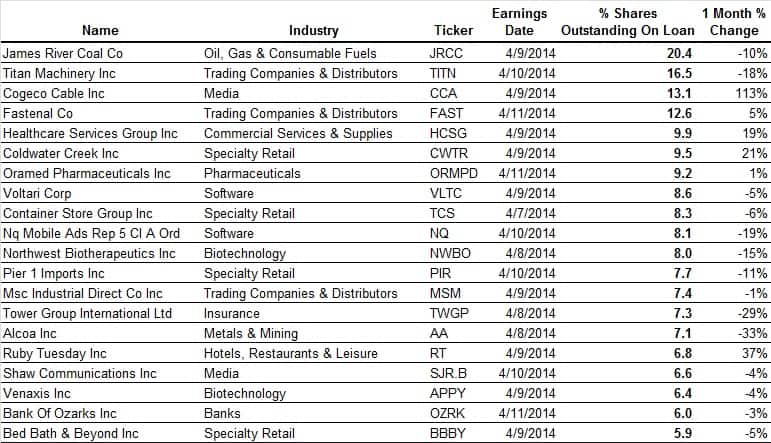

After a tumultuous fourth quarter earnings season, the market sets its sights on initial 2014 earnings with the start of the first quarter earnings season. The start of the Q1 earnings season has 20 firms announcing earnings with 6% or more of their shares out on loan.

Alcoa kicks off the earnings season after having seen its demand to borrow fall to its lowest level in over a year. The aluminium company has producer has seen its shares surge by over 50% in the last year as US automobile and aerospace demand picked up, boosting the company’s prospects. While revenues held flat, the company was able to boost its profitability by switching to a higher margin product mix. This seems to have rung well with investors as the demand to borrow has fallen by a third in the last four weeks to 7.1% of shares outstanding.

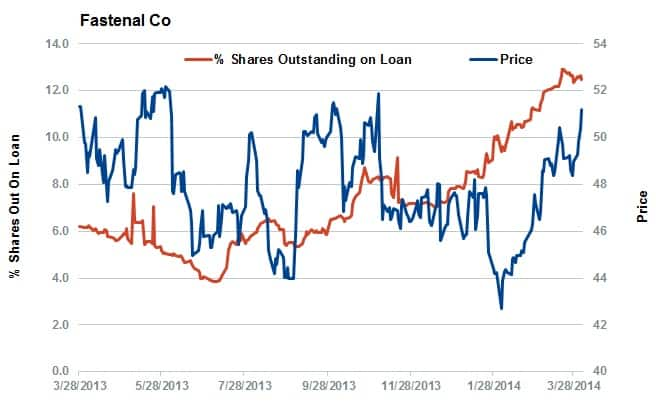

While the majority of heavily shorted companies announcing earnings this week have seen a fall in demand to borrow over the last month, we’ve seen shorts hold steady in industrial supplier Fastenal. The company is looking to become the Red Box of construction material with its vending machine distribution chain though it disappointed investors last time it announced results and has seen short interest shoot up to an all-time high 12% of shares making it the fourth most shorted company announcing earnings this week.

Fellow industrial distributor Msc Industrial Direct has also seen short interest shoot up in recent months with 7.4% of the company’s shares now out on loan.

Another sector featuring prominently on the list of heavily shorted list this week are home improvement firms with Container Store Group, Pier 1 Import and Bed Bath & Beyond all making this week’s list.

Europe

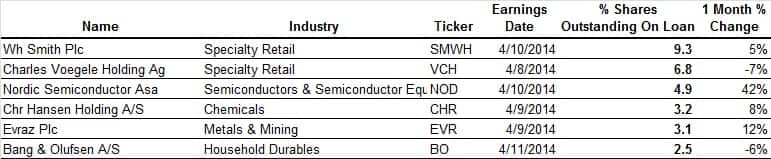

Europe also sees subdued earnings activity and therefore has only five firms with more than 3% of shares out on loan ahead of imminent results.

UK newsagent chain Wh Smith is the most shorted European company announcing results this week with 9.3% of its shares out on loan. The retailer, which has looked to reposition itself away from the struggling UK high street to focus on the faster growing travel business, has seen its gross profit margin jump by 10 percentage points over the last five years. These developments have seen Wh Smith shares surge to new highs. Short, which had a heavy presence in Wh Smith’s shares, have more than halved their positions from their highs and current demand to borrow now sits at an 18-month low.

Swiss department store Charles Voegele is also seeing heavy short interest ahead of what analysts are expecting to be the third straight annual loss. The company now has 6.8% of shares out on loan.

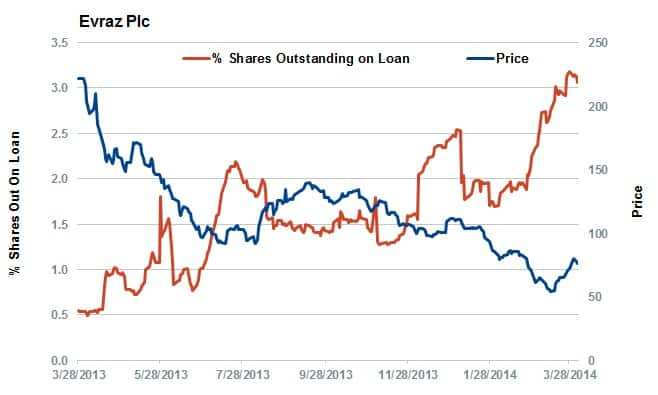

Another interesting short is steel producer Evraz which has seen demand to borrow surge to an all-time high 3% of shares outstanding over the last couple of months. The company relies on Russian demand for 43% of its revenues and has seen its shares come under pressure in the wake of the Crimean crisis.

Asia

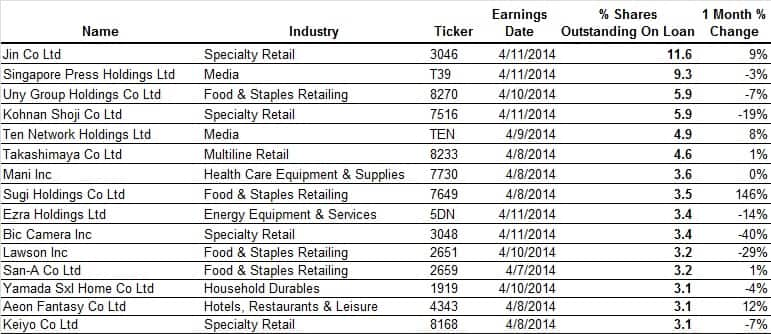

There are 15 firms in Asia announcing results with more than 3% of shares out on loan.

Japanese retailers make up nine of the heavily shorted shares announcing earnings this week as the country raised its sales tax in order to try to jump start inflation. This has raised alarm amongst many market commentators who fear higher inflation could lead to a drop in consumer spending.

Topping the list of heavily shorted retailers is eyewear retailer Jin Co which has 11.6% of its shares out on loan. The weeks leading up to the sales tax increase has seen Jin shares nearly halve. Interestingly analysts are forecasting the firm to post a fall in revenues for the quarter which ended prior to the sales tax increase. This goes against reports of panic buying ahead of the new tax regime.

Also heavily shorted are Uny Group and Kohnan Shoji which both have more than 6% of shares out on loan.

Looking beyond Japanese retailers, Media firms Singapore Press Holdings and Ten Networks also see heavy demand to borrow with 9.3% and 5.1% of shares out on loan, respectively.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042014120000Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042014120000Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042014120000Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042014120000Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04042014120000Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}