Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 04, 2016

Energy rally breaking bears' conviction

Fuelled by a recovery in energy markets, high conviction short trades have turned sour as crowded positions deliver the worst performances seen since the financial crisis.

- Shorts misjudge rally by the worst margin since 2008 as sought after names surge in April

- Consecutive losses place top conviction trades in negative for the year

- Least desired short trades magnify trend reversal, posting consecutive monthly declines

Underpinned by rising energy prices, a rally in equites during April has proved quite costly for short sellers.

High conviction names recorded the biggest spike (losses) in shares seen since the financial crisis with shorts subsequently covering positions aggressively.

Markit's Research SignalsImplied Loan Rate (ILR) factor* captures and gauges the demand or 'conviction' among short sellers. By ranking stocks according to prices, shorts are willing to pay to borrow shares. The ILR is able to indicate which names see relatively higher demand, implying more negative sentiment.

Historically, with a 75%+ hit rate, short demand has indeed provided valuable signals into which stocks are expected to fall - shorting the top 10% or decile of in demand stocks on a monthly basis, has returned close to 120% in excess returns since 2007 (underperforming the market on a cumulative basis).

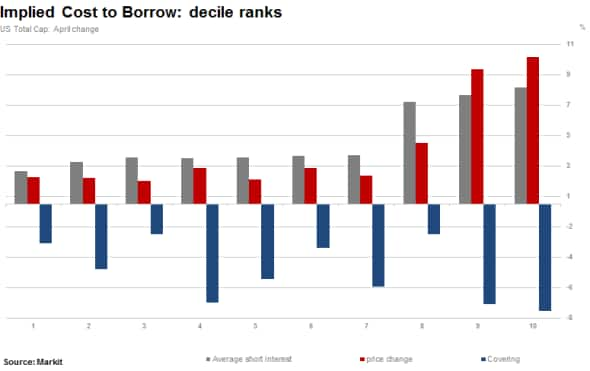

However, the recent rally has interrupted the relationship between conviction and subsequent price declines. The most in demand names in the US posted the second highest monthly rise in prices seen since 2009, jumping by 5.8% on an excess returns basis.

This is only the third occasion where the top percentage of in demand names have posted a monthly excess return above 3%, in almost 10 years. On a year to date basis, the most in demand names are now in positive price performance territory.

More disheartening however, is that the 10% least targeted names by short sellers have in fact posted consecutive price declines since February, falling by 2.8% in April.

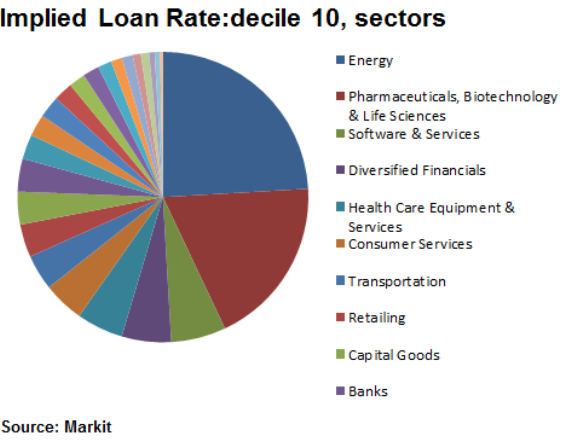

Not surprisingly, a quarter of names that make up the top 10% conviction shorts' are energy firms, followed by 19% of names in the biotech sector.

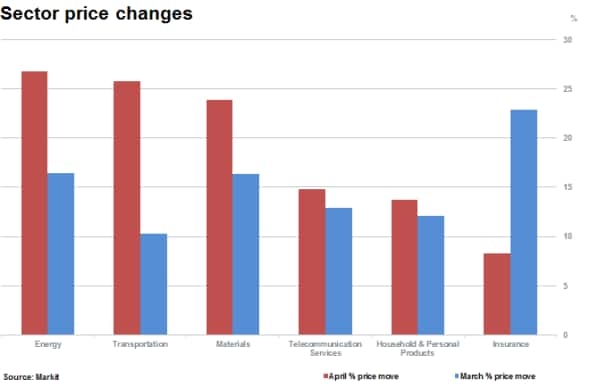

Showing the extent to which energy names have rallied in the past two months, the most demanded energy names moved on average 27% higher in April after already rising some 16% in March.

The transportation and materials sectors were the next highest rising sectors on a price basis in April. However these sectors are less represented among the top 10% of conviction trades.

While broad covering in April occurred across a universe of over 3000 US stocks, significant covering was seen in the top 20% of the most in demand stocks which at the same time witnessed the strongest price increases.

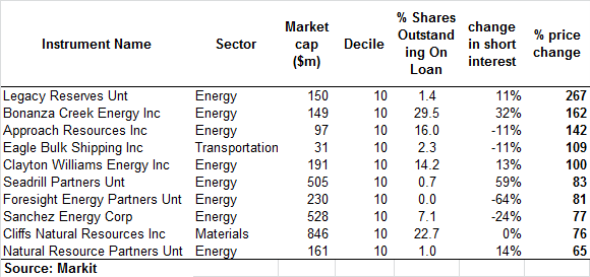

In terms of single names surging in April the top 10, which increased by an average of 85%, include some familiar names but were overwhelmingly energy stocks with an average cost to borrow that was just shy of 20%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-equities-energy-rally.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-equities-energy-rally.html&text=Energy+rally+breaking+bears%27+conviction","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-equities-energy-rally.html","enabled":true},{"name":"email","url":"?subject=Energy rally breaking bears' conviction&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-equities-energy-rally.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Energy+rally+breaking+bears%27+conviction http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-equities-energy-rally.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}