Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 04, 2015

Sterling bonds outstrip global counterparts

Gilts have proven relatively stable amid the recent bout of global bond volatility, helping UK corporate bonds outperform their international peers.

- 10 year gilts have widened by a smaller margin than 10 year bunds since mid-April

- Sterling denominated corporate debt is down by less than 0.5% for the year

- High yield sterling bonds have also outperformed, driven by spread compression

The last few weeks have been something of a rollercoaster ride for bond investors, with the latest selloff sending bond markets into negative territory for the year. But this selloff did not impact all bond classes universally, particularly in developed markets.

The selloff hit benchmark rates in Europe and the US most violently, with UK rates managing to escape a heavier impact. As a result, we have seen sterling denominated corporate debt outperform its global peers over the last six weeks.

Gilt less volatile than bunds

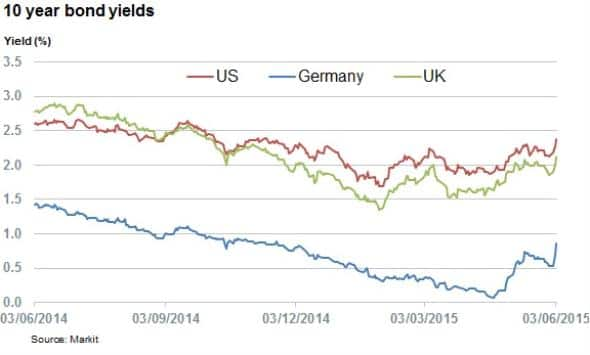

The market's bond selloff started on April 20th, when 10 year German bunds started to see their yields climb from their all-time low of 7bps. The selloff in the subsequent six weeks has seen the benchmark European rate climb steadily to hit a fresh yearly high of 0.86% on June 3rd.

This widening was also seen in the 10 year US and UK bond yields, but the trend was much less pronounced with both benchmark rates climbing 48bps higher over the last six weeks.

Sterling debt more resilient

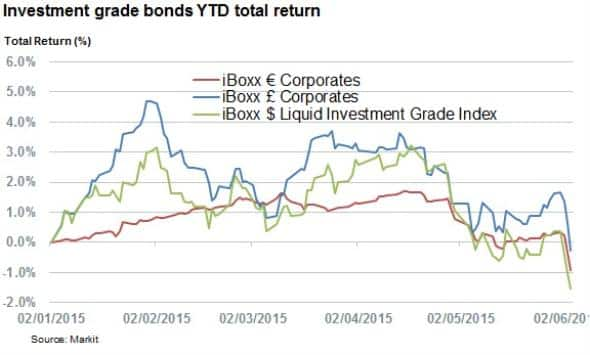

Surging benchmark rates in Europe have seen euro denominated investment grade corporate bonds head into negative territory for the year. Year to date (ytd) returns of the Markit iBoxx Corporates are down by 90bps, after relinquishing 2.6% of total returns in the last six weeks.

Sterling denominated investment grade debt is down by a much lower 0.1% for the year so far, in part due to the fact that gilt rates have proven less volatile over the last six weeks.

Interestingly, dollar denominated investment grade debt has failed to outperform its euro peers as the Markit iBoxx $ Liquid Investment Grade Index is down by 1.7% ytd. This is mostly driven by the fact that investors are requiring more yield over benchmark rates to hold bonds over the last few weeks; the spread of the index has widened by 10bps since the start of the year.

The benchmark spread of the " and € investment grade bonds are flat for the year.

High yield sterling also outperform

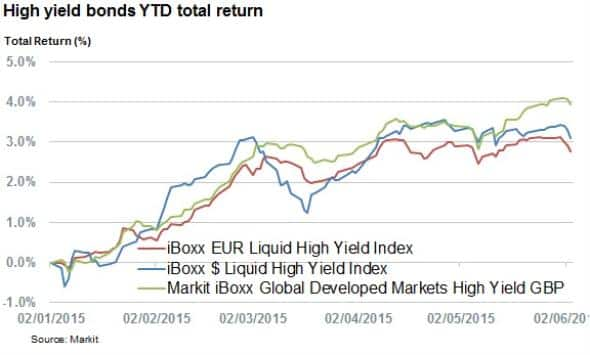

Spread shifts have also helped GBP denominated high yield bonds outperform over the last few weeks, as investors are now requiring less extra yield to hold risky sterling denominated bonds.

The benchmark spreads of the Markit iBoxx Global Developed Markets High Yield GBP Sub-Index are down by 40bps in the last six weeks, much more than the spread tightening seen in euro and dollar high yield debts.

This in turn means that GBP high yield debt is up by roughly 4% year to date, which is 0.9% and 1.1% more than its USD and EUR peers.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04062015-credit-sterling-bonds-outstrip-global-counterparts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04062015-credit-sterling-bonds-outstrip-global-counterparts.html&text=Sterling+bonds+outstrip+global+counterparts","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04062015-credit-sterling-bonds-outstrip-global-counterparts.html","enabled":true},{"name":"email","url":"?subject=Sterling bonds outstrip global counterparts&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04062015-credit-sterling-bonds-outstrip-global-counterparts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sterling+bonds+outstrip+global+counterparts http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04062015-credit-sterling-bonds-outstrip-global-counterparts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}