Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 04, 2014

Appetite for Chinese exposure strong

Despite a brace of worse than expected PMI numbers, the last couple of months have seen investors from around the globe clamour for more Chinese exposure.

- Chinese exposed funds have seen $6.1bn of inflows since June

- US and Asian (ex China) investors were the most eager to add to their Chinese exposure, adding $3.5bn of inflows in August

- But appetite was not global, as domestic Chinese and European investors trimmed their exposure

The last few months have seen many investors start to doubt whether the Chinese economy can sustain the 7.5% growth target set by the central government. With the country's most recent PMI reading indicating only a slight growth in output, market commentators are now looking to the country's government to see if it will step in to revive China's growth with a mix of monetary stimulus and infrastructure spending, in order to match the rate of growth enjoyed in recent years.

This type of central government intervention has historically proven popular with investors across the world. This trend looks to again be ringing true, as the FTSE China A50 index which tracks the country's large domestically traded companies has managed to jump by over 10% in the last three months.

Today's look at asset flows into Chinese ETFs shows that investors are still clamouring for Chinese exposure, as the 279 Chinese exposed ETPs have seen their asset bases surge to a new all-time high of $74bn over the last few months.

ETF inflows surge

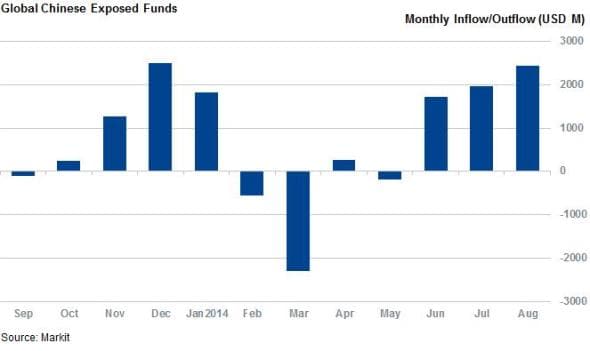

The recent buoyant market in Chinese equities has seen ETF investors continue to add to their exposure in the country over the last three months. The aggregate net inflow into Chinese tracking funds has totalled $6.1 since the start of June. August saw the largest net inflow into Chinese funds since the start of the year as investors added $2.4bn of Chinese exposure to their ETF shopping baskets.

US and Asia leading the way

Breaking down August's bumper inflow numbers, we see US and non-Chinese Asian investors as the most eager to add to their exposure. The Chinese exposed ETFs listed in these two regions have seen over $3.5bn of inflows over the month.

US investors regained their appetite for Chinese exposure in July, snapping a six month outflows streak which saw the 39 US listed lose over $1.4bn.

Non China listed Asian funds also saw the largest inflows out of any region with $2.6bn flowing into these products. This was mostly driven by Hong Kong listed products, as the 76 mainland exposed products saw just over $2bn of net inflows, marking ten months of net inflows out of the last 12.

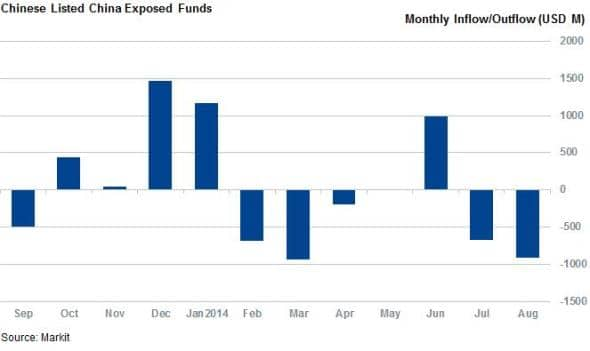

Chinese investors wary of domestic exposure

Interestingly, while investors across the world clamoured for more Chinese exposure, domestic Chinese investors continued to trim their exposure in their home market as Chinese traded, China exposed ETFs saw $912m or net withdraws. This built on July's net outflows, which saw domestic exposed Chinese ETF flows turn negative for the year, to the tune of $1.23bn.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014appetite-for-chinese-exposure-strong.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014appetite-for-chinese-exposure-strong.html&text=Appetite+for+Chinese+exposure+strong","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014appetite-for-chinese-exposure-strong.html","enabled":true},{"name":"email","url":"?subject=Appetite for Chinese exposure strong&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014appetite-for-chinese-exposure-strong.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Appetite+for+Chinese+exposure+strong http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014appetite-for-chinese-exposure-strong.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}