Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 05, 2016

Risk off-mode continues in earnest

Last week saw the bond market discount the possibility of an interest rate hike, while credit risk continued to surge.

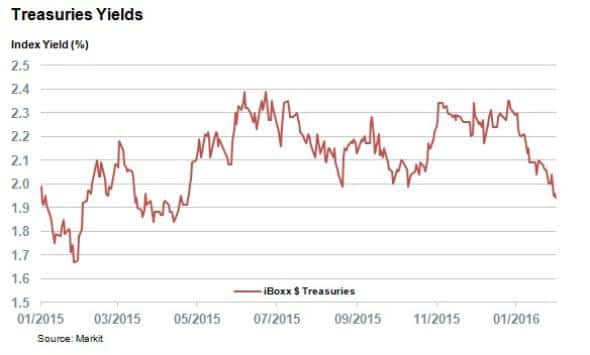

- The Markit iBoxx $ Treasuries sees its yields fall to 1.9%, a ten month low

- CDS spreads jump to multi year highs on both sides of the Atlantic

- European banks see their credit deteriorate after a spate of disappointing earnings

Last week was disappointing for US interest rate hawks. The market took stock of the cooling growth, both domestically and abroad and discounted the possibility of further fed rate hikes in the near term. This saw investors bid down yields in treasuries in earnest with the iBoxx $ Treasuries index seeing its yield fall by 6bps over the week to settle below the 2% mark for the first time since last August. The current yield, 1.94% marks a ten month low for the index which underscores the overall market consensus around interest rates.

Interest rate hawks also capitulated in the UK as the rate setting body of the Bank of England unanimously voted to keep interest rates flat. This breaks a six month string of discord within the organisation.

Credit risk jumps

The cooling growth was also evidenced in the level of credit risk priced into investment grade bonds. Tracked by benchmark spreads, investment grade bonds surge to multi year highs as investors demand to be compensated in order to hold the asset class. The current benchmark spread of the iBoxx $ Investment Grade jumped to 231bps, the highest level since 2012.

This trend was also seen in the CDS market as the Markit CDX IG index jumped by 9bps over the week to settle within 1bps of the three year high seen last week.

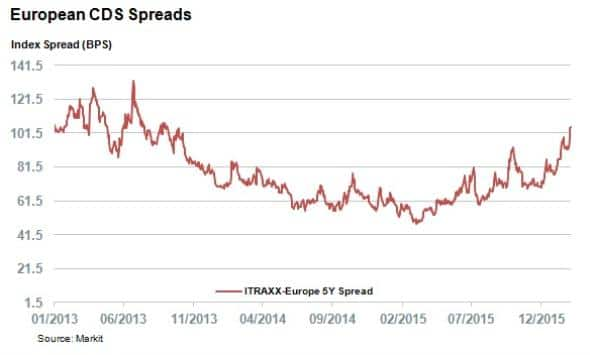

European CDS spreads also surged last week as the iTraxx Europe index jumped pass the 100bps mark for the first time since October 2013.

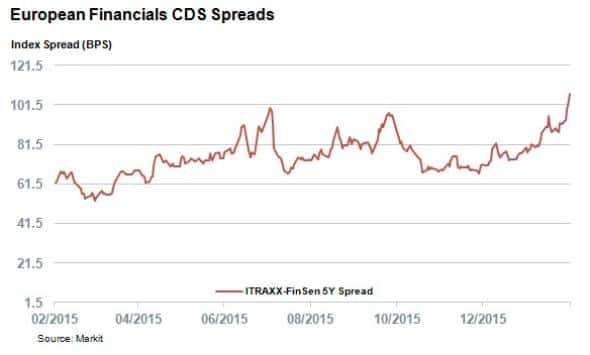

This surge in European CDS spreads was led by financials as a string of poor results saw the Markit iTraxx Senior Financials index jump to 112 bps a fifth higher than the close of last week. The index has now surpassed the levels seen over the depths of the Greek crisis last year.

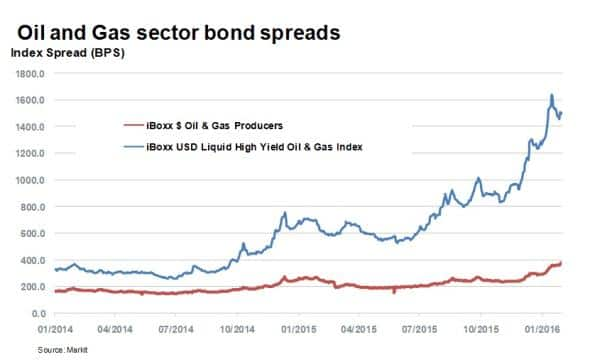

Oil majors

This week saw a host of major oil companies report 4Q 2015 earnings too much despondence. For the first time since 2002, Chevron posted a quarterly loss and announced deep spending cuts given the low oil price environment. Fellow US oil giant Exxon Mobil also announced disappointing results as profits plunged 58% year on year, while BP announced a 70% collapse in profits.

With further downside risk a possibility, credit risk amongst oil producers and explorers has continued to soar, with S&P cutting the credit ratings on companies across the sector, even threatening Exxon Mobil's coveted AAA rating.

The Markit iBoxx $ Oil & Gas Producers index, composed of investment grade rated bonds in the sector, has seen its annual benchmark spread rise to 377bps as of February 4th, double the level seen in May last year. Similarly, high yield bonds in the sector, as represented by the Markit iBoxx USD Liquid High Yield Oil & Gas Index has seen its spread rise to 1491bps, or a 14.91% extra yield over US treasuries.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-Credit-Risk-off-mode-continues-in-earnest.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-Credit-Risk-off-mode-continues-in-earnest.html&text=Risk+off-mode+continues+in+earnest","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-Credit-Risk-off-mode-continues-in-earnest.html","enabled":true},{"name":"email","url":"?subject=Risk off-mode continues in earnest&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-Credit-Risk-off-mode-continues-in-earnest.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Risk+off-mode+continues+in+earnest http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022016-Credit-Risk-off-mode-continues-in-earnest.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}