Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 05, 2017

Price rises set to test strength of underlying demand in Spain

PMI data from IHS Markit signalled that prices charged by Spanish companies rose in March at the sharpest pace since the global financial crisis. The upturn in prices will provide an important test as to the strength and sustainability of demand.

There are already signs that manufacturing growth is slowing in the face of stronger inflationary pressures. That said, the PMI pointed to another quarter of solid growth at the start of 2017, with GDP likely to rise more quickly than at the end of 2016. The survey data are broadly consistent with GDP rising by 0.8-0.9%.

GDP growth set to pick up

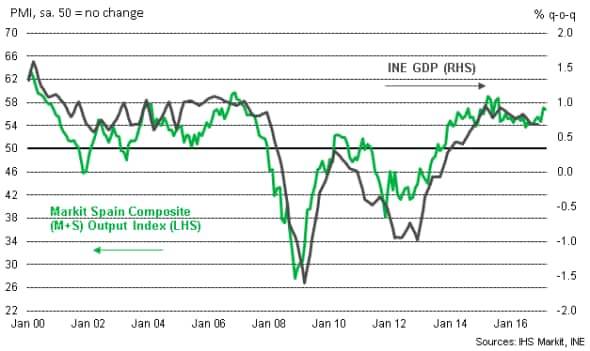

The survey data for March signalled a positive completion to the first quarter of the year. The Composite PMI (covering the manufacturing and service sectors) pointed to a sharp monthly rise in business activity, an increase that was only marginally weaker than the 18-month high seen in February.

The average PMI reading over the first quarter of the year (56.2) was above that from the final three months of 2016 (55.0). Given the excellent relationship between the PMI data and quarterly changes in GDP, the rate of economic growth signalled by official data is likely to have quickened from the 0.7% rises seen in the third and fourth quarters of 2016.

PMI data v GDP

The near-term outlook also looks bright, with companies' confidence regarding the prospects for output growth over the coming year the highest since the end of 2015. IHS Markit is currently forecasting GDP growth of 2.4% for 2017, but the strong start to the year suggests that there may be some upside risk to this forecast.

Price rises set to test demand sustainability

One potential headwind to the generally positive picture is the build-up of inflationary pressures, with higher prices having the potential to subdue demand. Growth in the Spanish economy in recent years has been helped by relatively mild price pressures as companies have been able to attract clients with competitive pricing. With this starting to change, firms will be hoping that demand is sufficiently robust for the recovery to be sustained.

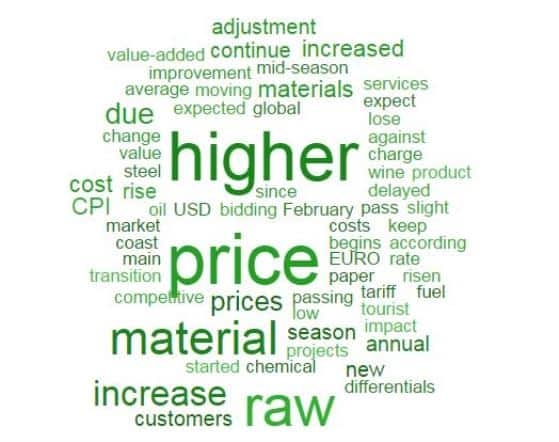

March saw the strongest rise in output prices among Spanish firms since August 2007, with companies primarily linking increased selling prices to the passing-on of higher input costs to clients.

Reasons for increasing output prices

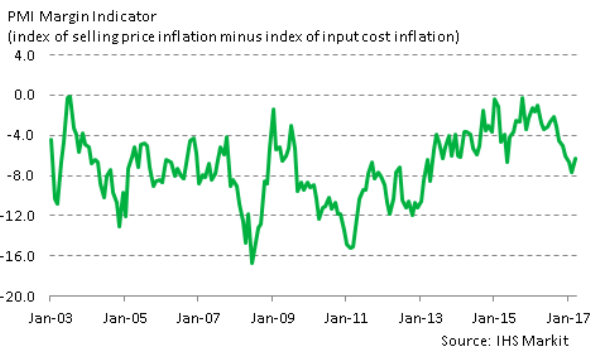

Anecdotal evidence suggesting that firms have reacted to higher cost burdens is backed up by our PMI Margin Indicator, which is derived from the input costs and output prices indices. The indicator showed that pressure on margins had been intensifying for six successive months up to February, when it hit a near four-year high. Many companies have subsequently sought to reduce pressure on margins by increasing prices charged.

PMI Margin Indicator

Growth slows in manufacturing sector

The spike in output price inflation in March was largely a reflection of trends in the service sector. Manufacturing factory gate prices rose sharply throughout the first quarter of the year, and at the strongest pace in nearly six years in January. One worry for the wider economy is that growth of both output and new orders in the manufacturing sector has slowed in three successive months, suggesting that clients are proving sensitive to price changes. If this trend is matched in the service sector, the outlook may start to look less rosy.

The recent pick-up in inflationary pressures signalled by the PMI data is backed up by official statistics. Producer prices in the manufacturing sector were up 6.5% year-on-year in February (the strongest since July 2011), while consumer price inflation has been running at around four-year highs in recent months.

PMI data for April will show whether inflationary pressures continue to build at the start of the second quarter, and what impact this has had on growth in the Spanish economy. Manufacturing PMI data will be released on May 2nd, with Services following two days later.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-Price-rises-set-to-test-strength-of-underlying-demand-in-Spain.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-Price-rises-set-to-test-strength-of-underlying-demand-in-Spain.html&text=Price+rises+set+to+test+strength+of+underlying+demand+in+Spain","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-Price-rises-set-to-test-strength-of-underlying-demand-in-Spain.html","enabled":true},{"name":"email","url":"?subject=Price rises set to test strength of underlying demand in Spain&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-Price-rises-set-to-test-strength-of-underlying-demand-in-Spain.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Price+rises+set+to+test+strength+of+underlying+demand+in+Spain http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-Price-rises-set-to-test-strength-of-underlying-demand-in-Spain.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}