Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 05, 2017

UK PMI indicates modest 0.4% GDP growth in first quarter despite March upturn

UK business activity growth regained some momentum after having slipped to a five-month low in February, but the upturn fails to change the picture of an economy that slowed significantly in the first quarter.

0.4% GDP growth signalled in first quarter

The Markit/CIPS all-sector PMI rose to 54.7 in March from 53.7 in February, though remained weaker than the readings seen in the prior three months.

Despite the March improvement, the relative weakness of the PMI survey data compared to the turn of the year suggests the economy will have grown by 0.4% in the first quarter, markedly lower than the 0.7% expansion seen in the fourth quarter of last year.

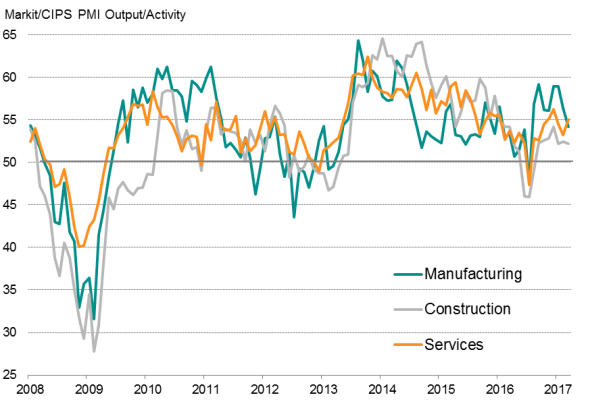

The upturn in March was driven by the service sector, which recorded the best expansion since December. Growth meanwhile slowed in manufacturing, down to its weakest since July, as well as in construction.

Output by sector

However, over the first quarter, both manufacturing and services sectors are likely to have seen growth weaken compared to the fourth quarter expansion of 0.8% for services and the 1.3% growth spurt seen in manufacturing.

The subdued construction PMI readings meanwhile indicate that the building sector has also seen growth wane markedly, with the PMI surveys consistent with a near- stagnation of output in the first quarter compared to a 1.0% rise in the fourth quarter.

The official data are also starting to show signs of a first quarter slowdown. Office for National Statistics data indicated falling output in the manufacturing, services and construction sectors in January.

Consumer slowdown

The survey data also point to a notable waning in demand from consumers. Within the service sector, the worst performance so far this year has been seen in consumer-oriented sectors, notably personal consumer services (which includes businesses such as sports centres, gyms and hairdressers) and hotels and restaurants. The greatest resilience has been seen in financial services.

In manufacturing, robust growth of investment and intermediate goods contrasted with sharply slower growth of consumer goods.

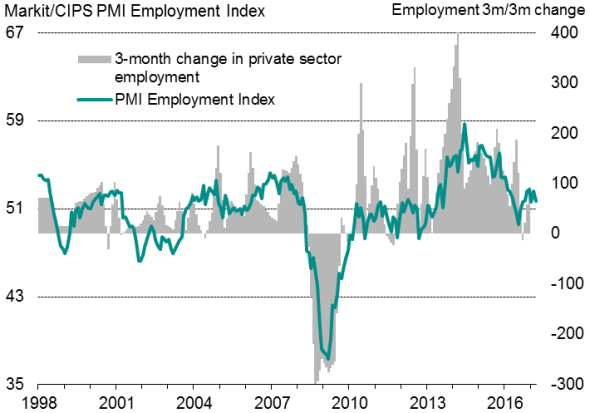

Weaker job creation

Employment growth has meanwhile slowed to the second-weakest seen in the past six months. A subdued labour market is a further worry for consumer spending in the months ahead, especially in an environment of rising prices.

Only manufacturing reported an upturn in hiring in March, with new jobs being added at the fastest rate for nearly one and a half years. Service sector staffing levels rose only modestly, showing the smallest gain since last August. Construction hiring slipped to a three-month low.

UK employment

Costs increase

Price pressures remained elevated. Average prices charged for goods and services rose at the steepest rate for just under six years. Service sector inflation hit the highest since September 2008, and factory gate prices likewise showed one of the largest increases seen since the global financial crisis.

Charges were commonly raised in order to pass higher costs on to customers. Measured across all sectors, average input costs rose sharply again, albeit with the rate of inflation having pulled-back markedly from January's peak.

While the softening of input cost inflation presents brighter news on the outlook for consumer prices, the survey data suggest that inflation still has further to climb from the 2.3% rate seen in February.

UK inflation

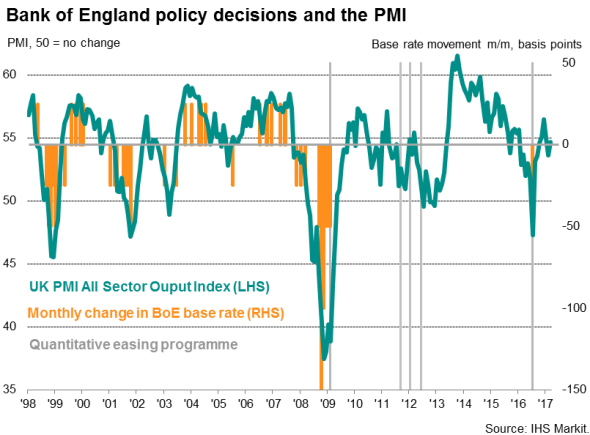

Policy outlook

The March uptick in the PMI surveys merely brings the data in line with a neutral policy stance at the Bank of England. With economic and political uncertainty likely to intensify as the Brexit process gets underway, policymakers are likely to continue to stress the need to look through any further upturn in inflation and focus instead on the need to keep policy on hold to support economic growth.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-UK-PMI-indicates-modest-0-4-GDP-growth-in-first-quarter-despite-March-upturn.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-UK-PMI-indicates-modest-0-4-GDP-growth-in-first-quarter-despite-March-upturn.html&text=UK+PMI+indicates+modest+0.4%25+GDP+growth+in+first+quarter+despite+March+upturn","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-UK-PMI-indicates-modest-0-4-GDP-growth-in-first-quarter-despite-March-upturn.html","enabled":true},{"name":"email","url":"?subject=UK PMI indicates modest 0.4% GDP growth in first quarter despite March upturn&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-UK-PMI-indicates-modest-0-4-GDP-growth-in-first-quarter-despite-March-upturn.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+indicates+modest+0.4%25+GDP+growth+in+first+quarter+despite+March+upturn http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-UK-PMI-indicates-modest-0-4-GDP-growth-in-first-quarter-despite-March-upturn.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}