Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 05, 2016

HSBC's very fragile dividend

HSBC has supported payments to shareholders with the use of scrip dividends but regulatory pressures, weak earnings and shareholders opting for cash rather than scrip equity suggests further risk and mounting pressure on the bank's dividends.

- Dividend yield soars to crisis highs as investors continue to sell down HSBC

- Shareholders opt for cash on scrip dividend to avoid more exposure as equity falls

- Regulatory requirements and litigation add to cash flow concerns and dividend risk

Markit Dividend Forecasting has released a detailed report outlining various scenarios for HSBC's dividend outlook. To access the full report please contact us.

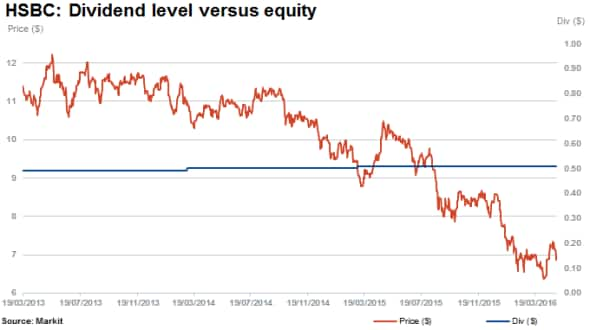

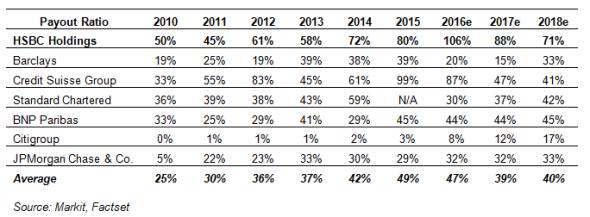

HSBC's current dividend yield and payout ratio clearly stick out from its peers, indicating investor sentiment that the current dividend outlook for the bank is particularly precarious.

It's clear to see that the rising yield has been caused by a continued sell off in the HSBC stock price since 2013, while the bank has managed to marginally shift the nominal dividend higher.

With an average payout ratio of more than double its peer average, investors clearly either expect future deterioration in the banks dividends or alternatively resurgence in earnings. The continued sell off in the company's shares would indicate the former which has propelled the current dividend to record highs last seen post the financial crisis - currently hovering above 8%.

Driven by a fall in earnings between 2011 and 2015, the higher payout ratio is set to in fact increase as consensus forecasts point to a further 10% decline in earnings in FY16. Additionally, Markit Dividend forecasting expects a stable dividend going forward but has incorporated some alternative scenarios.

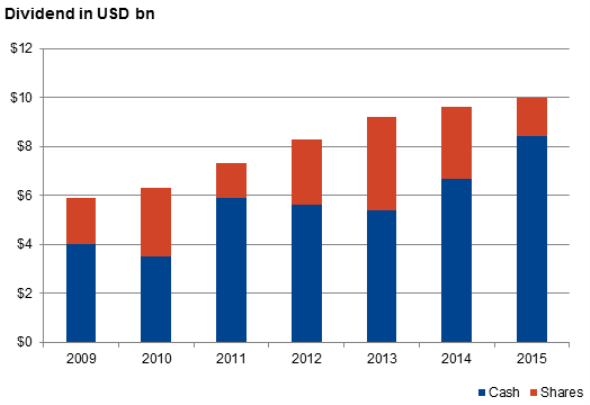

In efforts to manage cash resources, HSBC has managed to successfully leverage the use of scrip dividends in recent years. Scrip dividends give the shareholder the option to receive cash or take up additional shares in the company, in lieu of cash distributions. The strategy mirrors efforts undertaken by Spanish banks.

However, since 2013 the percentage of investors who have elected to take shares as has significantly declined, moving from 41% to 15% in 2015. The net cash cost of dividends has subsequently risen from $5.4bn to $8.4bn.

Shareholders are clearly not willing to take up more equity in the bank as the shares continue to slide lower, falling by an additional 20% this year reducing the appeal of the scrip dividend. Additionally, the company has yet to indicate its intentions to counteract dilution effects of the share issuance through share buybacks, mentioning its intent several times but yet to confirm any timelines.

With a potentially increased portion of dividends to be paid in cash, also impacting earnings and cash flow in recent years has been the frequent litigation costs incurred by the bank. These costs tally over $8bn in the last three years and further charges are a key risk to capital buffers. Compounding these concerns is the need to confirm to regulatory capital requirements.

Markit Dividend forecasting currently expects the bank's dividend to be stable over the next few years. However, a potential management change in the form of a new chairmen expected in 2017 could be the catalyst for a drastic dividend policy change.

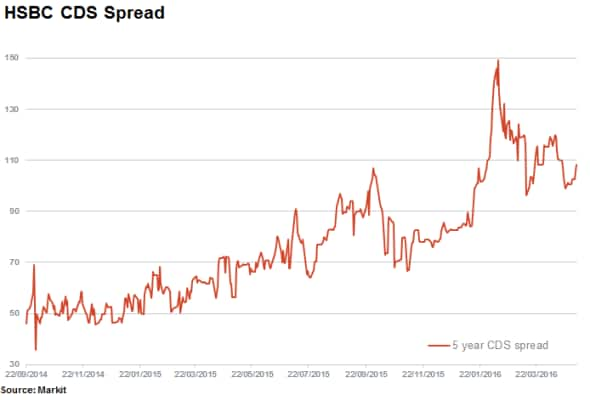

With the banks CDS spreads rising almost 30% this year, credit investors are also showing signs of increased scepticism.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-equities-hsbc-s-very-fragile-dividend.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-equities-hsbc-s-very-fragile-dividend.html&text=HSBC%27s+very+fragile+dividend","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-equities-hsbc-s-very-fragile-dividend.html","enabled":true},{"name":"email","url":"?subject=HSBC's very fragile dividend&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-equities-hsbc-s-very-fragile-dividend.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=HSBC%27s+very+fragile+dividend http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-equities-hsbc-s-very-fragile-dividend.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}