Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 05, 2014

Positive outlook for food producers

After coming out on top of the latest Global Sector PMI data from Markit, we have seen global short covering in the food manufacturers sector - a trend absent for beverages firms, which came at the bottom of the latest survey.

- Food manufacturers have indicated the largest growth output since the PMI survey began

- Shorts have reduced their positions in food and beverage firms by 15% in the last 12 months

- 19 of the 20 most shorted firms a year ago have seen net loan returns

Global food firms lead the latest output growth in the May instalment global sector PMI survey. Food firms have posted the largest jump in output since the global series started in October 2009, after surveyed firms indicated a large jump in new orders.

These buoyant trading conditions, in which food firms indicated a growth in output in every release of our global surveys since 2009, have been reflected in the recent bout of M&A activity which has swept US food firms in recent weeks.

This strong run shown by food producers has not been mirrored by their beverage peers, which came at the bottom of the latest output survey. While the sector has always been one of the more volatile PMI respondents, the latest survey posted the lowest number since March last year.

Shorts cover out of food names aggressively

The recent PMIs are mirrored somewhat by short selling in the sector. Average short interest in the global food and beverage sector has fallen by over 14% over the last 12 months. Strongly performing food firms have led the short covering with 16% less average short interest than was seen a year ago. While beverage firms have seen some short covering, the 4% decrease in average short position trails their food peers by a wide margin.

It’s worth noting that the sector’s perceived safety as a firm staple has never made it a target for short sellers. The sector has 0.95% of shares currently out on loan across the sector, down from 1.1% a year ago.

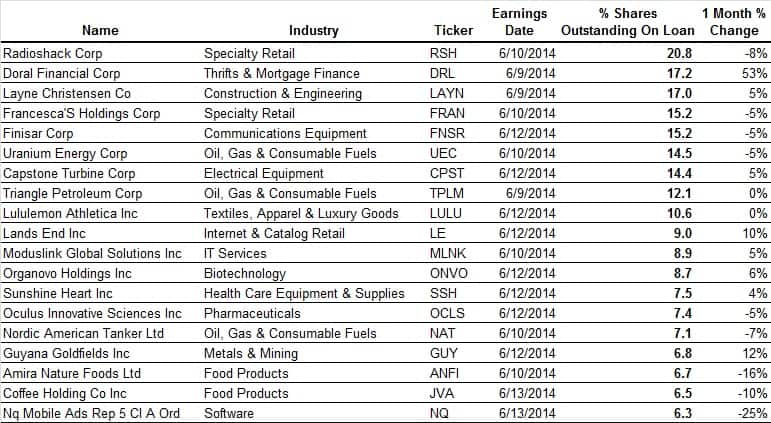

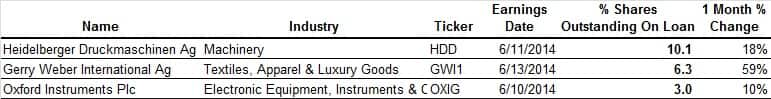

Heavily shorted names lead the covering

The heavily shorted names seem to have ridden the recent wave of good results.19 of the most shored names a year ago have seen less short interest than at the same time a year ago.

The largest amount of short covering in the last year was seen in Diamond foods which was able to put its recent accounting scandal behind it to take advantage of the strong demand for almonds, posting a string of positive results. These developments saw Diamond shares more than double in the last 12 months while short sellers closed out over three quarters of their positions.

Whitwave Foods was also able take advantage of buoyant demand for almond milk to prove short sellers wrong with a string of positive results, which saw its share surge by 88% in the last 12 months to an all-time high. This strong performance saw short sellers cover the entirety of their positions from a high 15% of shares 12 months ago.

Overall, the 20 most shorted food firms were able to post a 23% average return over the last 12 months.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062014120000positive-outlook-for-food-producers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062014120000positive-outlook-for-food-producers.html&text=Positive+outlook+for+food+producers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062014120000positive-outlook-for-food-producers.html","enabled":true},{"name":"email","url":"?subject=Positive outlook for food producers&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062014120000positive-outlook-for-food-producers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Positive+outlook+for+food+producers http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062014120000positive-outlook-for-food-producers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}