Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 05, 2015

Shorting IPO lockup expiration

Despite the limited free float of IPOs, short sellers have been able to successfully pre-empt stock debuts falling out of favour prior to lockup expirations.

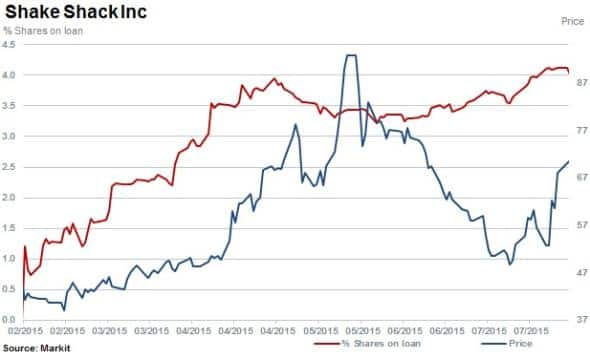

- Short sellers in Shake Shack feel the pain as the stock rallies a third through its lock up

- Twitter and GoPro shorts benefit from post IPO declines prior to lockup expirations

- Short sellers tracking Etsy and Fitbit as stocks approach lockup expiration in 2015

Locking up incentives

IPO lockups are intended to keep company insiders from immediately selling stock when a company raises public capital, supporting share prices and aligning shareholder and insider incentives. This creates unique supply and demand constraints in securities lending markets as short sellers bet against the new issuance hype.

Shorts have stubbornly stomached the pain of being short Shake Shack as shares in the burger chain have risen by a third since July 28th 2015, a day prior to the company's IPO lockup expiration.

Shorts have continued to pay over 100% to borrow arguably the most hyped IPO of the year to date, even after being squeezed out of positions in May as shares rose above $90. The increased number of Shake Shack shares expected to come to market was hoped to put downward pressure on the stock price, the opposite in fact has occurred with the stock rallying in July. However half (1.4m) of the company's limited free float of ~2.8m shares remains shorted currently (8% of shares in issue).

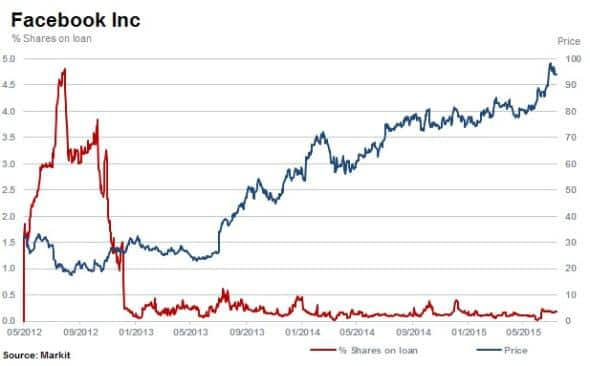

Shorting Facebook short-lived

One of the most anticipated IPOs in recent years, shorts sellers were successful in timing Facebook's initial post IPO lull in 2012 and benefited from the effects of lockup expirations.

Short interest peaked at 4.7% of shares out on loan in August, with shorts covering positions by 35% as shares fell 40% before a large expiration occurred in November 2012. Post expiration however, Facebook shares have continued to rally with negligible interest from short sellers.

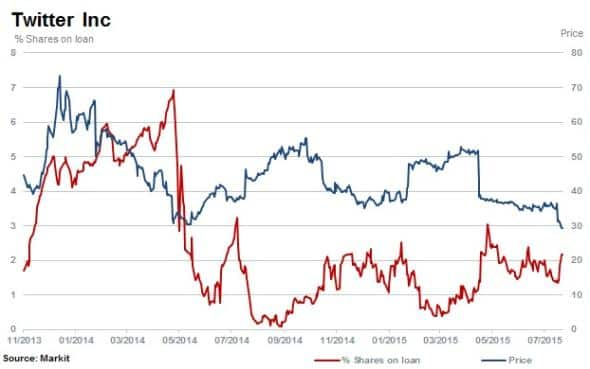

Shorting the expiry

Short sellers were willing to pay up to 30% to short Twitter prior to the company's lockup expiry on May 6th 2014. This position largely paid off as the stock fell 25% between IPO and the lockup expiration. Since then, with more stock in the market, the cost to borrow has fallen and short sellers have retreated with the stock falling a further 8%. Takeover rumours surrounding the social network may be keeping shorts at bay.

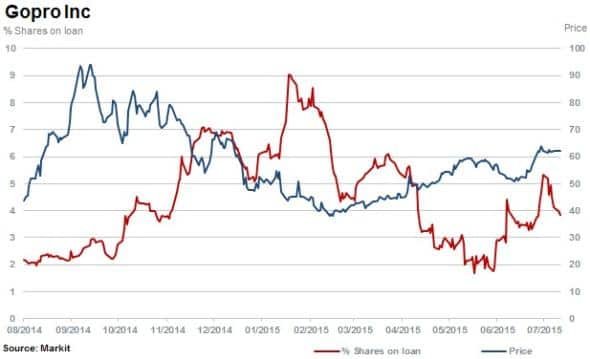

Touching $93 in October 2014 prior to lockup expiration in December 2014, GoPro stock soared post its July 2014 IPO and short sellers were prepared to pay close to 100% to short the camera maker. With limited free float in the market, shares slid 50% to the delight of shorts before the lockup expiry resulted in additional shares coming to market.

Tracking new expirations

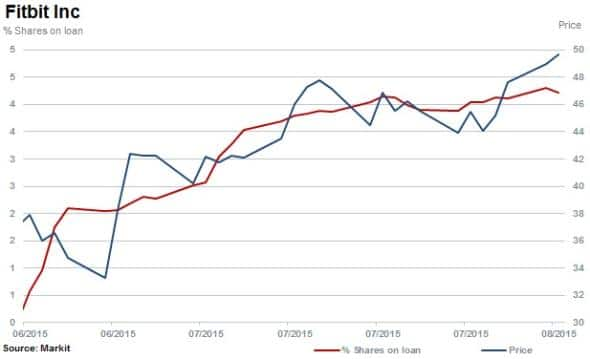

Fitbits's lockup is set to expire on December 15th 2015. Short sellers have been attracted to the stock since its IPO in June 2015, with the quantity of shares on loan increasing eight fold from 1.1m on June 22nd to 8.8m currently. This represents 20% of the company's free float out on loan.

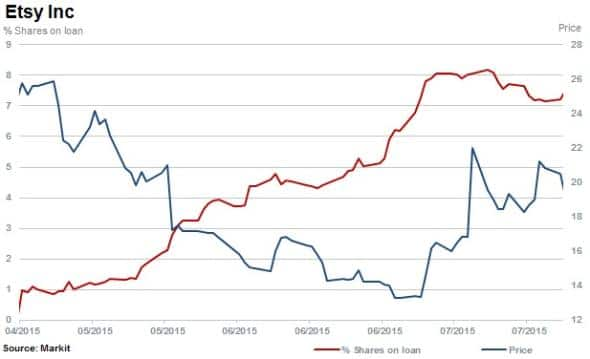

Etsy's 180 day lockup expires on October 13th 2015 and the stock has attracted a tremendous amount of interest since listing in April. The cost to borrow stock surged above 40% in mid-July as the stock spiked 30% due to a mention of the company in Google's earnings announcement.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-equities-shorting-ipo-lockup-expiration.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-equities-shorting-ipo-lockup-expiration.html&text=Shorting+IPO+lockup+expiration","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-equities-shorting-ipo-lockup-expiration.html","enabled":true},{"name":"email","url":"?subject=Shorting IPO lockup expiration&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-equities-shorting-ipo-lockup-expiration.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorting+IPO+lockup+expiration http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-equities-shorting-ipo-lockup-expiration.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}