Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 06, 2017

MVA: The next challenge for derivatives pricing

Staying competitive in the derivatives markets today requires participants to price in the total cost of the trade to the bank. The total cost must include the potential for credit losses (CVA), funding costs (FVA/ColVA) and capital (KVA), together known as xVAs (or 'x' valuation adjustments). Central clearing of derivatives, and the related introduction of bilateral Initial Margin rules, can reduce CVA and KVA costs, but the net effect is to shuffle costs into funding the Initial Margin (IM) on the positions. This cost, known as MVA (Margin Valuation Adjustment), is the latest xVA to be added to the list. In an effort to stay profitable, banks are increasingly looking to optimize their xVA costs by constructing net xVA reducing trading strategies. However, effective optimization requires computing all xVAs consistently and this is a formidable financial engineering challenge, particularly with the onset of MVA.

The introduction of IM posting for non-centrally cleared derivatives aims to promote the central clearing of derivatives and reduce systemic risk by ensuing enough excess collateral is available to cover the shortfall experienced at times of default. This collateral is posted up-front and segregated to a third party to ensure its availability. Promotion of central clearing is achieved by ensuring the costs of bilateral trading reflect those of trading with CCPs that already require the posting of IM.

The CVA of a collateralized portfolio is driven by the gap risk at default. IM is to be calculated as the 99% VaR over this period of risk meaning CVA is reduced to only the expected 99% shortfall over this margin period of risk. While this essentially eliminates CVA on these fully collateralized portfolios, the trade-off is the new cost of funding the IM or MVA as it has become known.

ISDA's SIMM has emerged as the global standard for computing IM. Calibrated to 99% VaR, the model leverages trade-level sensitivities in an FRTB-style Sensitivity Based Approach aggregation. IM is rebalanced frequently and computed on portfolios of non-centrally cleared products, including options. As a result, IM is highly path dependent, varying by portfolio composition and market conditions. Accurate approaches to computing MVA therefore require projecting the forward IM within a Monte Carlo simulation.

While CVA with IM may be essentially zero, CCR capital under the presence of IM can still be significant. Under the rules of SA-CCR, the benefit of over collateralization is progressively scaled in and capped at 95% reduction in PFE through the PFE multiplier. Banks that price in KVA on SA-CCR must therefore also accurately model the future IM in order to capture the IM relief in their KVA. This again involves projection of IM within the KVA Monte Carlo simulation.

Projecting IM within Monte Carlo simulations raises a number of challenges for xVA systems. Firstly, the calculation of trade level sensitivities per path and time step in the simulation poses computational challenges. Secondly, IM can have significant contribution from Vega and Basis risk in addition to Delta risk. Capturing the trade level Vega and Basis risk would require the xVA models to treat basis spreads and volatility as risk factors, which is beyond the means of many xVA engines. The dominate Vega risk for CVA is the volatility of the risk factors driving the exposure, whereas the Vega risk of interest for the forward IM projection is the Vega of each trade, and how that Vega varies with underlying market levels.

Additionally, the low number of risk factors (i.e. 1 or 2-factor short rate models) typically used in xVA models may map poorly to the high number of dimensions (ten distinct tenor buckets on each yield curve) used in SIMM, further missing the granular risk factor weighting and correlation offsets built into SIMM. Finally, as SIMM may be recalibrated from time to time, a lifetime projection of IM would ideally account for this calibration impact.

Standard approaches to projecting IM are yet to emerge in the industry. The above challenges have motivated the proposal to bypass SIMM and revert to the 99% VaR definition of IM. This can be relatively easily computed within the Monte Carlo simulation using regression techniques. A scaling to the time zero SIMM can be used to account for - at least crudely - the components of SIMM missed in the MVA model. Algorithmic Differentiation (AD) is another possible approach, but it can still suffer from the challenges of Vega and Basis risk mentioned above, as well as the adaptability of AD to compute forward sensitivities per trade to forward market factors.

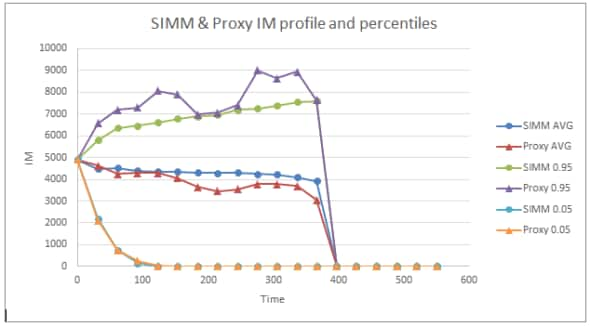

Figure 1 below shows a comparison of a SIMM within Monte Carlo approach to one implementation of a regression based approach. The choice of regression variables, regression techniques and scaling all impact the accuracy of these approximation approaches. As evidenced in the plot, the average IM required for MVA and the shape of the distribution can be well approximated with these approaches, at least for small portfolios. However, when more risk factors drive the portfolio exposure, the approximations can deteriorate as the set of required regression variables grows. In particular, accurately modelling the path-wise IM required to capture correlation (Wrong-way or Right-way) between IM and exposure (such correlation could impact the KVA benefit of IM) is likely beyond the scope of these approaches.

Figure 1: Expected IM profile, 5th and 95th percentiles of IM distribution for a SIMM within Monte Carlo approach (circles) and regression proxy (triangles) for an ATM swaption.

As more banks and the size of the portfolios subject to IM grow, traders will start to feel the squeeze from the IM funding cost. Those prepared to accurately price it into trades and optimize it along with other xVAs will ensure no undue costs are taken on, providing a competitive edge in the derivatives markets.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072017-in-my-opinion-mva-the-next-challenge-for-derivatives-pricing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072017-in-my-opinion-mva-the-next-challenge-for-derivatives-pricing.html&text=MVA%3a+The+next+challenge+for+derivatives+pricing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072017-in-my-opinion-mva-the-next-challenge-for-derivatives-pricing.html","enabled":true},{"name":"email","url":"?subject=MVA: The next challenge for derivatives pricing | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072017-in-my-opinion-mva-the-next-challenge-for-derivatives-pricing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=MVA%3a+The+next+challenge+for+derivatives+pricing+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072017-in-my-opinion-mva-the-next-challenge-for-derivatives-pricing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}