Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 06, 2015

European real estate dividends grow

Markit is expecting dividends from European real estate firms to increase by 16% in 2015; the fifth consecutive year of dividend growth for the sector.

- European real estate companies are forecast to declare €5.9bn in dividends, up 16%

- Strong yields are nearing 4% but down on the previous year due to share price increases

- France, Netherlands and Germany are the largest contributors to aggregate dividends

Consecutive increases

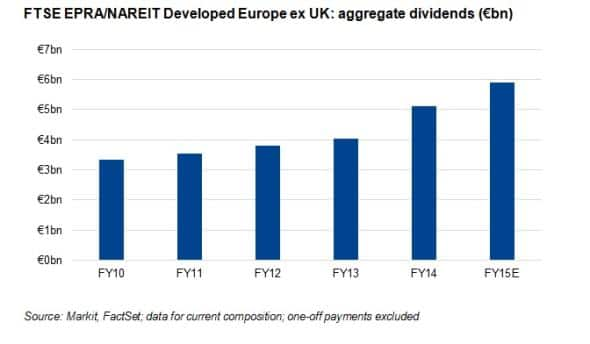

Markit Dividend Forecastingis expecting ordinary dividends from European real estate firms outside the UK* to increase by 16% in the 2015 fiscal year, with total payments reaching €5.9bn.

This double digit growth is somewhat overshadowed by the previous year's 26% increase, but still marks the fifth consecutive annual increase with 75% growth in payments since 2010.

60% of firms are expected to increase their payments, with a third of these rising by more than 10%. The remaining firms are expected to maintain payment levels.Due to strong share prices performances, the average t dividend yield is forecast to be slightly lower at ~3.9%.

Dividend nations

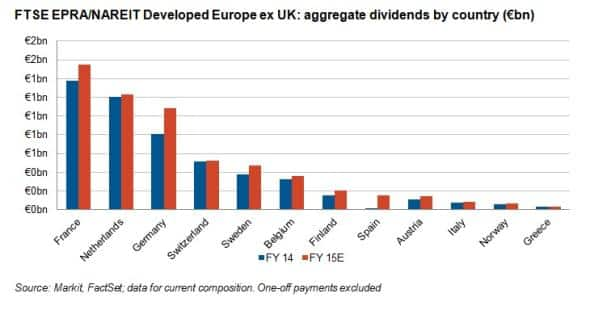

French, Dutch and German real estate companies account for two thirds of total aggregate dividends expected to be declared for fiscal 2015.

France is the largest payer on a country basis, with four of the top seven payers. Unibail-Rodamco, listed on both the Amsterdam and Paris stock exchanges, is responsible of three quarters of dividends stemming from Netherlands-based firms.

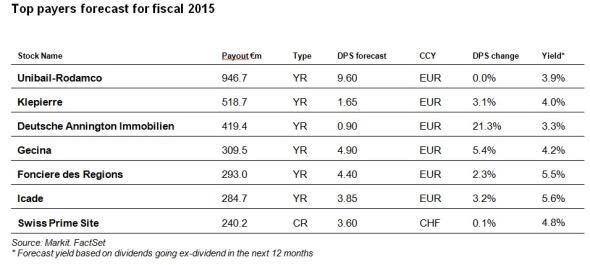

Top payers forecast for fiscal 2015

Unibail-Rodamco is forecast to remain the highest payer, with aggregate payments of almost €1bn on a stable per share dividend of €9.6 for FY15. Forecasts are in line with bullish statements from the ceo, who said that for fiscal 2015, despite of the impact of the 2014 and 2015 disposals, the company intends to maintain a dividend of at least €9.6 per share.

Klepierre is expected to distribute a dividend of €1.65 reflecting a 3% increase compared with FY14 and a payout ratio of 76% on consensus earnings expectations, in line with previous years.

Deutsche Annington Immobilien is expected to payout €420m in FY15, following the firm's takeover of Gagfah.

Dividend growth of 5% is expected from Gecina based on maintaining the historical payout ratio of just under 90%, taking into account consensus earnings.

A small dividend increase is forecast for Fonciere des Regions for FY15 due to increased consensus in underlying profits and growth in cash flow. The company is expected to move towards historical payout levels of around 85%.

* FTSE EPRA Developed Europe ex. UK

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06082015-Equities-European-real-estate-dividends-grow.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06082015-Equities-European-real-estate-dividends-grow.html&text=European+real+estate+dividends+grow","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06082015-Equities-European-real-estate-dividends-grow.html","enabled":true},{"name":"email","url":"?subject=European real estate dividends grow&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06082015-Equities-European-real-estate-dividends-grow.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+real+estate+dividends+grow http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06082015-Equities-European-real-estate-dividends-grow.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}