Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 07, 2016

US jobs report spurs on emerging market bulls

The recent poor US non-farm payroll number has encouraged market bulls as the spectre of rising US interest rates receded.

- Emerging market equity ETFs have seen over $1bn of inflows in last two days

- Short interest in the iShares MSCI Emerging Markets ETF has fallen by over 10% in last week

- Investors are choosing low cost and low volatility upstart funds

Emerging market bulls roared back to life as the poor US non-farm payroll and the receding probability of an imminent rate rise saw ETF investors return to one of their favourite trades of the quarter.

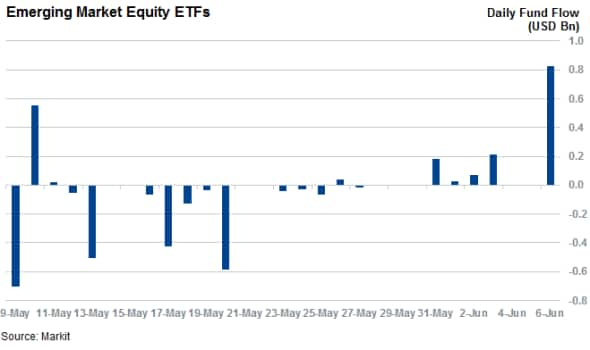

Emerging markets equities were the hot trade when the markets rebounded from their February lows, but investors had lost some of their appetite for the asset class in recent weeks as the possibility of a June interest rate hike from the Federal Reserve grew. This change of heart was also driven by economic facts on the ground, as the May release of the Markit Emerging Markets Composite PMI sank back into contraction territory after stalling in April. Emerging market ETFs snapped a 12 week inflow streak over May with over $1.2bn flowing out of the asset class in the second week of the month.

Friday's disappointing non-farm payroll number was seen by the markets as a catalyst for a continuation of the current status quo regarding US interest rates, which in turn quieted some of the bearish sentiment seen in emerging market equities. ETF fund flows have reflected this change of mood as emerging market funds registered over $1bn of inflows in the two days since Friday morning's announcement from the US Bureau of Labour Statistics.

These inflows have proved well timed as the Vanguard FTSE Emerging Markets Stocks ETF (VWO), the largest emerging market ETF, has outperformed the S&P 500 index by over 2.5% since the jobs report was released.

Interestingly, the recent inflows have not been driven by the two established incumbent funds, the previously mentioned VWO and the iShares MSCI Emerging Markets ETF (EEM) which together manage 58% of the total emerging market equity ETF AUM. The two funds seeing the lion's shares of the current inflows are the iShares Core MSCI Emerging Markets ETF and the iShares MSCI Emerging Markets Minimum Volatility ETF which offer low cost exposure and low volatility respectively and have seen three quarter of recent inflows respectively.

ETF investors also covering

Short sellers, which had added to their positions in many of the largest emerging market ETFs in recent weeks, are also paring back their trades as the asset class surges ahead of domestic US equities. Short interest in the EEM ETF had surged by four-fold in the weeks since the emerging trade momentum fell out of favour. 80 million shares of the EEM ETF were shorted at the end of last month, representing over $2.7bn of short position.

That number has since retreated by over 10% to less than 70 million shares.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07062016-Equities-US-jobs-report-spurs-on-emerging-market-bulls.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07062016-Equities-US-jobs-report-spurs-on-emerging-market-bulls.html&text=US+jobs+report+spurs+on+emerging+market+bulls","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07062016-Equities-US-jobs-report-spurs-on-emerging-market-bulls.html","enabled":true},{"name":"email","url":"?subject=US jobs report spurs on emerging market bulls&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07062016-Equities-US-jobs-report-spurs-on-emerging-market-bulls.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+jobs+report+spurs+on+emerging+market+bulls http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07062016-Equities-US-jobs-report-spurs-on-emerging-market-bulls.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}