Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 07, 2014

Asian real estate lags behind rest of world

The first release of the Markit Asia Sector PMI has indicated a fall in output for Asian real estate firms, in stark contrast to their European and US peers where the sector indicates the strongest jump in output in over five years.

- Real estate companies have indicated the sharpest fall in month on month output in nearly three years, according to the Markit Asia Sector PMI

- Short sellers have taken note of the recent weakness and added to their positions

- Japanese firms have taken over from Hong Kong listed companies as the most shorted

Unlike in Europe and North America, where real estate markets are driving ahead, Asia’s real estate markets seem to be cooling. While the recent cooling of prices in Hong Kong, Mainland China and Singapore will be seen as a positive trend for those worried about a potential bubble developing in the region over the last couple of years, the recent halt in the region’s price rise is unwelcome news to its real estate firms which have indicated that output fell in June, according to the first release of the Markit Asia Sector PMI.

Real estate fallingReal estate firms have indicated a slight fall in output in June from the previous month. This number follows May’s disappointing reading which indicated the sharpest fall in month on month output in nearly three years.

While the sector comes in as fifth worst amongst its regional peers, the global real estate sector came in top of June Global Sector PMI survey.

The region’s recent cooling prices are also highlighted in the recent PMI reports as real estate firms reported that their output prices fell from the previous month.

Short interest up

Developments within the real estate world in Asia have not gone unnoticed by short sellers, which have increased their positions steadily over the last 18 months. The current average demand to borrow across the 293 Asian listed real estate firms with a market cap greater than $200m we have data for now stands at 1.3% of free float on average, 30% higher than the number seen a year ago.

Shorts changing their focus

Interestingly, while the aggregate short positions have been roughly flat over the last 12 months, short sellers have by and large shifted their positions over this period of time. Whereas last year saw short sellers busy themselves with Hong Kong listed firms, the current top ten list of heavily shorted companies has seven Japanese firms amongst them, compared to one in the same screen 12 month ago.

Among the Japanese firms currently on short seller’s minds is website Next Co Ltd with 8.2% of free float on loan, lease frim Sun Frontier (7.5%) and survey firm Jibannet (7.1%).

Although Hong Kong firms have by and large disappeared from the most shorted list we saw a year ago, we still see Evergrande Real Estate Group as the most shorted firm in the region with 28.7% of its free float currently out on loan, as the company was forced to cut its prices in order to shift stock.

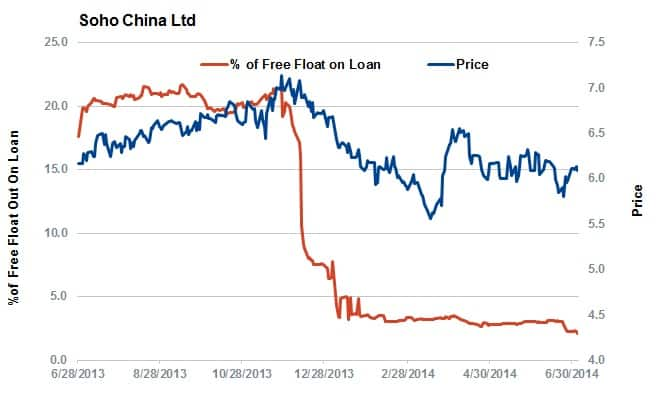

The other heavily shorted Hong Kong firms seen a year ago have experienced significant short covering in the face of falling share prices. Top among the Hong Kong firms seeing shorts cover is Soho China which has seen its short interest fall by 90% to 2.1% of free float in the last 12 months.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072014120000Asian-real-estate-lags-behind-rest-of-world.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072014120000Asian-real-estate-lags-behind-rest-of-world.html&text=Asian+real+estate+lags+behind+rest+of+world","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072014120000Asian-real-estate-lags-behind-rest-of-world.html","enabled":true},{"name":"email","url":"?subject=Asian real estate lags behind rest of world&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072014120000Asian-real-estate-lags-behind-rest-of-world.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asian+real+estate+lags+behind+rest+of+world http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072014120000Asian-real-estate-lags-behind-rest-of-world.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}