Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 07, 2014

Global Sector PMI

Global real estate activity increases at record pace in July

- Real estate activity grows at fastest rate since global sector data started in October 2009

- Other finance-related areas also see robust growth

- Service sectors driving global growth

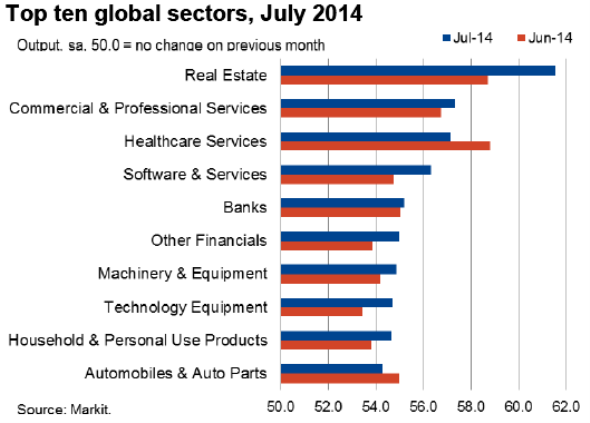

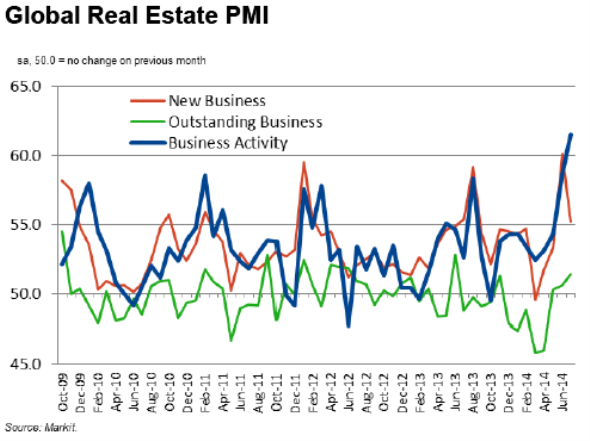

PMI data from Markit showed that the real estate sector led the global upturn at the start of the third quarter, building on June's strong performance. The Global Real Estate Business Activity Index rose to a new record high of 61.5, and signalled stronger expansion than all other global sectors covered by PMI data.

Global summary

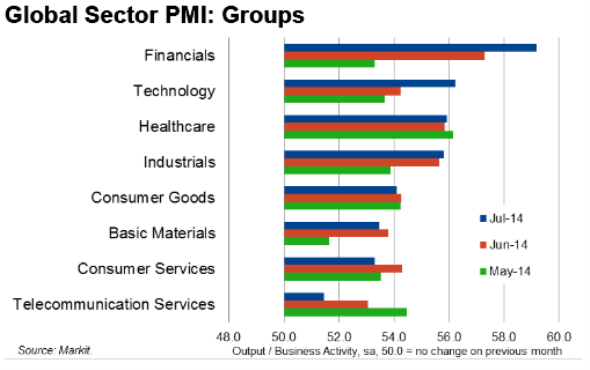

Services-related sectors occupied the top six global rankings in July. Commercial & professional services held second place behind real estate, with growth accelerating to an eight-month high. Third-placed healthcare services saw activity rise at a slightly weaker rate than June's record. Software & services, banks and other financials took the next three places in the growth table.

Data at the broad sector level showed a further acceleration in growth in financials - including real estate, banks, insurance and other financials - which was the highest ranked among eight groups for the second month running in July. The Global Financials Business Activity Index posted 59.2 in July, a record high since the series started in October 2009.

Real Estate

The surge in real estate business activity in July reflected June's record gain in new business. Moreover, outstanding business rose for the third month running in July, the longest sequence in two years. That said, growth of new business slowed sharply in July, indicating that the rate of expansion in real estate activity may ease in August. The rate of job creation meanwhile slowed to a three-month low in the latest period, but remained solid overall.

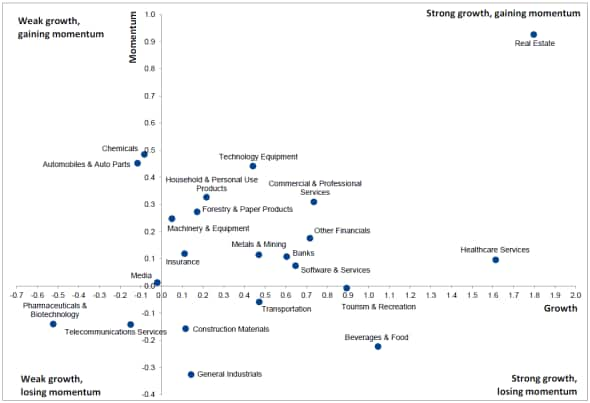

Relative growth and momentum by sector

Momentum and relative growth

Global Sector PMI data can be usefully analysed according to momentum and relative growth.

Momentum is calculated as the difference between the average of the Business Activity Index's month-on-month movement over the latest three-month period and the long-run average of its month-on-month movement (since October 2009), divided by the standard deviation from the mean.

A relative growth score is the difference between the Business Activity Index's average over the latest three-month period and its long-run average (since October 2009), divided by the standard deviation from the mean.

The stand-out sector in terms of both momentum and relative growth in the three months to July was real estate. This reflected record high Business Activity Index readings in both June and July, and an 8.4 point rise in the Index since April - more than any other sector. In comparison, the next biggest cumulative improvement over the same period was a 3.2 point rise in the Chemicals Output Index. Correspondingly, chemicals companies were ranked second in terms of momentum (though failed to achieve strong relative growth over the period, with the Output Index merely in line with its long-run average of 52.9.

The three other finance-related sectors were all positioned in the top-right quadrant of the chart in the latest period, showing both strong relative growth and positive momentum. Of these, other financials - covering consumer financial services, speciality financials and investment services - registered the strongest relative growth and momentum scores.

The worst-performing sectors were telecommunications services and pharmaceutical & biotechnology, which both saw weak growth by historical standards that was also losing momentum compared to prior months.

Notes on data

Markit Global Sector PMI data are derived from surveys of over 20,000 companies operating in 28 countries. The data are typically released on the fifth working day (UK) of each month at 0930 UK time.

The Global Sector PMI data provide corporate planners and decision makers, economic analysts, policy makers and investors with a powerful and unique database with which to monitor business cycles by industry. Sector trends over time can be tracked as well as relative performance between sectors, allowing identification of key growth industries and the drivers within them.

The data create powerful insights into sector profitability and provide tools for investment strategy and asset allocation. Corporate users are able to examine trends within industry sectors, to help industry forecasting and inventory planning.

The dataset provides monthly indicators of business trends across variables such as output, order books, prices, inventories and employment for eight major groups including: basic materials, consumer goods, consumer services, financials, healthcare, industrials, technology and telecommunication services; and a further 26 sectors and subsectors of those groups.

Detailed historical global sector data are available via a subscription from Markit, and datasets are also available for Europe. For further information please contact economics@markit.com.

Trevor Balchin | Economics Director, IHS Markit

Tel: +44 149 1461065

trevor.balchin@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082014120000Global-Sector-PMI.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082014120000Global-Sector-PMI.html&text=Global+Sector+PMI","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082014120000Global-Sector-PMI.html","enabled":true},{"name":"email","url":"?subject=Global Sector PMI&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082014120000Global-Sector-PMI.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+Sector+PMI http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082014120000Global-Sector-PMI.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}