Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 07, 2015

EM slowdown opens up positive CDS-bond basis

Heightened volatility in Europe has seen investors rush to the CDS market to hedge against credit risk; this has in turn opened several basis arbitrage opportunities.

- Groupe Casino and HSBC saw their positive basis grow after weak Asian data

- AB InBev saw its basis move from negative to positive as it pursues SABMiller takeover

- Glencore and Volkswagen now trade with large implied basis in the wake of CDS surge

The CDS-bond basis captures the relative value between a cash bond and CDS contract of the same credit entity. Loosely defined, it is an entities bond swap spread subtracted from its CDS spread.

CDS-bond basis = CDS spread - cash bond spread

Theoretically the spreads both measure an entity's credit risk, so the basis should be zero. Fluctuations in the basis give rise to arbitrage opportunities. To take advantage of these opportunities, a positive basis would involve selling the cash bond (pay spread) and concurrently selling protection (receive spread) on the same credit. Likewise a negative basis trade would involve buying the bond (receive spread) while buying protection (pay spread) on the same credit.

An analysis of European investment grade credits which make up the 125 constituents of the Markit iTraxx Europe Main index and their corresponding CDS spreads and reference bonds sees many such discrepancies which could be arbitraged away. This analysis is based on the actual CDS-bond basis (mid) as calculated by Markit's bond pricing service.

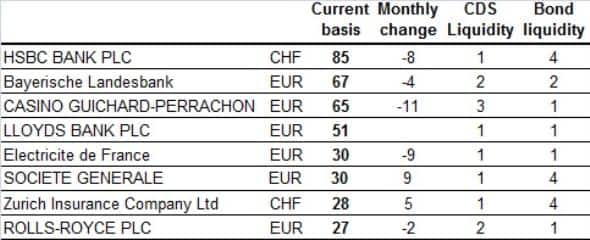

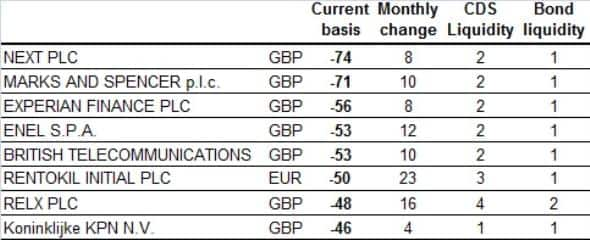

Using a 50bps threshold, there are currently four entities trading with a positive basis in the Markit iTraxx Europe Main index, up from three at the start of September. On the negative basis side, there are more possibilities with five entities, up from two a month ago. The small number of entities trading with a very wide basis marks a stark contrast to US investment grade credit, which typically has a much wider basis, particularly on the negative side.

September was a particularly turbulent month in fixed income markets with heightened risk in European investment grade credits such as Volkswagen and Glencore, affecting the broader market. The need to hedge risk effectively bolstered CDS trading activity to one year highs, according to data from DTCC.

Positive basis

Two of the four names currently trading with negative basis are European names with large Asian exposure which have both seen their CDS spreads get ahead of their bond asset swap spread.

Near the top of the list is French mass retailer Groupe Casino, whose basis is currently 64bps, up by 11bps from early September's level. This comes as no surprise given the retailer's geographic positioning, with operations concentrated in South America and Asia. Economic activity in both regions is expected to slow down more than previously anticipated according to the IMFs latest projections. Groupe's 5-yr bond also exhibits better liquidity than its 5-yr CDS peer, exacerbating the basis.

British Bank HSBC, which also has strong operations in Asia, has seen its basis widen to 85bps, the highest on the list.

One of the biggest monthly movers on the list was Anheuser-Busch InBev, whose basis moved 29bps, from negative to positive. The world's largest beverage maker has been chasing the acquisition of rival SABMiller, in what would be one of the biggest deals of the year, of which there would be inevitable risks.

Negative basis

Topping the list of negative basis trades are UK clothes retailers Next and Marks and Spencer. Both exhibit a wide negative basis, 74bps and 71bps, respectively, and have become more negative over the past month.

Of the top five names with the widest basis, none have a CDS of liquidity 1 (the highest rank) according to Markit's CDS pricing service and all are denominated in pound sterling.

Glencore/VW

While this report uses actual CDS-bond basis data, certain limitations mean that not all names are covered. Glencore and Volkswagen, using a theoretical CDS-bond basis calculation, unsurprisingly exhibited a positive basis of 67bps and 50bps, respectively, as investors rushed to hedge against downside risk.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102015-credit-em-slowdown-opens-up-positive-cds-bond-basis.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102015-credit-em-slowdown-opens-up-positive-cds-bond-basis.html&text=EM+slowdown+opens+up+positive+CDS-bond+basis","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102015-credit-em-slowdown-opens-up-positive-cds-bond-basis.html","enabled":true},{"name":"email","url":"?subject=EM slowdown opens up positive CDS-bond basis&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102015-credit-em-slowdown-opens-up-positive-cds-bond-basis.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=EM+slowdown+opens+up+positive+CDS-bond+basis http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102015-credit-em-slowdown-opens-up-positive-cds-bond-basis.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}