Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 08, 2017

Competition and consolidation are coming – impact of potential SEC institutional transparency requirements

Increased transparency for institutional orders is on the horizon. Based on the market response to retail disclosure requirements, expect to see further price improvement in equity markets as a result. Dark venues focused on institutional flow should prepare for competition to ramp up.

The updates to 600 and 606 order disclosure requirements are still in flux, but it’s clear that the SEC will mandate greater transparency for institutional orders, whether specifically for large (> $200k value) orders or not. Current drafts suggest brokers will be likely to publish aggregate execution quality numbers for these orders, grouped according to strategy in order to make the numbers comparable. The goal is to provide investors with access to results that reveal the quantities executed at the near side of the market, within the spread, and far side of the market for each group.

Given the requirement for these statistics to be available to institutional customers for their own orders, and the existing requirement that institutions have a process in place for evaluating ‘best execution’, the message is clear: institutions will be expected to evaluate their brokers’ results, and to manage their order flow in a way that rewards those who provide higher execution quality. Therefore, we can expect to see institutions directing more of their order flow to brokers and venues that provide a higher ratio of executions at the near side or inside the spread within each aggressiveness category.

So how might the market be shaped by these new requirements?

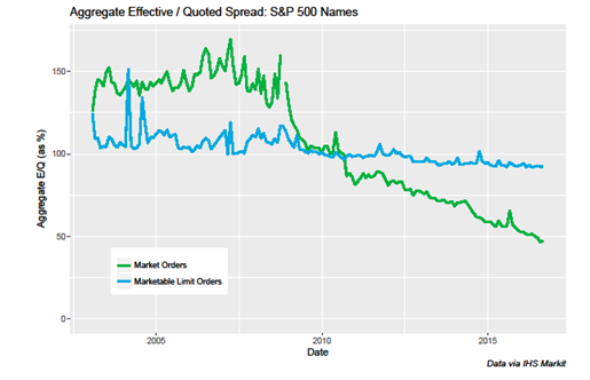

Since the 605 and 606 transparency requirements were originally published 12 years ago, execution quality has become a key driver of business relationships between retail brokers and their wholesaling partners. Specifically, both sides constantly measure execution quality, via Effective divided by Quoted Spreads, and Price Improvement (both as a percentage of shares and the amount per share); metrics revealed directly by the data mandated by market centers’ 605 reports. Retail brokers quickly shift order flow among wholesalers to reward those who provide superior execution quality by these measures. As a result, Effective over Quoted spreads for retail-type orders have improved significantly since these reporting requirements were introduced.

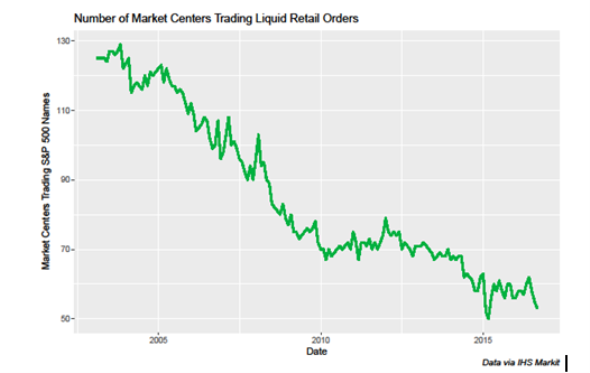

As Effective over Quoted spreads on retail-sized orders have improved since the introduction of Reg NMS, the market has also seen the number of market centers who trade liquid retail orders reduced significantly. Presumably, the improving execution quality has tightened margins, forcing the less competitive operations to exit.

As new regulations bring transparency to institutional trading we should expect similar results: improved execution quality (in this case, more executions inside the spread) and the exit of less competitive market centers from the space. In order to compete for institutional order flow, market centers will therefore need to deliver a higher portion of near-side and inside the spread executions to their customers, and will likely need to do so at lower cost.

Goldman Sachs’ recent announcement to move its SigmaX dark pool to NASDAQ’s infrastructure appears to respond to both of these pressures. It is rational to assume that (1) by moving their infrastructure onto NASDAQ’s, they will likely reduce both operating cost and the expense of monitoring the pool. (2) In addition, it is reasonable to expect that clients will be more comfortable with SigmaX due to the increased distance from Goldman’s trading operation, which could increase the amount of order flow customers expose to SigmaX, and increase the odds of execution.

Based on historical data, we should all expect that well-constructed disclosure rules will lead to a much more competitive institutional trading marketplace, lowering trading costs for institutions and their asset owners. And as the competition increases, we may also see a major shakeout in the market as only the most competitive market centers are able to survive. Get ready for a bumpy ride.

John Halloran, Director, Trading Services

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-In-My-Opinion-Competition-and-consolidation-are-coming-impact-of-potential-SEC-institutional-transparency-requirements.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-In-My-Opinion-Competition-and-consolidation-are-coming-impact-of-potential-SEC-institutional-transparency-requirements.html&text=Competition+and+consolidation+are+coming+%e2%80%93+impact+of+potential+SEC+institutional+transparency+requirements","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-In-My-Opinion-Competition-and-consolidation-are-coming-impact-of-potential-SEC-institutional-transparency-requirements.html","enabled":true},{"name":"email","url":"?subject=Competition and consolidation are coming – impact of potential SEC institutional transparency requirements&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-In-My-Opinion-Competition-and-consolidation-are-coming-impact-of-potential-SEC-institutional-transparency-requirements.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Competition+and+consolidation+are+coming+%e2%80%93+impact+of+potential+SEC+institutional+transparency+requirements http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-In-My-Opinion-Competition-and-consolidation-are-coming-impact-of-potential-SEC-institutional-transparency-requirements.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}