Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 08, 2016

ETF industry finds growth in fixed income

ETF issuers have benefited from timely fixed income listings in 2016 as investors continue to pour billions into the asset class and pull funds from equities.

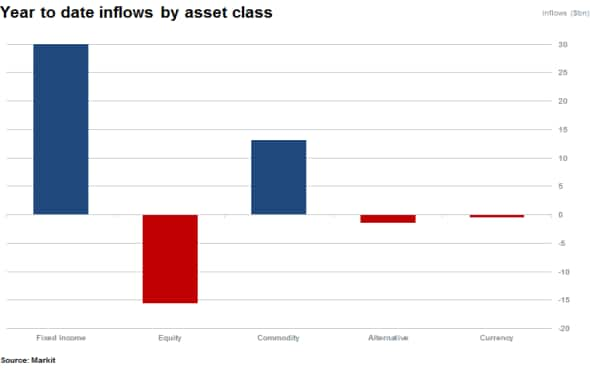

- Investors have pushed $30bn of funds into fixed income ETFs ytd as they retreat from equities

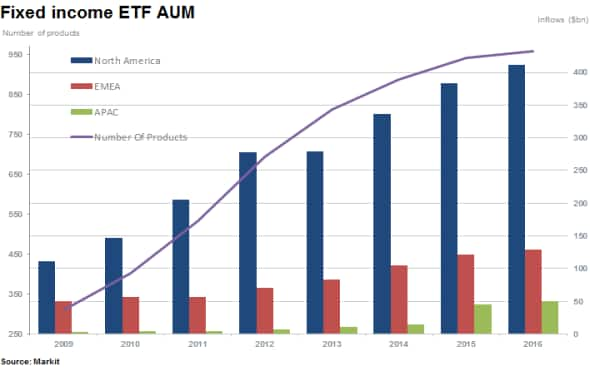

- Fixed income ETF AUM swell to an all-time high $583bn as funds gather pace globally

- Majority of ETFs listed in February are fixed income, adding to over 900 products available

Issuers cater for fixed income appetite

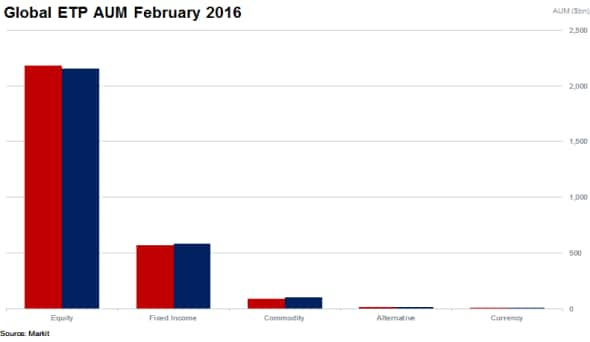

Once again, global ETF AUM is edging closer to the slippery $3trn mark which was last breached in October 2015. AUM of global ETFs has risen $130bn ytd. A quarter of this has been driven by $35bn of inflows with the balance driven by price moves in underlying investments and net asset values.

This year to date jump in AUM is even more impressive when taking into consideration the fact that equity funds which manage 75% of all assets have seen their AUM shrink since the start of the year due to falling markets and outflows out of the asset class.

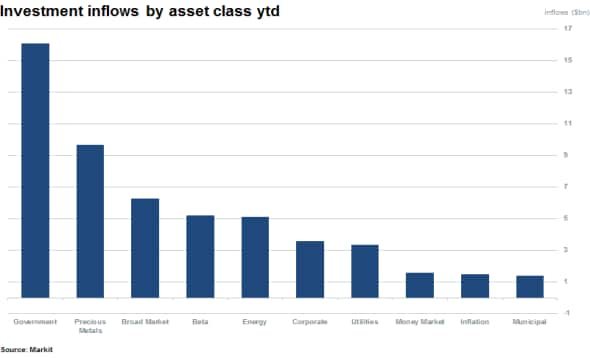

A further look into inflows shows that investor were most eager to buy government bond funds with the asset class gathering half of all inflows since the start of the year. Gold and other precious metal ETFs were the only non-fixed income asset class to break into the top three in terms of year to date inflows.

Issuers hone in on fixed income

This strong investor demand for fixed income means that the market share of the asset class has risen by 30% in the past five years. The asset class now manages an all-time high $585bn of AUM which represents a fifth of all assets managed by the ETF industry. There are a growing number of funds serving this market with 957 products as of latest count.

The affinity towards fixed income ETFs is also proving to be a global phenomenon as European and Asian listed funds gather pace. Apac fixed income AUM has grown nine fold since 2011 to $50bn. The strong growth in the region is attributable to Chinese fixed income products attracting large inflows in 2015 which has continued in 2016.

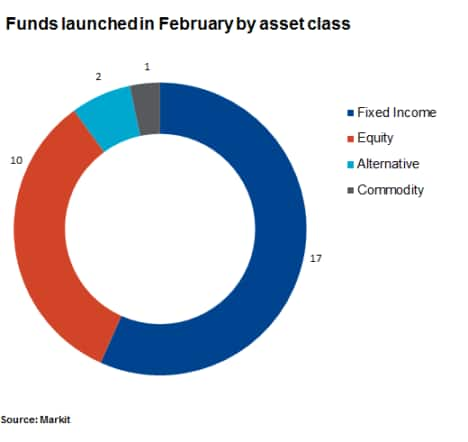

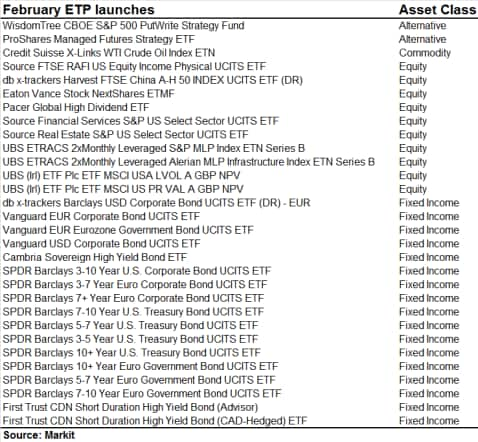

While there is almost 6,500 different exchange traded products available to investors, fixed income products represent only 15% of these but manage 20% or current assets. ETF issuers have had seemingly more luck in fixed income than with equity products which have become more exotic as the market gets crowded. Only five products launched in February are 'general' in nature, following broad market or large cap strategies. The balance is either sector focused, leveraged or has specific styles/strategies in place to improve their differentiation.

This is in comparison to current listings of fixed income products launched which mostly track vanilla debt instruments. Of the 17 fixed income ETFs which were launched in February, most provide exposure to US and Euro corporate and government bonds. Vanguard and SPDR Barclays are the leading issuers in this wave of issuances.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032016-Equities-ETF-industry-finds-growth-in-fixed-income.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032016-Equities-ETF-industry-finds-growth-in-fixed-income.html&text=ETF+industry+finds+growth+in+fixed+income","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032016-Equities-ETF-industry-finds-growth-in-fixed-income.html","enabled":true},{"name":"email","url":"?subject=ETF industry finds growth in fixed income&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032016-Equities-ETF-industry-finds-growth-in-fixed-income.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ETF+industry+finds+growth+in+fixed+income http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032016-Equities-ETF-industry-finds-growth-in-fixed-income.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}