Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 08, 2016

ECB boosts covered bonds; Puerto Rico bonds fall

In this week's credit wrap; covered bond demand accelerates new Puerto Rico laws but bond restructuring talks in doubt, and French company Numericable issues record high yield bond.

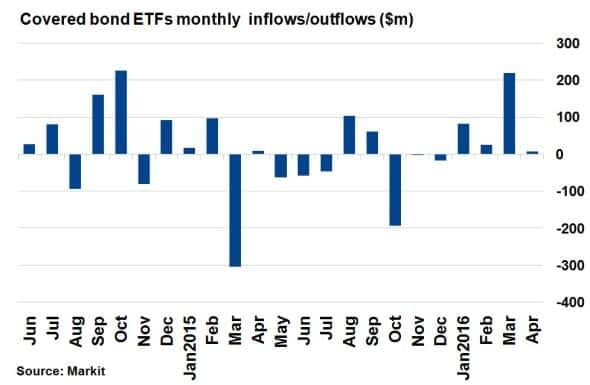

- Covered Bond ETFs saw their best monthly inflow since October 2014

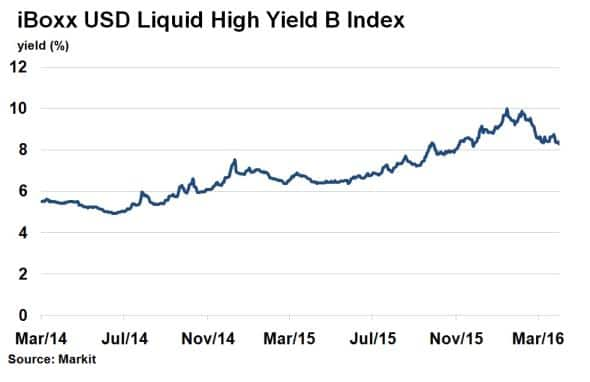

- Markit iBoxx USD Liquid High Yield B Index has seen its yield fall 1.68% since January 20th

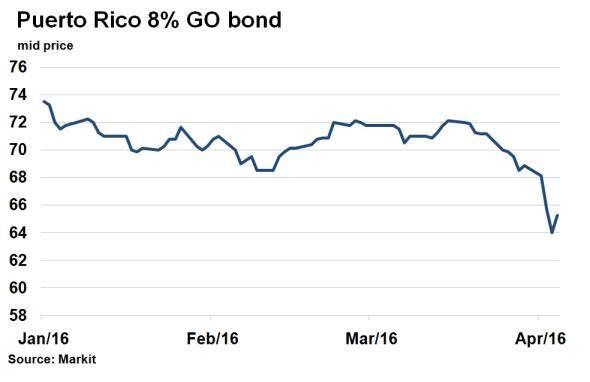

- Puerto Rico's 8% General Obligation bond saw its price drop to lowest level so far this year

Investors snap up covered bonds

Higher yields on offer and falling risk premia have seen investors rush towards covered bonds at the fastest pace since October 2014.

According to Markit's ETP analytics service, ETFs tracking covered bonds saw inflows of $218m in March, a sharp increase compared to prior months. Global asset volatility over the past several months sent covered bond yields higher - the Markit iBoxx EUR Covered index yielded 0.71% last December, more than double the level several months prior.

The higher yields and the European Central Bank's (ECB) decision to expand monetary stimulus (supressing credit risk in the process) provided investors with an attractive risk/reward trade off to re-enter the covered bond market. Interestingly, the last time covered bond ETF monthly inflows reached this high, in October 2014, the ECB had just launched its third covered bond purchasing programme (CBPP3).

Setback for Puerto Rico's restructuring

Laws were passed this week to freeze Puerto Rico's debt payments, as the US commonwealth struggles to keep essential public services running. The move threatens to derail restructuring talks between bondholders and policymakers. Bond prices fell on the back of the news.

Puerto Rico's 8% General Obligation bond saw its price drop to 64 (cash basis to par), lowest level so far this year according to Markit's Municipal bond pricing service. The bond, the most senior among Puerto Rican bonds, was valued at 68.5 at the start of the week. Creditors fears harsher debt terms should the saga continue to linger.

Numericable reignites high yield

The comeback in high yield bonds since February's depths was rubber stamped this week as French Telecoms Company Numericable sold $5.2bn of high yield bonds to heavy investor demand.

The record breaking deal comes after the B rated company rose its offering from an initial target of $2.25bn; a positive sign for the high yield market. The 10-yr bonds were set with a coupon 7.38%, much lower than what would have been expected over the past few months. The Markit iBoxx USD Liquid High Yield B Index, which has an average maturity of six years, has seen its yield drop to 8.32%, from 10% on January 20th. Numericable is currently in the process of acquiring US Telecoms firm Cablevision for $17.7bn.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-credit-ecb-boosts-covered-bonds-puerto-rico-bonds-fall.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-credit-ecb-boosts-covered-bonds-puerto-rico-bonds-fall.html&text=ECB+boosts+covered+bonds%3b+Puerto+Rico+bonds+fall","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-credit-ecb-boosts-covered-bonds-puerto-rico-bonds-fall.html","enabled":true},{"name":"email","url":"?subject=ECB boosts covered bonds; Puerto Rico bonds fall&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-credit-ecb-boosts-covered-bonds-puerto-rico-bonds-fall.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ECB+boosts+covered+bonds%3b+Puerto+Rico+bonds+fall http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-credit-ecb-boosts-covered-bonds-puerto-rico-bonds-fall.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}