Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 08, 2014

Quarterly Review - Spring clearing

As the securities finance industry prepares for yet another round of regulation-driven change, we asses at the spring cleaning needed to adapt to the new normal.

- Inventory levels maintained their upwards momentum in the first quarter an now sand at an all-time high,

- But utilisation is hovering at record low levels

- Balance sheet regulation looks set to drive the need for term borrowing, yet the aggregate value of term trades has remained flat

- Borrowing demand for high quality fixed income securities has proven resilient in the last quarter

Download the latest Markit Securities Finance Quarterly Review:

Looking at the pages of this latest quarterly review, you could be forgiven for thinking that we’d forgotten to update the previous issue.

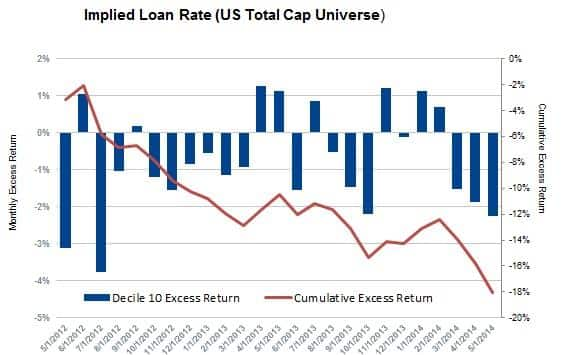

Last year’s stories of loan balances failing to keep up with ever rising inventory levels continued to play out in the opening months of the year. This in turns put pressure on the fees charged for exiting loans, a trend which was no doubt exasperated by the fact that the industry has managed to add another $700 billion of inventory since the start of the year.

This phenomenon was discussed in our last Forum. The “size of the pie” shared amongst industry participants is not growing and the extra supply means that the remaining revenue is spread more thinly.

To highlight the case, the last quarter saw utilisation levels across all asset classes hover in the 10-11% range, down from 13% at the same time three years ago and 20% in 2008. With daily total earnings across the industry holding steady, the added supply has ensured that the return to lendable figure across the entire industry fell to all-time lows at the end of last year.

While the opening months of the year have seen a slight lift in securities lending profitability, the return to lendable figure is still down on where it stood this time last year.

Despite all this doom and gloom, 40% of Forum attendees identified themselves as positive about the outlook of the securities lending industry for the coming two years.

Ever the optimists, we look at what could be driving this upbeat view and what steps are needed to adapt to the coming waves of regulation, which will no doubt shape much of the market.

Regulatory impact

Regulation, as ever, will dictate much of the coming evolution. From a securities lending point of view, the two main pieces of legislation are those that will dictate balance sheet and the type of assets borrowed.

On the balance sheet front, Basel III will see banks look to lock-in longer term funding in order to avoid the heavy cost of capital for short dated liabilities.

As such, institutions willing to lend on a term basis will see an opportunity. However, this regulatory pressure has yet to make its way to the market, as the aggregate term balance has remained anaemic over the last three years.

Capital charges are expected to affect the shape of the markets with regards to exposure to certain counterparties and also the cost to indemnify securities lending programs.

While the former will be discussed later, the balance sheet costs of indemnification could potentially be passed on beneficial owner which stand to see a further erosion in returns.

The debate still rages as to whether or not this could see participants leave securities lending, but some commentators at our Forum did state that indemnification was becoming less of an issue to well-informed beneficial owners who have a good oversight of their collateral policies. To this extent, the onus is now on the industry to educate beneficial owners as to the risk/reward trade-offs in the collateral space.

The need to clear derivatives on exchanges provides a second regulatory impetus. Many commentators believe the financial industry will have to rely on the securities lending and repo markets to secure enough high quality assets to post as collateral. The fact that estimates of this collateral shortfall lie anywhere between $40 billion and several trillions of dollars exemplifies the uncertainty around the issue.

What is clear however is that the financial industry will have to go through a collateral mobilisation phase and that high quality collateral will become increasingly scarce.

An example of this increasing scarcity is the demand to borrow German Bunds which have seen utilization climb to 50% recently from 40% three years ago.

Lending high quality assets with flexible collateral terms looks to be a clear area of opportunity, though this opportunity may not suit all types of beneficial owners uniformly.

Structurally, regulation may drive a convergence of the securities lending, repo and collateral management roles.

A few market participants have already rationalised their collateral management operations under one function to ensure that collateral flows in the most efficient manner.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052014120000Quarterly-Review-Spring-clearing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052014120000Quarterly-Review-Spring-clearing.html&text=Quarterly+Review+-+Spring+clearing","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052014120000Quarterly-Review-Spring-clearing.html","enabled":true},{"name":"email","url":"?subject=Quarterly Review - Spring clearing&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052014120000Quarterly-Review-Spring-clearing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Quarterly+Review+-+Spring+clearing http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052014120000Quarterly-Review-Spring-clearing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}