Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 08, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Sotheby's and Nordstrom are two short highlights in North America

- K&S sees resurgent short interest after it rejected a tie-up with Potash

- Japanese toy company Happinet sees a 60 fold jump in short interest after recent rally

North America

Canadian trench solution company Badger Daylighting is the most shorted company announcing earnings in the coming week as just under 30% of its shares are currently out on loan to short sellers. Badger's exposure to infrastructure and oil spending, which have been impacted by the recent slump in oil prices, has seen its first quarter revenues shrink by over 10% and prompted short sellers to add to their already high positions. Investor sentiment in Badger has brightened somewhat in the run-up to earnings however as its short interest is down by 14% from the all-time high seen a month ago.

Another Canadian stock seeing heavy short interest in the run-up to earnings this week is Boardwalk REIT. The firm has a large exposure to the formerly booming, now cratering, Alberta and Saskatchewan provinces which are seeing rising vacancy rates. While Boardwalk shares have rallied by a third from the lows seen in January, short sellers have been adding to their positions as short interest has surged by two thirds over the same period of time.

Retailers are another key focus heading into this week's earnings with both high end and low end plays seeing heavy short interest leading up to earnings.

High end spending plays this week include auction house Sotheby's which has seen short interest surge by a quarter in the last month to 23.7% of its shares outstanding, an all-time high. This rising demand to sell short has been driven by a desire to play the softening high end art market which has seen analysts forecast a 13% drop in Sotheby's auction revenues, its largest source of income.

Short sellers need to be wary however as the recent jump in short interest means that Sotheby's shares now feature among the most likely to squeeze, according to the Markit Research Signals Short Squeeze model.

Another high end retail play seeing surging short interest in the lead-up to earnings is Nordstrom which has seen short interest surge by 19% in the last month to 23% of shares outstanding. A slew of disappointing earnings means that the current shorting activity in Nordstrom shares is over 15 times higher than at the same time last year.

On the low end side, perennial short JC Penney sees 20% of its shares shorted. Short sellers had covered most of their positions after the firm posted a surprising jump in store sales in the first quarter, but the company was unable to continue this run of form which in turn prompted a return from short sellers.

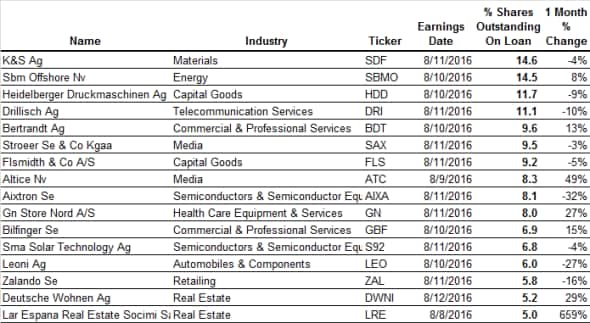

Europe

K&S is the most shorted European firm announcing earnings this week as 14.6% of the German potash and salt company's shares are now on loan. K&S rejected an offer from Canadian competitor Potash last year which had forced short sellers to retreat. The withdrawal of the deal and the continuing weak fundamentals for potash, which the company cited in its last earnings report, has seen short sellers return in earnest.

Short sellers haven't been deterred by a possible resumption of the production cartel between Belarus and Russian producer Uralkali, whose breakdown kick started the recent price slump for potash, hasn't deterred short sellers as demand to borrow has remained steady since rumours resurfaced in June.

Offshore driller Sbm is the second most shorted European company announcing earnings this week with 14.5% of its shares shorted. Sbm has seen consistently high short interest in the last two years as short sellers look to profit from the slump in demand for the offshore energy and exploration. Short sellers are yet to see much in the way of profits for their high conviction short positions however as Smb shares have traded roughly sideways over the last 18 months despite the fact that analysts are forecasting a 50% drop in Smb's revenues from the highs seen in 2014.

The largest amount of short covering was seen in perennial short Aixtron which has seen a 32% fall in demand to borrow its shares. This covering has been driven by the company's decision to be taken over by Chinese investment group Fujian Grand Chip Investment Fund.

Apac

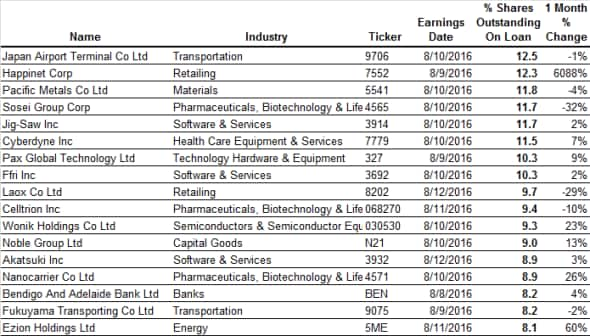

Japan Airport Terminal sees the highest short interest out of the Asian firms announcing earnings this week. The firm failed to meet its revenue and profit expectations in the last two earnings round which has prompted short sellers to triple their bets in the company to the current 12% of shares outstanding.

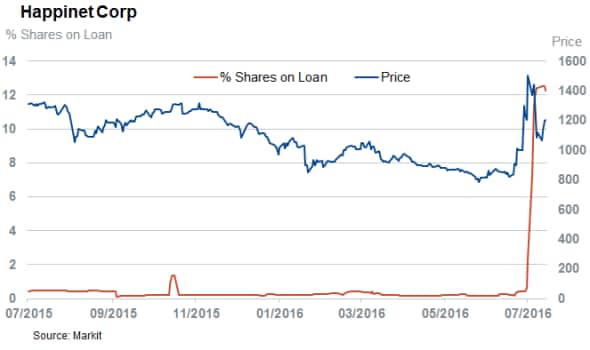

Another interesting high conviction short announcing earnings this week is Happinet, which develops toys and video games. The company's shares look to have been boosted by the recent Pok"mon Go frenzy which has propelled Nintendo shares higher with its shares up by over 40% in the last six weeks. Much like Nintendo, Happinet has also seen a surge in short interest from investors looking to profit from a reversal of the recent surge which and short interest is now over 60 times higher than a month ago.

Singapore trading house Noble group also makes the most shorted ahead of earnings list as 9% of its shares are currently out on loan despite the fact that its shares are down by over 80% in the last 24 months.

Simon Colvin, Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082016-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082016-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}