Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 08, 2014

Investor indifference to Scottish independence

Despite polls tightening in recent weeks, investors have barely reacted in the run-up to Scotland's upcoming referendum.

- Short interest in Scottish domiciled FTSE 350 companies has fallen 10% over the last month

- Implied volatility for FTSE 100 options has not moved

- The UK's CDS spreads have remained near recent lows

The pound tumbled in the wake of this weekend's YouGov poll which showed that Scots are increasingly warming up to the prospect of independence. Though this is only one of the many polls conducted over the last few months, the forex market has taken heed as evidenced by the fact that the cost to insure pound to dollar volatility for the coming month has surged by 10% to the highest level in over a year.

This uncertainty looks to be limited to the FX market as both equity and fixed income risk gauges have shown little in the way of pre referendum jitters over the last few weeks.

Shorts remain steady

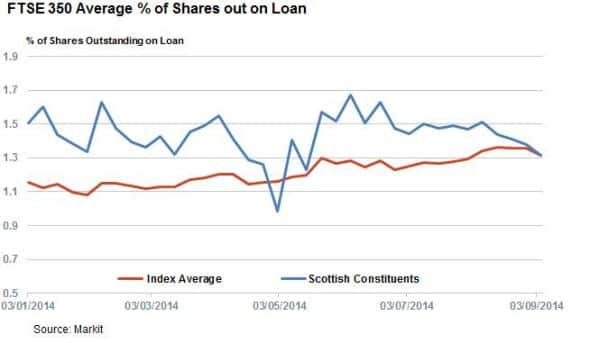

The average short interest across FTSE 350 constituents has stayed relatively flat over the past few months with 1.4% of shares out on loan on average across the index. This number has stayed flat over the last four weeks, despite the recent tightening in the polls.

Narrowing down the index constituents to companies which are domiciled in Scotland also shows little in the way of pre referendum panic. Shorting across the 21 index constituents which are headquartered north of the border has actually fallen by more than 10% in the last four weeks.

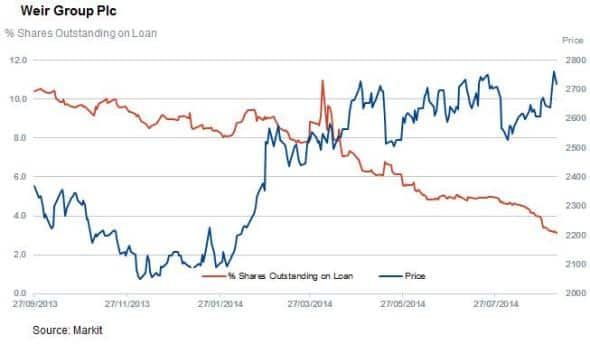

Pump maker Weir Group has led this covering with the company now seeing the lowest demand to borrow its shares in over three years. The firm's shares have also proven resilient as they recently recorded a fresh three year high.

The other two Scottish companies seeing large demands to borrow from short sellers, Aberdeen Asset Management and Aggrecko have also seen shorts cover in recent weeks.

Equity options also proving resilient

Equity options have also shown little in the way of reaction to the recent poll tightening according to Markit Equity Volatility. Implied volatility for 90 day at the money FTSE 100 options has actually tightened over the last four weeks and now sits near the yearly lows seen in July. This tightening was also seen in the wider European stock market as Stoxx 50 options have also seen a contraction in implied volatility over the last month.

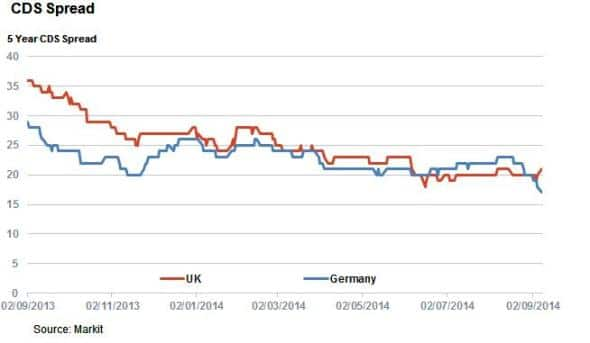

CDS markets also unmoved

In the CDS market, the cost to insure UK government debt over the next five months has also remained largely unchanged over the last few weeks. Current CDS spreads for the UK sovereign debt stands at 21 basis points, roughly 40% lower than the level seen a year ago.

Conclusion

The market reaction to the possibility of Scotland becoming independent looks set to be contained to the pound which has been the key point of contention as investors have not positioned themselves to profit from a broad share price tumble. In the fixed income world, CDS investors have not priced in any issues with UK sovereign debt over the last few weeks.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092014-investor-indifference-to-scottish-independence.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092014-investor-indifference-to-scottish-independence.html&text=Investor+indifference+to+Scottish+independence","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092014-investor-indifference-to-scottish-independence.html","enabled":true},{"name":"email","url":"?subject=Investor indifference to Scottish independence&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092014-investor-indifference-to-scottish-independence.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investor+indifference+to+Scottish+independence http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092014-investor-indifference-to-scottish-independence.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}