Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 09, 2015

Greece facing renewed recession as uncertainty hits the economy

Economic data show the Greek economy turning down again, having briefly shown signs of reviving late last year. Economic uncertainty has meanwhile mounted following the government's decision to not renew existing bail-out terms. Fears of Greece having to default on its loans, its banking sector collapsing and leaving the euro have grown.

As yet, credit markets indicate there is no contagion to other euro countries, but it remains far too early to determine if the crisis might spread.

'Grexit' fears mount

Fears of Greece leaving the euro have spiked higher after prime minister Alexis Tsipras declared the country's existing bail-out to have failed and to therefore not seek to continue the arrangement when it comes up for renewal at the end of February. The coming weeks will be crucial in determining Greece's future in the euro area, requiring the new government to outline workable alternatives.

The anti-austerity movement will meanwhile be boosted by signs of the economy moving into reverse again. Official data showed the economy to have performed worse than expected at the end of last year, with industrial production falling some 3.8% on a year ago in December compared to expectations of a 1.5% decline. Some solace can be gleaned from the fact that factory output rose 2.1% on a year ago, but electricity production slumped 18.6% and mining and quarrying output was down 13.2%.

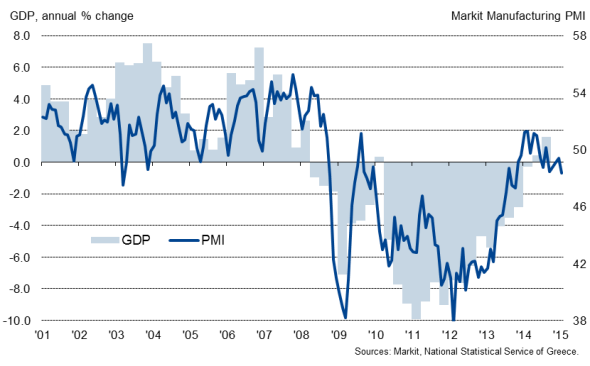

The disappointing official data come as no surprise. Markit's PMI data showed manufacturers' operating conditions deteriorating for a fifth successive month in January, worsening to the greatest extent since October 2013. Factory output fell for the first time in three months amid a steepening loss of orders.

Economic growth and the PMI

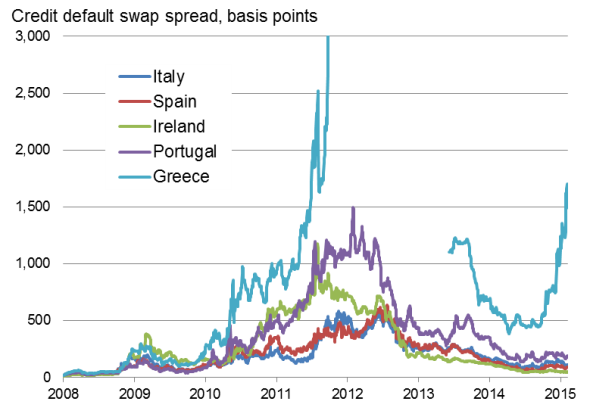

Credit default swaps*

*Greek CDS data not available from late-2011 to mid-2013. Source: Markit.

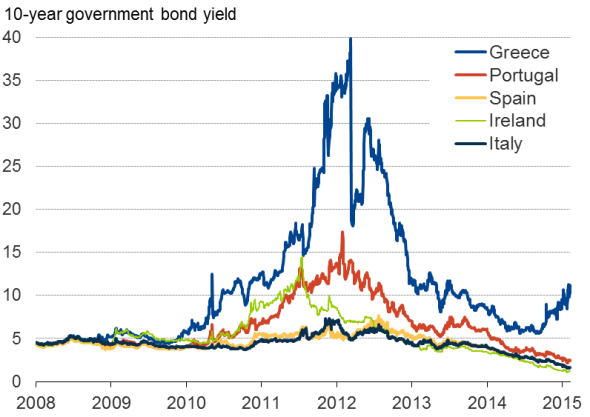

Government borrowing costs

Sources: Ecowin, Markit.

The PMI data are especially worrying. The survey had correctly signalled the Greek economy's return to growth in 2014 (GDP rose 1.6% on a year ago in the third quarter), but the recent data suggest that a new recession looms. Businesses reported heightened uncertainty among customers due to the elections in January.

Containing the crisis

With the Greek stock market having collapsed by over 40% from their 2014 peak, led by an exodus from the banking sector, it is likely that the economy will have deteriorated further in February amid heightened uncertainty fuelled by the escalating debt crisis.

Greece's borrowing costs have also spiked higher in response to the growing crisis. The latest data show 10-year bond yields rising to 11.2%; a doubling compared to last summer.

Credit default swaps, which are essentially derivatives which allow investors to insure against default by a bond issuer, have implied a 70% chance of default by the Greek government on average in recent sessions. That's not as high as during the 2011-12 crisis, before ECB president Mario Draghi pledged to do 'all that it takes' to preserve the euro, but clearly a sign that the chances of default and an ensuing 'Grexit' are dangerously high.

Fortunately, at the moment, the bond and CDS markets are not signalling any contagion to other 'peripheral' euro members. With countries such as Spain and Ireland also seeing strong economic growth, the likelihood of political unrest in these countries has eased. However, other countries will be watching carefully as to whether the new Greek government will be able to successfully ditch previously agreed austerity measures and bail-out terms while remaining a member of the eurozone. With the anti-austerity movement gaining popularity in Spain, it is far too early to tell if the current crisis will be limited to Greece.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022015-Economics-Greece-facing-renewed-recession-as-uncertainty-hits-the-economy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022015-Economics-Greece-facing-renewed-recession-as-uncertainty-hits-the-economy.html&text=Greece+facing+renewed+recession+as+uncertainty+hits+the+economy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022015-Economics-Greece-facing-renewed-recession-as-uncertainty-hits-the-economy.html","enabled":true},{"name":"email","url":"?subject=Greece facing renewed recession as uncertainty hits the economy&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022015-Economics-Greece-facing-renewed-recession-as-uncertainty-hits-the-economy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greece+facing+renewed+recession+as+uncertainty+hits+the+economy http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022015-Economics-Greece-facing-renewed-recession-as-uncertainty-hits-the-economy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}