Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 10, 2015

UK manufacturing output barely rises at year-end

UK factories fared better than expected at the end of last year, but weakening growth of the industrial sector over the course of last year was clearly a contributor to a slowing of the wider economy. The outlook is mixed, with clouds from Russia and Greece threatening to lead to heightened business uncertainty and risk aversion. But low interest rates, low inflation and solid domestic demand should mean the UK remains on a robust growth path, as reflected in growing investor sentiment towards the UK-exposed investment funds.

Industry slips on oil

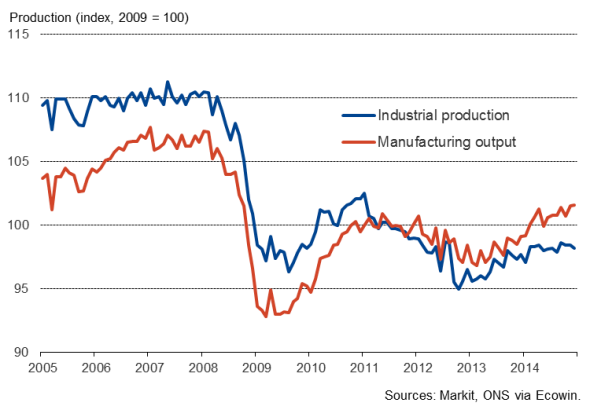

UK industrial production fell 0.2% in December, according to the Office for National Statistics, after a flat November. The data mean industry grew by just 0.1% in the final quarter of 2014. That's better than the 0.1% decline the ONS had originally estimated in its initial GDP calculations, but doesn't change the picture of a weakening industrial sector being a key contributor to the GDP slowdown late last year. The pace of overall economic growth slowed to 0.5% in the fourth quarter.

The data are a reminder that the UK remains all-too dependent on consumer-focused services to sustain its economic recovery. By comparison, services output grew by 0.8% in the fourth quarter.

Dig deeper into the data and a slightly brighter picture emerges. The fall in industrial production in December was in fact caused by a maintenance-related drop in North Sea oil production. Manufacturing output meanwhile rose 0.1% after a 0.8% jump in November. However, factory output over the fourth quarter rose just 0.2%, down from 0.4% in Q3 and far below the 1.2% rate of increase seen in the first quarter of last year.

Lower gear

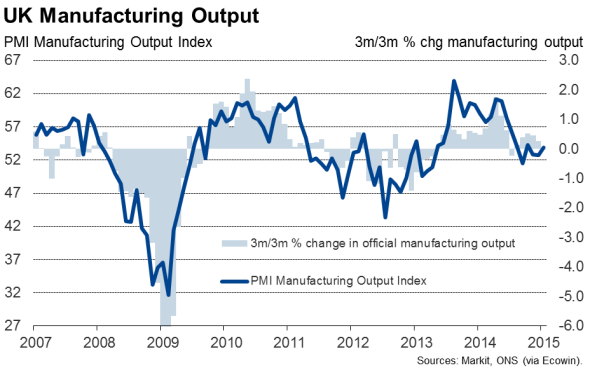

The manufacturing sector therefore clearly saw a steep growth slowdown over the course of 2014, but growth should pick up slightly in January. The Markit/CIPS manufacturing PMI rose from 52.7 to 53.0 at the start of the year, buoyed by stronger domestic demand as well as the fastest growth of exports for five months.

However, despite picking up, growth of the manufacturing economy remains a shadow of its former self this time last year, when business was booming.

Mixed outlook

Looking ahead, domestic demand is expected to remain strong, boosted by real wage growth, rising employment, low inflation and low interest rates. Export demand should also start to pick up as the ECB's quantitative easing programme revives demand in the euro area.

On the other hand, worries about an inconclusive General Election at home could cause business uncertainty to spike higher, meaning companies pull-back on spending, hiring and investment plans. Companies are also growing increasingly worried about the escalating Greek and Russian crises, which threaten to derail economic growth across Europe.

The Bank of England is therefore likely to downgrade its growth and inflation forecasts this week, but is also likely to be at pains to send a reassuring signal that, notwithstanding any further escalation of the Greek and Russian situations, the UK is set for a period of robust economic growth over the next two years. With inflation remaining low, the Bank will be able to raise interest rates very gradually.

Investor optimism

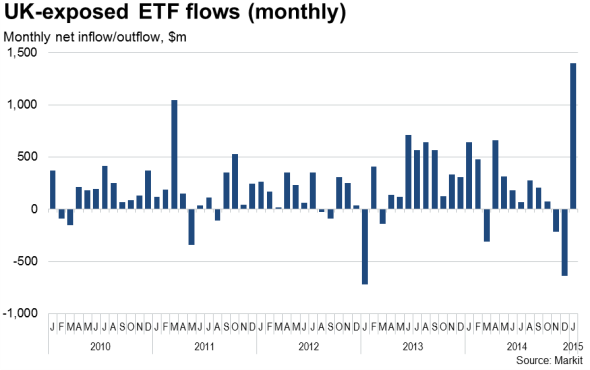

Such optimism in relation to UK growth prospects is being seen in the markets. Markit data show UK-exposed exchange traded funds (ETFs) enjoyed record net inflows in January, contrasting with net outflows in the final two months of 2014. Investors piled money into both equity and fixed-income funds, both of which saw record net monthly inflows at the start of the year after suffering net outflows in the fourth quarter. February has also so far seen a net inflow into UK-exposed ETFs.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022015-Economics-UK-manufacturing-output-barely-rises-at-year-end.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022015-Economics-UK-manufacturing-output-barely-rises-at-year-end.html&text=UK+manufacturing+output+barely+rises+at+year-end","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022015-Economics-UK-manufacturing-output-barely-rises-at-year-end.html","enabled":true},{"name":"email","url":"?subject=UK manufacturing output barely rises at year-end&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022015-Economics-UK-manufacturing-output-barely-rises-at-year-end.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+manufacturing+output+barely+rises+at+year-end http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022015-Economics-UK-manufacturing-output-barely-rises-at-year-end.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}