Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 09, 2015

Tidal wave of streaming floods Pandora

The content war for streaming content has heated up in recent weeks and short sellers look to have singled out Pandora.

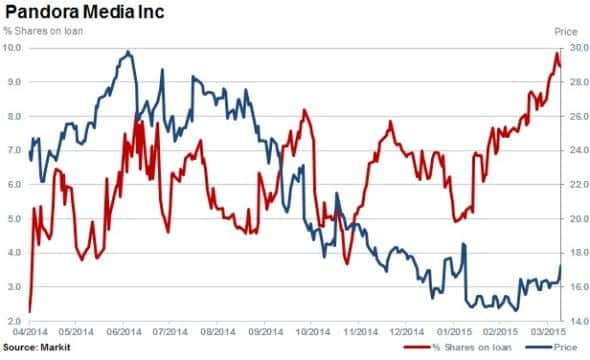

- Pandora has seen short sellers increase positions by 37% year to date

- Pandora shares have also struggled declining 29% in 12 months in the face of new rivals

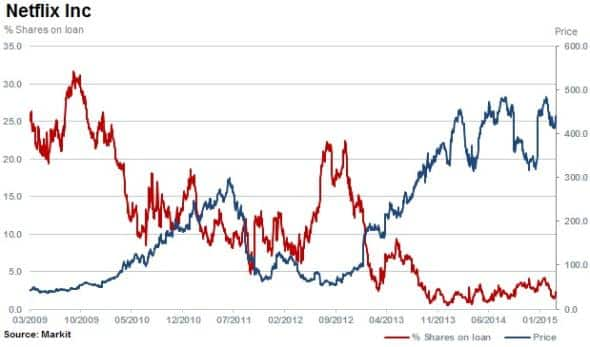

- Netflix sees multi year lows in short interest despite recent growth in competition

Streaming challenged

Competition in digital music and video distribution continues to increase with a slew of new players entering the market through a mix of new launches and acquisitions. From free services covered by advertising to premium monthly subscriptions offering exclusive content, the battle between providers and content creators has just started.

Apple, the gorilla of digital distribution over the past decade through iTunes, was a relatively late entry to the streaming landscape, but its recent purchase of Beats electronics now makes it a credible entrant to the field though its streaming service is currently only available in the US. Google, similarly slow to evolve, has recently acquired music streaming service Songza and initiated premium YouTube subscriptions which are ad free and provide more revenue to artists.

Rounding out the list of new entrants is Tidal, whose owners include a cadre of artists fronted by rapper Jay Z many of whom have promised to furnish the site with exclusive content.

These movements are in response to the astonishing growth of free and premium subscription based streaming services, such Spotify and Pandora. The former has recently raised fresh capital with a private valuation of $5.7bn, up from $4bn in its previous capital raising efforts in 2013.

Pandora struggles

While the tech industry is clamouring to grab market share, Pandora, one of the oldest digital streaming businesses has seen short interest surge in recent months. The proportion of shares outstanding on loan for Pandora has increased by 35% in the last three months and now stands at 9.5%, a multi year high for the company. This surging demand to sell the company short comes after its shares have retreated by over 40% in the last 12 months.

The rising demand to borrow comes as the firm faces an increasingly tough battle from increasingly better capitalised sets of competitors for both content and subscribers.

Content distributors such as streaming sites are facing a backlash from content creators who are demanding a bigger slice of royalties. This has seen artists pull catalogues from platforms disputing revenue payments and frequency.

Ironically, licensing and royalty issues have halted Pandora's growth outside the US, New Zealand and Australia as the service has been restricted from these regions since 2008.

Netflix in the clear

While Pandora has attracted increasing scrutiny from short sellers, other subscription streaming service Netflix has seen shares outstanding on loan decrease to multi year lows of 2.3%. This covering comes as investors' questions about Netflix's business model have largely been answered as the firm successfully switched its business model to streaming and started to create its own content.

While video streaming has seen its fair share of new entrants from the likes of Google's recently announced premium YouTube, short sellers don't seem as worried about Netflix.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-equities-tidal-wave-of-streaming-floods-pandora.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-equities-tidal-wave-of-streaming-floods-pandora.html&text=Tidal+wave+of+streaming+floods+Pandora","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-equities-tidal-wave-of-streaming-floods-pandora.html","enabled":true},{"name":"email","url":"?subject=Tidal wave of streaming floods Pandora&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-equities-tidal-wave-of-streaming-floods-pandora.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tidal+wave+of+streaming+floods+Pandora http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-equities-tidal-wave-of-streaming-floods-pandora.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}