Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 09, 2016

Peer to peer lenders prove shorts right

Short sellers have been circling unconventional lending companies LendingClub and OnDeck since their 2014 IPOs, and are adding to their already profitable positions after a wave of poor results from the sector.

- LendingClub's short interest jumped by 40% since January ahead of its recent share collapse

- OnDeck has seen short interest triple since the start of the year to hit 6% of issued shares

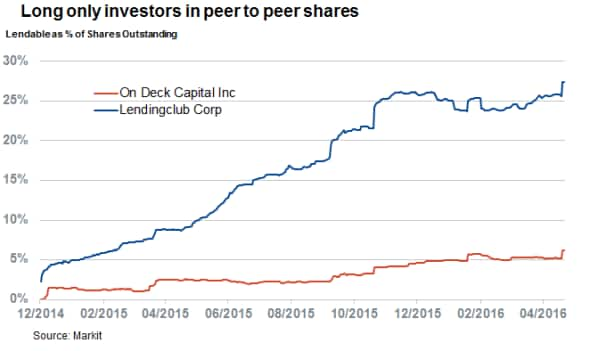

- Long only investors show no signs of selling yet as lendable in both firms at all-time highs

Peer to peer lending firms have struggled to meet their promised potential in recent weeks, encouraging short sellers to pile into the sinking shares of the two companies most exposed to the trend.

LendingClub and OnDeck Capital (OnDeck) listed in late 2014, but have suffered a steady decline in their share prices as both firms failed to live up to investors' growth expectations. This share price slide has accelerated in the last few days after the latter of the two firms reported stalling growth last week, sending its shares diving by over 40%.

LendingClub has also had to contend with management troubles, as its ceo announced his departure on Monday following an investigation into the sale of loans that the company originated.

Short sellers circle in

Not surprisingly, this severe downward momentum has attracted its fair shares of short sellers as both firms now see a record amount of their shares out on loan.

Lendinglub, which is one of the most shorted companies announcing earnings this week, is the most shorted out of the two with over 19.2% of its shares out on loan. While Monday May 9th's developments have vindicated short sellers, the recent disappointing earnings from OnDeck is most likely the cause behind the recent surge in demand to borrow.

OnDeck is relatively less shorted, with 6% of shares out on loan, but negative sentiment shows no signs of easing up as its short interest has increased by over 20% in the last week, despite a collapse in share price. This recent surge in demand to borrow OnDeck stock means that short interest in the firm has tripled since the start of January.

Long only investors not selling out

Despite the increase in bearish sentiment and severe headwinds faced by both shares, long only investors have shown no signs of giving up on peer to peer lending as both LendingClub and OnDeck have seen the number of their shares sitting in lending programs climb to new all-time highs in recent weeks. OnDeck has 6% of its shares outstanding in lending programs, while its larger peer is much more widely held by long only investors which lend their shares, as over 27% of its shares now sit in lending programs.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052016-Equities-Peer-to-peer-lenders-prove-shorts-right.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052016-Equities-Peer-to-peer-lenders-prove-shorts-right.html&text=Peer+to+peer+lenders+prove+shorts+right+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052016-Equities-Peer-to-peer-lenders-prove-shorts-right.html","enabled":true},{"name":"email","url":"?subject=Peer to peer lenders prove shorts right | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052016-Equities-Peer-to-peer-lenders-prove-shorts-right.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Peer+to+peer+lenders+prove+shorts+right+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052016-Equities-Peer-to-peer-lenders-prove-shorts-right.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}