Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 09, 2015

Investors turn to ETFs amid rate volatility

Recent bond volatility has been largely driven by underlying benchmark rate movements, driving a surge in interest rate hedged ETFs.

- Interest rate hedged bond ETFs hit $1.4bn, an all-time high

- Four fund managers have launched 11 products in the last two and a half years

- The Markit iBoxx EUR Liquid Corporates 100 Interest Rate Hedged Index has outperformed its unhedged peer by 81bps year to date

The year to date total return for global corporate bonds turned negative last week as the prospects of a US rate rise and resurgent inflation in Europe sent government bond yields up sharply from the recent lows seen in the closing week of April. With the great majority of the recent bond returns driven by fluctuations in benchmark rates, investors have been turning to interest rate hedged ETFs in order to insulate themselves from the recent volatility.

Investors turn to rate hedged ETFs

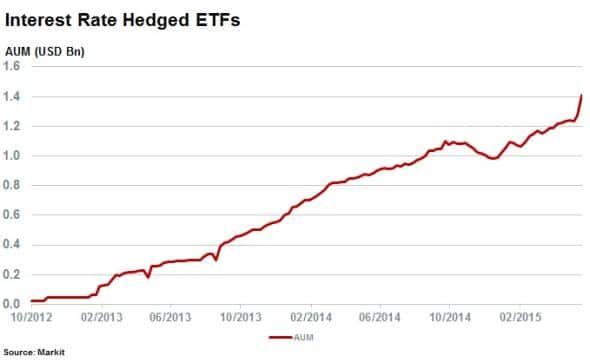

Interest rate hedged ETFs offer exposure to corporate bonds while protecting investors from volatility in underlying benchmark rates. They achieve this by taking offsetting positions in benchmark bond futures contracts. These funds have seen their AUM surge to new highs amid the recent bond market volatility. The AUM managed by the 11 interest rate hedged ETFs tracked by the Markit ETP Encyclopaedia now stands at $1.4bn, up 60% compared with a year ago.

While growth in AUM growth has been relatively steady since the first interest rate hedged product launched in October 2012, the recent volatility has seen the trend accelerate in earnest with interest rate hedged funds seeing their AUM grow by $220m since April 20th.

The majority of the recent AUM surge has come from the iShares Euro Corporate Bond Interest Rate Hedged UCITS, the first interest rate hedged product. The ETF, which manages more than half of all interest rate hedged AUM, has seen its assets jump by $188m in the last month, no doubt driven European investors keen to gain some respite from recent runaway bund yields.

US investors have also been actively hedging their benchmark rate exposure as the ProShares Investment Grade-Interest Rate Hedged Fund, the largest such US listed product has seen its AUM jump to a new all-time high in the last six weeks.

Asset managers keen to get on board

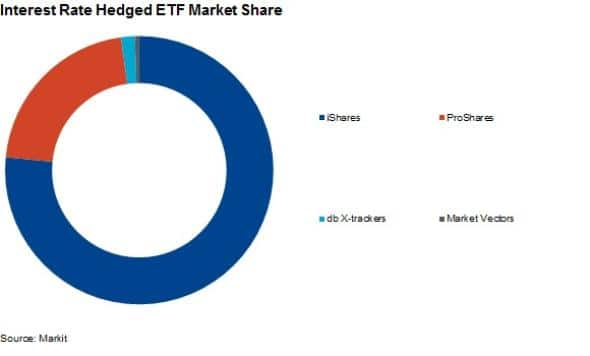

Issuers have been keen to get on board the interest rate hedged bandwagon with 11 funds launching in the last two and a half years from four different issuers.

BlackRock's iShares was first to the interest hedged ETF game in 2012 and has managed to hang on to the top spot as it manages over three quarters of all assets in the category.

Hedged resilient in volatility

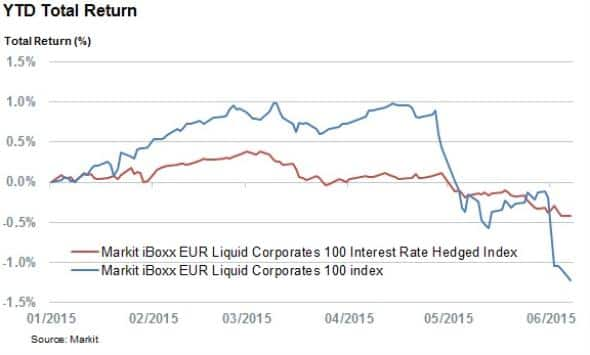

The recent surge in demand to gain interest rate protection has proved to be well timed as rate hedged strategies have performed strongly during the recent volatility. This return difference is gauged by the Markit iBoxx EUR Liquid Corporates 100 Interest Rate Hedged Index which is currently outperforming its unhedged Markit iBoxx EUR Liquid Corporates 100 index by over 80bps year to date.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062015-credit-investors-turn-to-etfs-amid-rate-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062015-credit-investors-turn-to-etfs-amid-rate-volatility.html&text=Investors+turn+to+ETFs+amid+rate+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062015-credit-investors-turn-to-etfs-amid-rate-volatility.html","enabled":true},{"name":"email","url":"?subject=Investors turn to ETFs amid rate volatility&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062015-credit-investors-turn-to-etfs-amid-rate-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+turn+to+ETFs+amid+rate+volatility http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062015-credit-investors-turn-to-etfs-amid-rate-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}