Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 09, 2016

Trading Brexit

Uncertainty around the UK's referendum has already negatively impacted UK companies but has just ticked higher as we near to the vote. An exit scenario for UK exporters indicates a possible 'win' but threat of sterling contagion in Europe looms.

- UK exporters seen outperforming compared to domestically exposed companies

- Brexit uncertainty hurting one in three British companies

- Short sellers creep into domestic UK names, while covering a fifth of positions in exporters

Approaching the upcoming EU referendum, Markit Research Signalshas produced a report outlining potential equity trading strategies using the platform and its unique factor library. Please contact us for the full report.

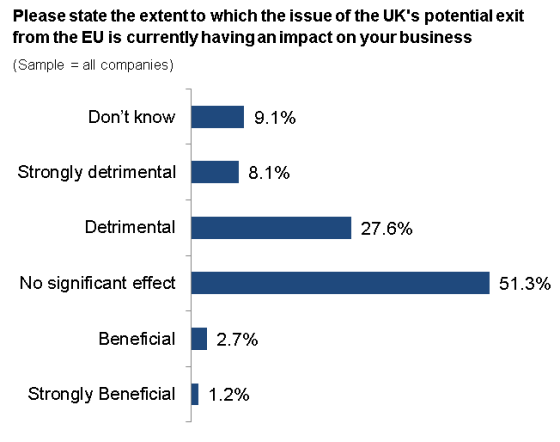

Brexit uncertainty is hurting one-in-three companies according to Markit survey data, with one-in-twelve reporting a strongly detrimental impact to their businesses through lower sales, delayed investments and staffing issues. UK economic activity has also slowed on this uncertainty with May composite PMI data pointing to a halving in GDP growth for the second quarter of the year.

These impacts to business will no doubt filter into firms' bottom lines and subsequently their share prices as investors position for either vote outcome.

Markit Research signals has analysed possible scenarios for the UK leaving the EU, with a premise that the sterling will indeed face some form of devaluation. Current estimates are wide, with a 5% to 30% fall in the pound forecast, a possible boon for exporters' earnings that could see shares bid up on exit.

However Visibility into the long term macro picture surrounding Brexit, is extremely limited and forms much of the current political debate.

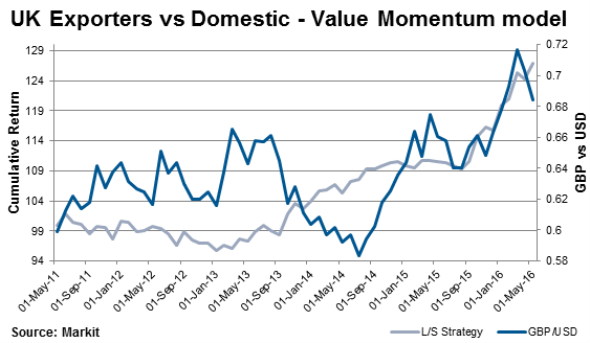

By separating companies into baskets of domestically focused firms and those that rely heavily on exports, a long short strategy can be employed in hopes to expose and capture expected underperformance of domestic firms on potential pound weakness.

The strategy has been modelled over two styles, namely Value Momentum model (VMM) and the Deep Value model (DVM). Portfolios are constructed by going long the top names scored by each model in the export basket and short the bottom names ranked in domestic baskets.

DVM is designed to identify stocks trading at discount to their intrinsic value or "cheap" and the strategy is long cheap exporters and short expensive domestic businesses.

The VMM has a bias towards earnings quality and growth, good valuations, strong balance sheets and price growth. The model thus goes long cheap exporters with price and earnings growth and short domestic stocks with the opposite features.

In terms of performance, DVM returns have been lacklustre but it has performed better recently as the sterling depreciated.

The VMM model has proved to be the more successful strategy over the back test period. Addition of momentum factors to form a diversified value and momentum model seems to have assisted in avoiding potential value traps and VMM shows a strong performance from 2014. Accelerating outperformance as of late has been due to the exporter basket outperforming as well as the domestic basket underperforming.

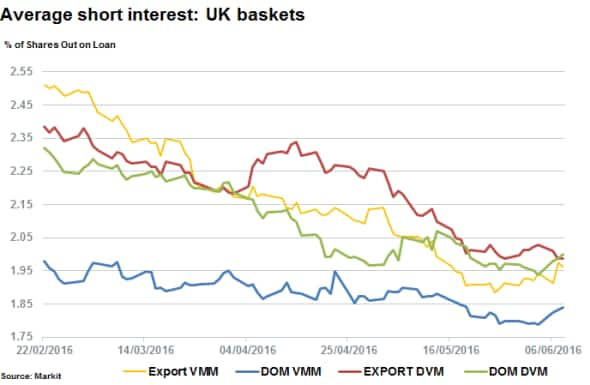

Short sellers have also been more active in domestic names as of late. Data is somewhat skewed by heavily short sold domestic focused retailers such as Sainsbury's and Ocado. However, average short interest of exporters in the DVM basket and VMM basket is now below that of UK 'deep value' domestic stocks, at an average of 2%.

Overall short sellers have covered positions in UK equities ahead of the referendum but exporters which stand to benefit from a possible Brexit have seen the lion's share of covering thus far this year.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062016-equities-trading-brexit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062016-equities-trading-brexit.html&text=Trading+Brexit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062016-equities-trading-brexit.html","enabled":true},{"name":"email","url":"?subject=Trading Brexit&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062016-equities-trading-brexit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Trading+Brexit http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062016-equities-trading-brexit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}