Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 09, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Consensus among short sellers and investors sees Mattel shares continue to fall

- Short sellers return to the iconic mobile home maker Winnebago as sales growth weakens

- Shorts begin to abandon positions in WH Smith, which continues to deliver results

North America

Most shorted ahead of earnings in North America this week is toymaker Mattel. Since the end of 2014, the company has had a torrid tale to tell relative to rival Hasbro.

Short sellers look to have rotated out of Hasbro and into Mattel since the end of 2014, while price movements indicate that investors have done the opposite, rewarding short seller positions.

Short interest in Mattel declined towards the end of 2014 as shorts took profits and covered but shares outstanding on loan have subsequently soared in 2015, rising almost five fold to 19.8%. Mattel stock has fallen by 28% year to date while Hasbro shares have climbed 34%.

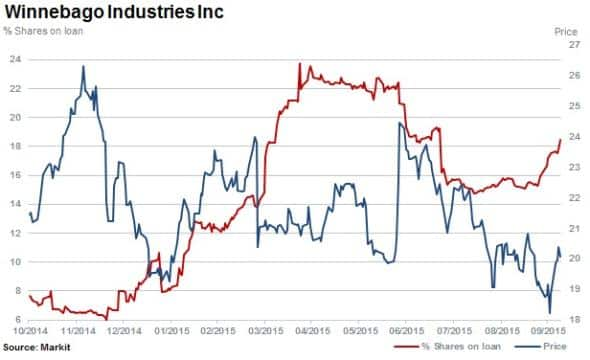

Second most shorted in North America ahead of earnings is Winnebago Industries with 18.5% of shares outstanding on loan. Shares of the company are relatively flat year to date, while short interest has increased by 150%.

Year to date Winnebago shares are down 7.7% as strong sales growth over the last three years slowed in 2015, along with earnings growth.

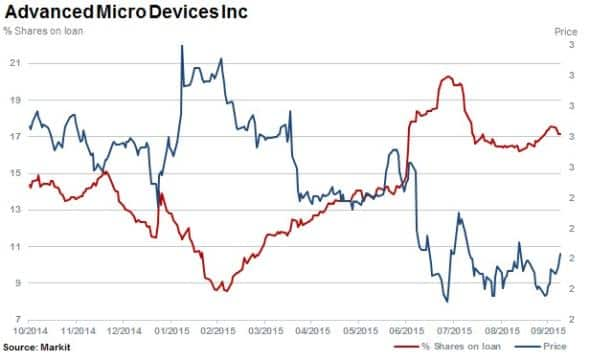

Despite a brief rally which squeezed some shorts, short sellers have held onto positions over the last few months in chipmaker Advanced Micro Devices, the third most shorted ahead of earnings. Short demand, however, remains strong for the stock with a cost to borrow above 10% and shares outstanding on loan currently standing at 17.2%.

The company joins others in the sector, which has attracted increasing levels of short interest as shifts in consumer electronic device demands cause changes in component supply.

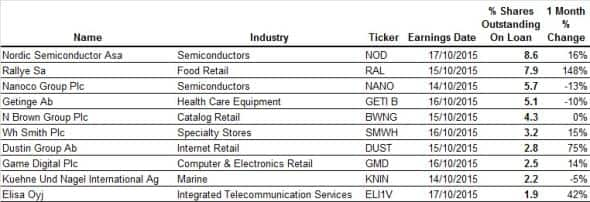

Europe

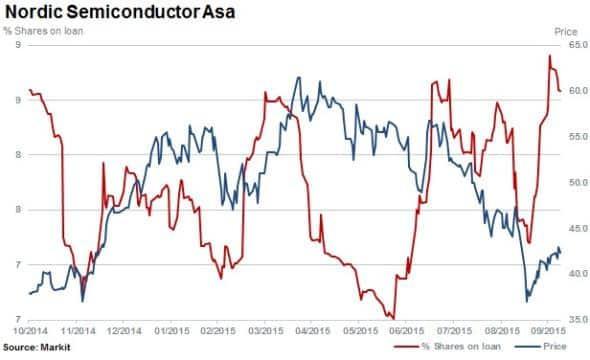

Most shorted ahead of earnings in Europe is Nordic Semiconductors with 8.6% of shares outstanding on loan. Shares in the integrated circuits maker have fallen by a third in the last 12 months despite strong sales and profit growth which are expected for the full 2015 financial year.

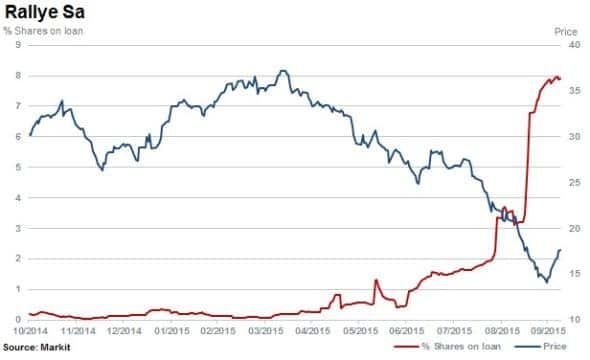

Second most shorted in Europe is French food and clothing retailer Rallye, which has seen a fivefold rise in short interest in the last three months with shares outstanding on loan standing at 7.9% currently. The stock has fallen 50% over the last six months due to a large exposure to Brazil. The fall in the value of equity has raised concerns about the company meeting certain debt covenants.

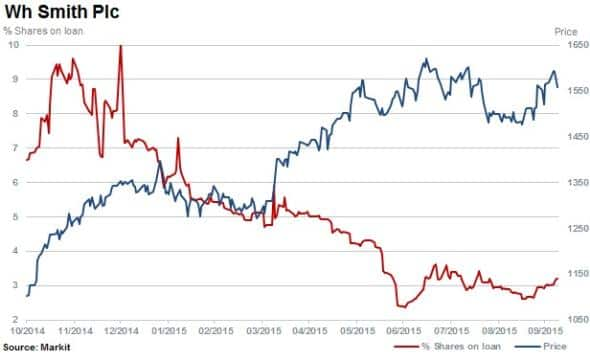

Making the top ten of the most shorted ahead of earnings in Europe is UK stationer and newsagent WH Smith. The firm has continued to send short sellers packing, with shares outstanding on loan halving in the last 12 months while shares have rallied 41%.

WH Smith has benefited from robust sales at airport and railway outlets, registering the company's first sales rise in six years in 2015.

Apac

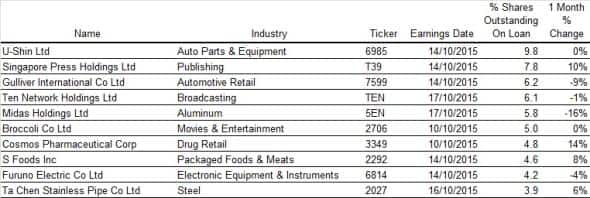

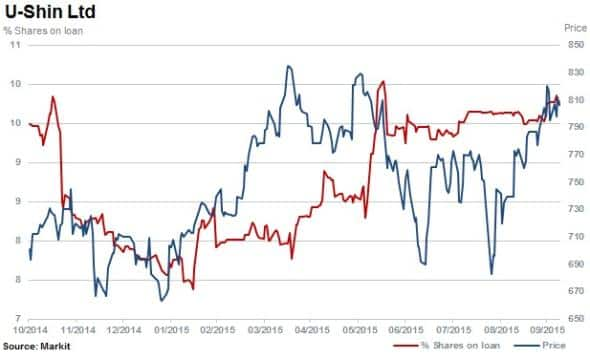

Most shorted in Apac ahead of earnings is Tokyo based U-Shin, a manufacturer of a wide range of products for the automotive and industrial sectors. Shares outstanding on loan have tracked the share price higher, increasing to 9.8% as shares have increased by a fifth in the last 12 months. The share price increase has in turn tracked a rise in sales and earnings at the company.

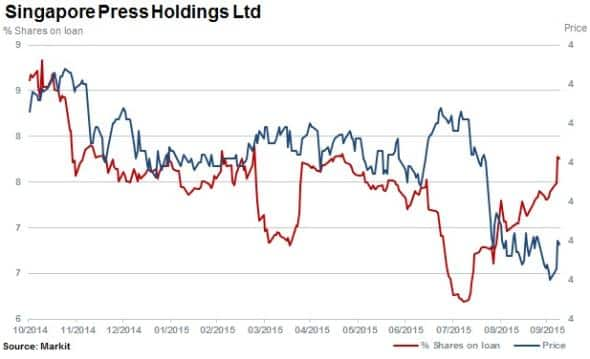

Second most shorted in Apac ahead of earnings is media and print company Singapore Press with 7.8% of shares outstanding on loan.

The publisher of the Straits Times and numerous other print and media titles has seen its shares decline 7.6% year to date. Sales and earnings and the publishers have stagnated since August 2011.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}