Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 09, 2015

Investors continue to flee healthcare

Investor sentiment towards the healthcare sector continues to sour despite the fact that the sector has come out on top of the October Markit Economics Sector PMI.

- Healthcare firms topped the October sector PMI survey, edging out financials

- ETF investors have withdrawn over $1.8bn of funds from healthcare ETFs so far in Q3

- Short interest in the IBB ETF has more than doubled since its July highs

Healthcare stocks had enjoyed a stunning start to the year, but allegations of price gouging in the industry as well as accusations of accounting irregularities from former industry darling Valeant has seen the sector's shares fall from their summer's highs. This negative investor sentiment is not driven by fundamental movement, however, as healthcare shares heading into earnings had been buoyant heading into this earnings season.

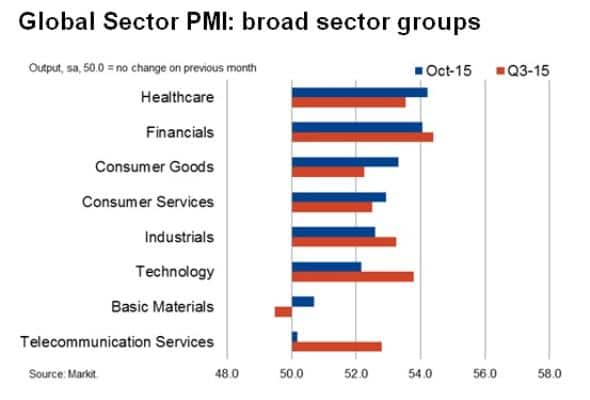

These buoyant trading conditions continued into the current quarter as healthcare firms came out on top of the October Markit Economics Sector PMI. The sector joined financials as the only two sectors with a business activity reading above 54, indicating strong growth for the month.

While both of the sector's subindustries recorded an improvement in trading conditions, services firms did carry the sector somewhat as pharmaceutical and biotechnology firms recorded a reading of 52.

Investors cash out

Despite the bumper PMI reading, healthcare shares have continued to lose ground to the rest of the market in recent weeks as the largest healthcare ETF, the Healthcare Select Sector SPDR has underperformed the S&P 500 by over 1.2% in the opening five weeks of the fourth quarter. This means that the index has trailed the wider market by over 5% in the last three months.

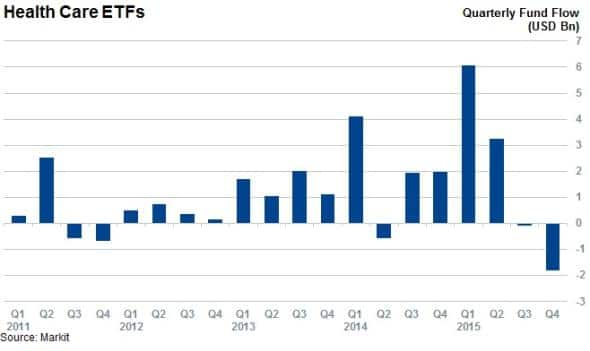

This underperformance has prompted a growing portion of ETF investors to trim their exposure to the sector as healthcare ETFs have seen over $1.8bn of outflows so far in the fourth quarter, putting them on track for their worst ever quarterly outflow by quite a wide margin.

Pharmaceutical firms, which have borne the brunt of the recent bad headlines, have seen their largest outflows with the iShares Nasdaq Biotechnology Index ETF (IBB) seeing investors pull over $850m of assets, by far the most out of any fund. This move looks to have been well timed as the IBB has lagged the broader Healthcare Select Sector ETF by over 0.7% so far this quarter.

Short sellers also converge on ETFs

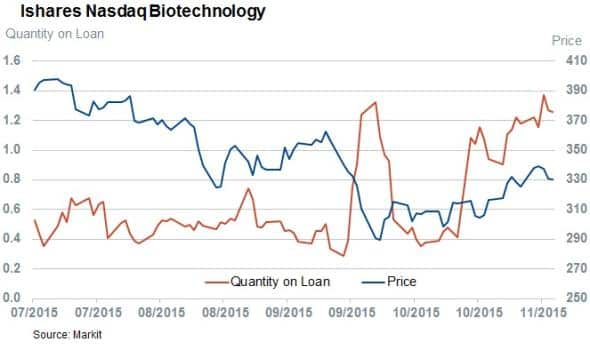

The negative investor sentiment is also reflected in shorting activity in the IBB ETF itself as the fund has seen the demand to borrow its shares triple in the three months since reaching an all-time high. There are now over 1.2m shares of IBB out on loan, which represents $420m of bearish bets in the sector.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112015-Equities-Investors-continue-to-flee-healthcare.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112015-Equities-Investors-continue-to-flee-healthcare.html&text=Investors+continue+to+flee+healthcare","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112015-Equities-Investors-continue-to-flee-healthcare.html","enabled":true},{"name":"email","url":"?subject=Investors continue to flee healthcare&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112015-Equities-Investors-continue-to-flee-healthcare.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+continue+to+flee+healthcare http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112015-Equities-Investors-continue-to-flee-healthcare.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}