Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 09, 2016

Trump rally makes value stocks great again

Value investing has trumped both growth and momentum strategies on both sides of the US election; attracting record inflows into the asset class

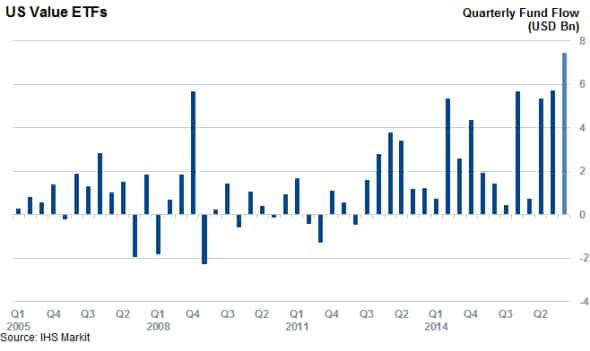

- US value ETFs have recorded a record $7.44bn of inflows in Q4 so far

- Shorts have been covering their positions in value names since US election

- Investors lose appetite for growth and momentum stocks as strategies underperform

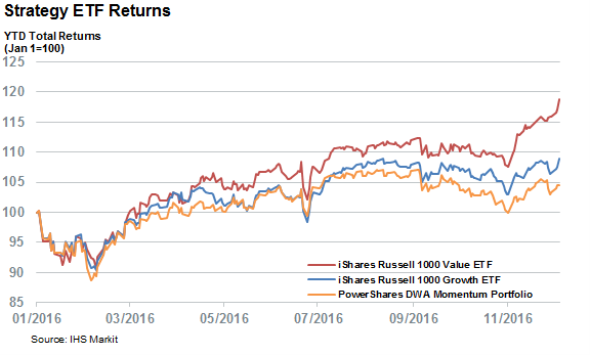

Value has been the dominant fundamental investment strategy of the year so far and the trend has only gathered pace in the wake of the recent US election, which has disproportionally benefited value shares. The largest value ETF, the iShares Russell 1000 Value ETF (IWD), whose year to date (ytd) returns were 2.5% ahead of the wider Russell 1000 universe the eve of the election, has gone on to double its outperformance since the November 8th vote.

Investors, who have been increasingly fond of value shares since the start of the year, have been eager to ride this rally as demonstrated by the fact that the 118 value ETFs tracked by the Markit ETF Analytics database have experienced over $7.4 bn of inflows since the election. These steady inflows mark the largest four week haul on record for this group of funds, indicating that investors have shown no signs of shying away despite the recent strong outperformance.

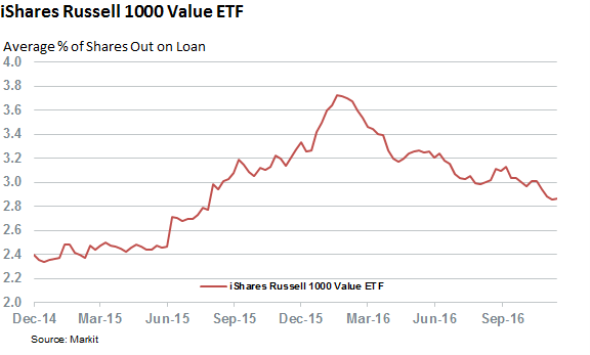

As with most rallies, the market surge of the last four weeks has stirred its fair share of sceptics. However short sellers, arguably the most contrarian of investors, haven't shown any appetite to short value investing's recent strong run. If anything, the shorting activity has declined materially in these high flying shares as evidenced by the fact that the average demand to borrow shares in the constituents of the IWD ETF has sunk fallen by 5% in the month since the election. This most recent bout of short covering takes the average shorting activity across this group of shares to the lowest level in 15 months.

IWD's 10 best performing constituents, which are up by a staggering 41% or more since the election, have so far failed to entice short sellers. Covering across these high flying stocks has been even more drastic than in the rest of the universe as demand to borrow shares across these stocks has fallen by a tenth since November 8th.

United States Steel, whose shares have returned a massive 79% since the election, exemplifies this trend as it has seen shorts halve their positions in the wake of the rally.

Growth and momentum slip further behind

Unsurprisingly, value's large outperformance since the election has seen its returns pull further ahead of two other competing strategy investments; growth and value. IWD is now 10% ahead of the largest growth ETF, the iShares Russell 1000 Growth ETF and 13.2% ahead of the largest momentum fund, the Powershares DWA Momentum ETF.

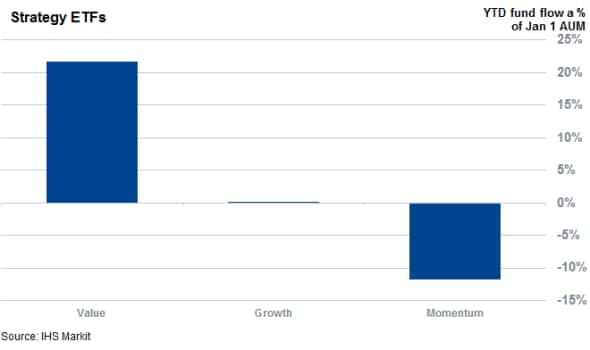

Investors have been voting with their allocations in light of their recent run of form. Momentum funds have experienced outflows which representing 12% of their January 1st AUM ytd. Investors have been relatively more kind to growth ETFs ytd as the strategy is roughly flat so far this year in terms of fund flows. This still pales in comparison to the large inflows into value funds which have seen net fund flows representing 21% their AUM.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-equities-trump-rally-makes-value-stocks-great-again.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-equities-trump-rally-makes-value-stocks-great-again.html&text=Trump+rally+makes+value+stocks+great+again","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-equities-trump-rally-makes-value-stocks-great-again.html","enabled":true},{"name":"email","url":"?subject=Trump rally makes value stocks great again&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-equities-trump-rally-makes-value-stocks-great-again.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Trump+rally+makes+value+stocks+great+again http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-equities-trump-rally-makes-value-stocks-great-again.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}