Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 10, 2015

European trading volumes jump by €2 trillion

European equities trading enjoyed a successful year, with volumes surging across the board, according to the 2014 Markit MSA full year results.

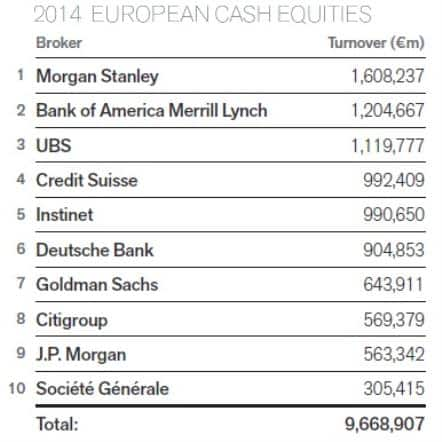

- Aggregate European equities volumes jumped by a quarter to €9.7 trillion over 2014

- Morgan Stanley topped the region's league table with over €400bn more executed client business than second ranked Bank of America Merrill Lynch

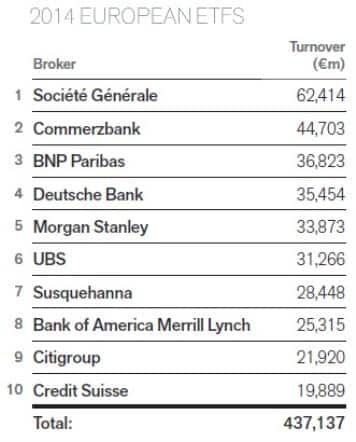

- Secondary ETF trading volumes jumped by 57% to €437bn; BlackRock products have been the most widely traded

Read the full report with broker rankings.

Despite trading mostly flat for the year, European equity markets still proved to be a boon for brokers across Europe, with contributing clients to Markit MSA reporting jumps in trading volumes across the region.

The buoyant trading conditions resulted in a 26% jump over the previous year's total. This increase in trading takes the aggregate 2014 tally to €9.67 trillion compared to €7.7 trillion in the previous year.

Morgan Stanley was the top contributing client, repeating last year's achievement. The bank's continuing strong performance saw it report €1.666 trillion of executed client business for the year; over €400bn more than second ranked broker Bank of America Merrill Lynch.

Instinet was the only climber among the top 10 contributing clients as the broker's league table rank improved by two spots to crack the top five. This climb came at the expense of Goldman Sachs and Deutsche Bank, which claimed the seventh and sixth spots respectively.

Strong trading across the board

A deeper dive into the individual indexes driving these strong volumes reveals that constituents of Western European large-cap indexes (the CAC 40, DAX 30, IBEX 35,FTSE MIB and FTSE 100), have been responsible for over half of the €2 trillion increase. Morgan Stanley reported the most turnover in all five of these indexes, which together account for 58% of all European cash equity trading volumes.

Constituents of small and mid-cap indexes also reported strong increases in volumes. The largest rises in trading volumes were seen in the Spanish and Italian small-cap indexes, which both saw trading volumes jump by tenfold on the previous year's aggregate tally.

Further north, Nordic equity trading also had another strong year with aggregate volume jumping by over €247bn to €1.1 trillion. Deutsche Bank claimed the top spot in the league table after overtaking Morgan Stanley and Bank of America with an aggregate €207bn of reported business.

The only region to buck the recent trend was Eastern Europe which saw a €11bn fall in aggregate volume. But this will leave little cause for concern for most, as the region represented less than 2% of the aggregate trading with €137bn of flow reported by contributing clients.

ETF trading surges

2014 also proved a strong year for ETF trading as clients reported €437bn of flow, which marks a significant 58% increase on the aggregate reported volume in 2013. Unlike the cash equities league table, this boost in trading volume shook up the league table with nine of the top ten contributing clients seeing their ranks change from the previous year. French broker Soci"t" G"n"rale jumped three spots to claim the top spot on the league table after it reported €62bn of flow.

BlackRock products saw the most trading over the last year with over €180bn of flow. These strong flows helped Soci"t" G"n"rale, as the broker jumped two spots in the BlackRock league table to claim the top spot with just under €21bn of reported business.

The two issuers which saw the greatest jump in trading volumes from the previous year were Vanguard and Deka whose products both saw contributing clients report €8bn of increased flows from the previous year to €11.1bn.

This analysis accompanies a summary of European cash equity and ETF trading for 2014 using Markit's suite of equity products. Markit MSA covers an estimated 80% of all cash equity trading in Europe across traditional exchanges, multi-lateral trading facilities and over-the-counter markets. Trade data is sourced directly from contributing brokers and represents what was actually traded, differentiating it from other surveys that rely on indications of interest or trade adverts.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022015-Equities-European-trading-volumes-jump-by-2-trillion.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022015-Equities-European-trading-volumes-jump-by-2-trillion.html&text=European+trading+volumes+jump+by+%e2%82%ac2+trillion","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022015-Equities-European-trading-volumes-jump-by-2-trillion.html","enabled":true},{"name":"email","url":"?subject=European trading volumes jump by €2 trillion&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022015-Equities-European-trading-volumes-jump-by-2-trillion.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+trading+volumes+jump+by+%e2%82%ac2+trillion http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022015-Equities-European-trading-volumes-jump-by-2-trillion.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}