Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 11, 2015

US high yield back in business

High yield bonds have experienced strong investor demand since the start of the year as yield seeking investors return to the asset class.

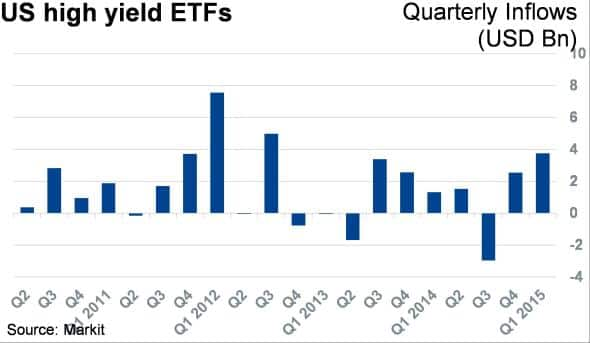

- High yield corporate ETFs have attracted $3.6bn of inflows in 2015, surpassing the total for 2014

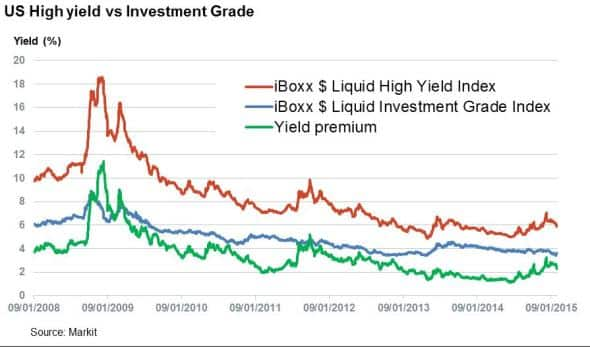

- High yield bonds offer the largest yield premium over investment grade in over two years, according to iBoxx indices

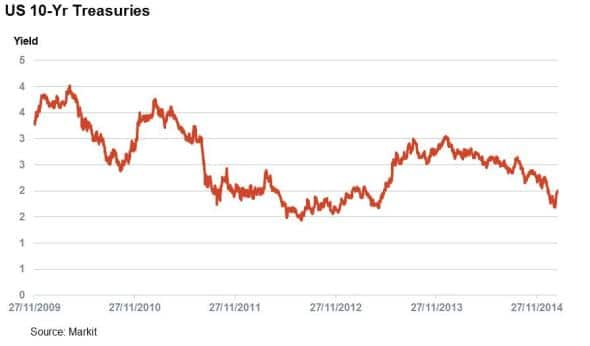

- Yields in investment grade and US treasuries are hovering at all-time low levels

US high yield and investment grade bonds have enjoyed a positive start to the year as investors search for yield in the context of a better US macro environment.

US high yield corporate bonds ETFs have enjoyed strong demand in 2015 so far, recording inflows of $1.6bn in January and $2.1bn so far this month. This total has already surpassed the whole of 2014's net inflows which amounted to $2.45bn. The quarter looks set to become the best since Q3 2012, as positive economic data, a rebound in oil prices and suppressed treasury yields attract investors back into risky assets.

Yield premium attractive

The strong demand for high yield has also been reflected in credit markets as bond yields have fallen. Yields on the iBoxx $ Liquid High Yield Index have been declining steadily since mid-December 2014, from around 7% to 5.9%. This is still a far cry from the average yields below 5% seen last summer. However, it is worth noting that those levels were not in the midst of heavy oil price declines and that 16% of the iBoxx $ Liquid High Yield Index constituents are oil & gas issuances.

The primary market is also showing signs of buoyancy, with high yield issuance set to have its busiest week this year. The first two days of this week tallied $9bn in issuance, mainly driven by the stronger credits in the high yield space such as Univision, Ally financial, and GTECH. The pipeline also looks strong.

So is there relative value between the two asset classes? The yield premium required to hold high yield bonds over investment grade bonds has consistently been under 2% for much of 2013 and 2014, with lows of 1.15% seen last summer.

While the premium has declined from 3.24% to 2.27% over the last two months, the convergence back to norms under a brighter outlook may provide value.

The recent low yields haven't quenched investor thirst for high quality assets, as US investment grade credit issuance continues to go from strength to strength as quality issuers take advantage of the preferential market conditions.

Microsoft is one such AAA issuer which announced a six part $10.75bn offering with the ten year tranche priced to yield a meagre 2.72%. With over half of the offering at maturities of 20 years and over, the demand signifies investors are also searching for returns at the long end of the term structure. The iBoxx $ Liquid Investment Grade Index reflects these buoyant trading conditions, and currently trades with the lowest yield since mid-2013.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-Credit-US-high-yield-back-in-business.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-Credit-US-high-yield-back-in-business.html&text=US+high+yield+back+in+business","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-Credit-US-high-yield-back-in-business.html","enabled":true},{"name":"email","url":"?subject=US high yield back in business&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-Credit-US-high-yield-back-in-business.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+high+yield+back+in+business http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-Credit-US-high-yield-back-in-business.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}