Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 10, 2016

Periphery trade continues despite market volatility

Spanish and Italian bonds have proven relatively resilient in the recent market volatility as investors seek the safety of the ECB.

- Italy and Spain's sovereign credit has proven largely immune to recent market swings

- ETFs tracking Eurozone government bonds have seen $2.7bn of inflows so far this year

- Greece and Portugal are not as fortunate as their 5-yr CDS spreads have widened significantly

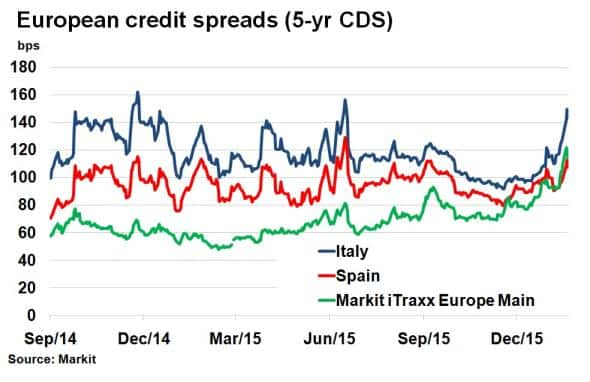

European credit markets, led by the banking sector, have seen risk escalate over the past several weeks with the Markit iTraxx Europe Main index seeing it's spread widen to June 2013 highs. One relative bright spot however, has been the region's sovereign credit, which has largely steered clear of the contagion developed in the corporate market.

Traditional safe haven assets such as German government bonds have performed very well in the risk off environment but investors have also proved very pragmatic around 'peripheral' European sovereigns, exemplifying the resilience among Eurozone sovereigns.

Over the past several years, Spain and Italy's 5-yr CDS spread has typically traded wider than that of European investment grade credit. As recently as April last year, the Markit iTraxx Europe Main index was trading 45bps and 77bps tighter than Spain and Italy's 5-yr sovereign CDS spread, respectively. The past several weeks has seen this basis tighten significantly, although some widening has been seen among the sovereigns, Spain is now trading 7bps tighter than European investment grade credit.

The resilience among European sovereigns can be attributed to the implicit backstop provided by the ECB and its "60bn per month QE asset purchase programme (which includes Spanish and Italian government debt), which lasts until 2017.

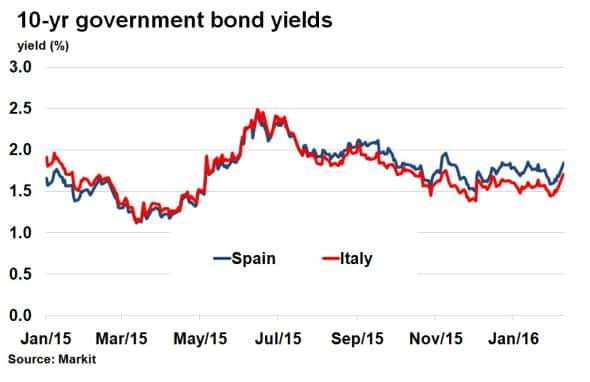

Further fuel was added to the fire last month after ECB President Mario Draghi hinted at the possibility of further asset purchases amid a spluttering of growth and inflation. Current Spanish and Italian government 10-yr bond yields are and 57bps and 72 bps higher than post QE lows last year, and investors have been keen to take advantage of the ECB's whatever it takes attitude through sovereign debt.

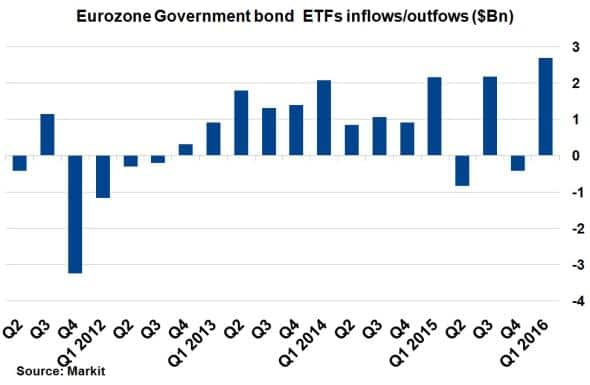

ETFs tracking eurozone government bonds have seen strong inflows in the opening weeks of the year according to data from Markit ETP. In fact the $2.7bn which has flowed into Eurozone sovereign ETFs puts the first quarter on track to be the best on record for the asset class. At least a portion of that flow, $95m has flows products tracking periphery sovereign bonds as investors seek their relatively attractive yields and the possibility of further QE driven capital returns.

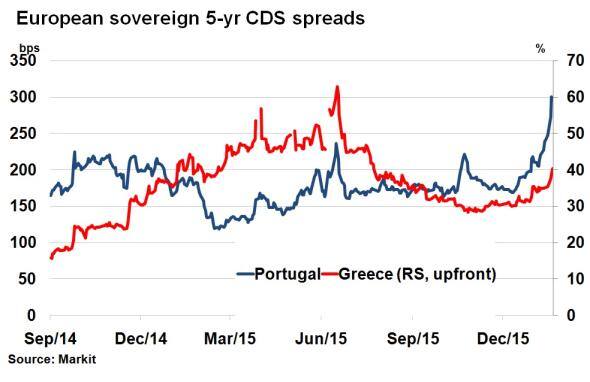

In contrast to Spain and Italy, weaker peripheral European nations have seen credit spreads widen significantly over the past few weeks. Greece's government debt is ineligible for QE and its upfront CDS spread has widened back to levels seen last August. Though Portugal is eligible for QE, it faces headwinds through potential downgrade risk. This sentiment is reflected in its 5-yr CDS spread, which surpassed 300bps amid the heightened risk environment in Europe.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-credit-periphery-trade-continues-despite-market-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-credit-periphery-trade-continues-despite-market-volatility.html&text=Periphery+trade+continues+despite+market+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-credit-periphery-trade-continues-despite-market-volatility.html","enabled":true},{"name":"email","url":"?subject=Periphery trade continues despite market volatility&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-credit-periphery-trade-continues-despite-market-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Periphery+trade+continues+despite+market+volatility http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-credit-periphery-trade-continues-despite-market-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}