Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 10, 2014

Sears mirrors RadioShack struggles

We sit down with credit analytics firm Leading Risk to discuss US retail firms currently seeing distress signals in their CDS as well as high short interest.

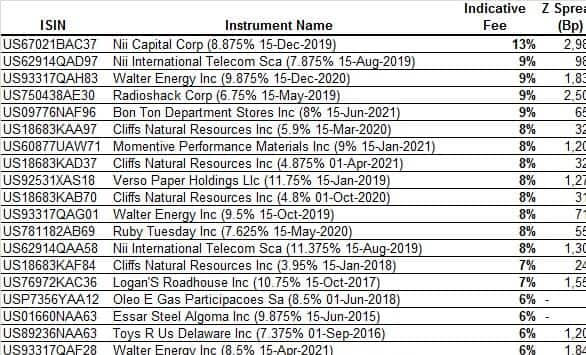

- RadioShack’s CDS spread surged to all-time highs after exhibiting bearish sentiment in January

- Sears recently showed negative credit signals in April, its CDS spread has since widened to new yearly highs

- Shorts have increased their positions in SHLD in the last couple of weeks

US retailer RadioShack’s latest earnings announcement saw the company report three times the loss seen in the same quarter of last year. The company, which has posted nine lossmaking quarters in a row, looks set to continue to prove a painful investment as consumers increasingly turn to the web for their purchases.

Having enough liquidity to weather this recent patch of bad times is key to delivering on the management’s turnaround strategy, which includes store closings and revamped offerings. The management expects that this will only be possible if the retailer is able to improve both sales and margins in the coming three quarters.

With falling sales and a business model heavily reliant on physical stores, many credit investors are clamouring to buy protection against what many speculate will be an inevitable default.

CDS trading showing bearish trend

Our recent partnership with Leading Risk provided some warning to the deteriorating situation in January of this year. Leading Risk’s analytic model, which monitors aspects such as the shape of the CDS curve to measure potential moves in the CDS spreads, highlighted bearish signal as early as January of this year. CDS spreads have since deteriorated further, as the five year spread widened all-time high levels.

Equity investors have been equally bearish about the company’s prospects, as its high proportion of shares out on loan prior to earnings made it the most shorted company announcing results globally this week.

While both CDS spreads and short interest in RSH are some way off their lows, this is likely driven by the fact that the recent deteriorating trading conditions have seen the company’s enterprise value atrophy to $450m, valuing the residual value of each of the company’s stores at around $80,000.

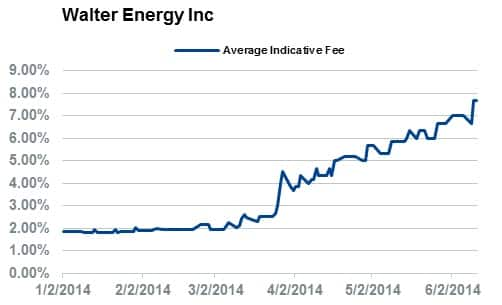

Sears exhibiting similar trading pattern

Another company to see a similar trading pattern in its CDS is fellow struggling retailer Sears Holdings, which the Leading Risk analytics highlighted as prone to potential further widening at the start of April. Sears has posted equally bad quarterly earnings track record as RadioShack in recent quarters.

The firm has seen its sales shrink for six years on the trot, a trend that is expected to continue for the coming couple of years. While the company has always been a perennial in both the heavily shorted/high CDS list for many quarters, the company’s CDS spreads were singled out by Leading Risk as prone for further deterioration in April and the spread has since widened to a new yearly high for the company.

As already seen in RadioShack, short sellers seem in tune with CDS traders as demand to borrow SHLD shares has surged in over the last couple of weeks.

About Leading Risk

Leading Risk was formed to exploit a proprietary approach for predicting risks and investment opportunities in the credit, bond and equity markets, based on a quantitative analysis of the information conveyed by current market data. Leading Risk provides unique insight into current market sentiment and predictive metrics for exploiting that sentiment. For more information, please see http://leadingrisk.net/

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062014120000sears-mirrors-radioshack-struggles.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062014120000sears-mirrors-radioshack-struggles.html&text=Sears+mirrors+RadioShack+struggles","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062014120000sears-mirrors-radioshack-struggles.html","enabled":true},{"name":"email","url":"?subject=Sears mirrors RadioShack struggles&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062014120000sears-mirrors-radioshack-struggles.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sears+mirrors+RadioShack+struggles http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062014120000sears-mirrors-radioshack-struggles.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}