Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 10, 2016

Government bond yields tumble; Oman taps market

In this week's credit wrap, government bond yields fall to record lows, Oman issues international bonds and the lowest rated European high yield bonds continue to struggle.

- 10-yr UK and German government bond yields fall to record lows

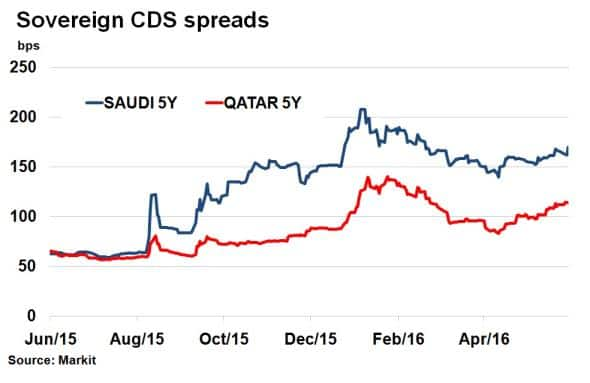

- Despite the rise in crude oil prices Saudi Arabia's 5-yr CDS spread has widened 13% over the past two months

- CCC rated European bonds have underperformed versus the wider high yield market

Records tumble

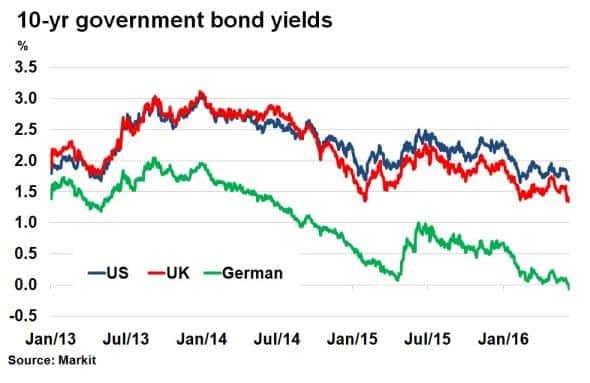

Long term government bond yields fell to record levels this week in the US, UK, and Germany. With little or no inflation on the horizon, and renewed dovish rhetoric from central banks, investors resumed their appetite for the safe haven asset class.

Weak payroll numbers last week in the US threw caution to the wind surrounding the timing of the Fed's next interest rate increase, sending US treasury yields lower. According to Markit's bond pricing service, 10-yr treasury yields fell to 1.68% as of June 9th, touching the lows seen in mid-2013.

In Europe, the ECB began purchasing corporate bonds this week as part of its ongoing QE programme, pushing down German government and corporate bond yields. 10-yr German bunds now yield almost zero, breaking through the 7bps low level seen mid-2015. 10-yr UK gilts saw a new record low yield, at 1.34%. Brexit fears have pushed back expectations of any imminent interest rate hike, a sharp contrast to last November, when yields were at 2%.

Oman taps market

The latest Gulf state to tap international bond markets, Oman issued $2.5bn worth of US dollar denominated 5 and 10 year maturity bonds. It would be the first time Oman has issued in nearly 20 years, demonstrating the disastrous effect the recent plunge in crude oil prices have had on public finances.

Oman joins Abu Dhabi, Qatar and most likely Saudi Arabia and Kuwait in the coming months, as Middle Eastern nations who have looked towards international investors for funding. Despite the recent rise in crude oil prices, from its depth in February to over $50 today, credit markets remain jittery. Saudi Arabia's 5-yr CDS spread has widened 20bps to 170bps over the past two months, and it's been a similar story for Qatar.

Lowest struggle

Not every sector of the European bond market has enjoyed positive total returns thus far this year. According to Markit's iBoxx indices, the broad European high yield bond market, as represented by the iBoxx EUR Liquid High Yield Index, has returned 4.2% so far this year..

A closer look however, shows that the lowest rated bonds in the sector have actually returned -4.7%, as seen by the Markit iBoxx EUR Liquid High Yield CCC sub-index. The underperformance has been in part due to struggling issuers such as Portugal Telecom International Finance BV, Frigoglass Finance BV and Norske Skog AS.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-credit-government-bond-yields-tumble-oman-taps-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-credit-government-bond-yields-tumble-oman-taps-market.html&text=Government+bond+yields+tumble%3b+Oman+taps+market","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-credit-government-bond-yields-tumble-oman-taps-market.html","enabled":true},{"name":"email","url":"?subject=Government bond yields tumble; Oman taps market&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-credit-government-bond-yields-tumble-oman-taps-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Government+bond+yields+tumble%3b+Oman+taps+market http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-credit-government-bond-yields-tumble-oman-taps-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}