Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 10, 2016

Investors covet gold over silver

Gold has been outshined by silver in terms of returns since the start of the year, but investors continue to prefer gold over its high flying peer.

- Relative inflows into gold ETF running at four times the pace of silver funds

- Gold mining ETFs have had 13X the inflows seen by their two silver peers

- Global silver miners short interest has stayed flat ytd, while gold producers have seen covering

Olympians aren't alone in having a preference for gold over silver as the former of the two commodities has far outstripped the later in terms of popular among ETF investors this year. While both commodities are enjoying some of their strongest performance since the financial crisis as investors seek the perceived safety of precious commodities, gold has trounced its peer in terms of inflows into the ETFs that track it.

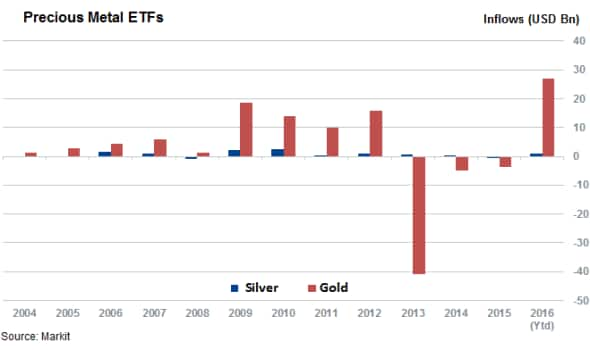

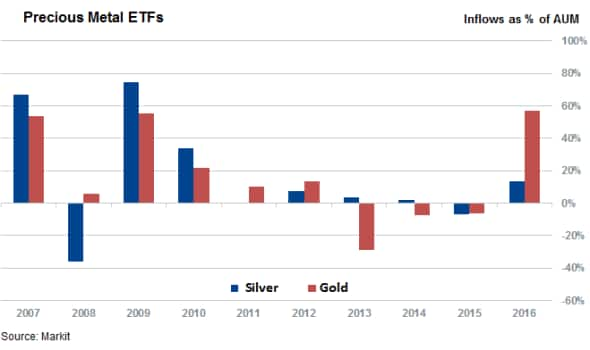

Gold ETFs, which overtook their previous yearly inflow record back in June, have continued to prove wildly popular with investors with the cumulative inflows into the asset class now topping $27bn, $8.4bn more than the 2008 record. Silver, which has outperformed gold by roughly 20% ytd, has proved much less popular with ETF investors which have only ploughed $1bn into silver tracking ETFs ytd. While these flows are still significant the money ploughed into silver ETfs ytd only represent 14% of the AUM at the start of the year, accounting for a quarter of the relative inflows into gold products.

This low appetite for silver exposure comes despite the fact that the ratio of gold to silver has continued to hover over its long term average indicating that the latter is relatively cheap in comparison to its more popular peer.

Investors have also proved much less willing to roll over profits from the recent surge in silver as silver ETFs have experienced three sets of weekly outflows over the last ten weeks, something which hasn't been seen in gold funds in any of the last 16 weeks.

Silver miners less popular

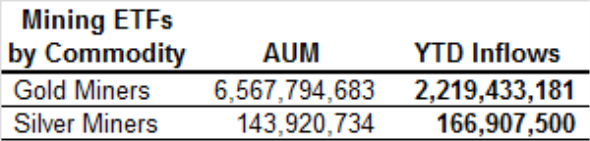

Gold's popularity with investors is also evidenced by the inflows pouring into ETFs that invest in precious metal miners. The 15 unlevered ETFs which invest in gold miners have seen $2.2bn of inflows ytd which is over 13 times of that seen by their two silver peers.

This comes despite the fact that silver's outperformance over gold has lifted silver miners over their gold peers. This outperformance has seen the largest silver mining ETF, the Global X Silver Miners ETF outperform its largest gold mining peer, the VanEck Vectors Gold Miners ETF, by an astonishing 56% ytd. This may be much for muchness however, as both ETFs are up by over 100% ytd on a total return basis.

Short sellers do prefer silver

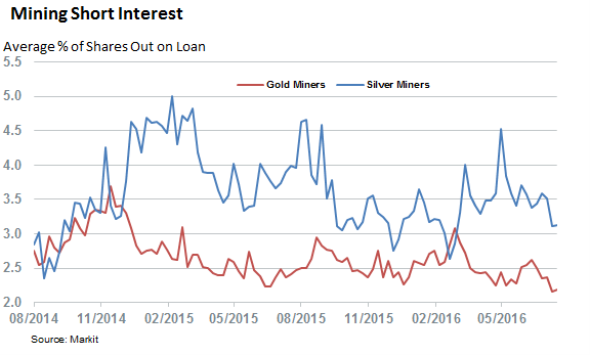

The one area where silver does edge out gold is in short selling where silver miners continue to see more bearish sentiment than their fellow high flying gold peers. The average short position across global silver miners has grown by 7% ytd with 3.1% of shares out on loan across the sector.

First Majestic Silver, whose shares are up by 435% ytd, has seen its short interest more than double over that period of time with 11.7% of its shares now shorted.

Short interest across gold miners has gone the other direction over the same period of time as the average number of shares shorted across global gold miners has fallen 10% to its lowest level in over two years. These diverging paths mean that silver miners now see 40% more short interest on average than their gold mining peers.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10082016-equities-investors-covet-gold-over-silver.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10082016-equities-investors-covet-gold-over-silver.html&text=Investors+covet+gold+over+silver","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10082016-equities-investors-covet-gold-over-silver.html","enabled":true},{"name":"email","url":"?subject=Investors covet gold over silver&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10082016-equities-investors-covet-gold-over-silver.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+covet+gold+over+silver http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10082016-equities-investors-covet-gold-over-silver.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}