Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 10, 2015

Brazilian bonds sink prior to downgrade

Brazil's recent downgrade to junk will come as little surprise to market observers given the increasingly bearish sentiment seen in Brazilian sovereign bonds.

- Brazilian CDS spreads at 371bps, twice where they stood a year ago

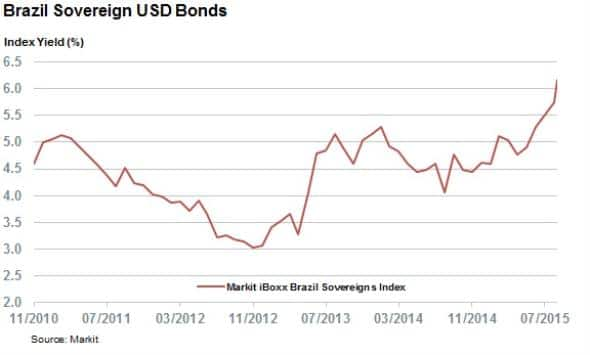

- The Markit iBoxx USD Brazil Sovereigns Index crossed the 6% threshold for the first time

- Local bonds still offer positive total return for the year despite a 2% spike in yields ytd

Brazil's ongoing struggles came to a head today when US rating agency Standard and Poor, downgraded its debt rating to junk. Competing rating agencies, Fitch and Moody's continue to rate Brazilian debt as investment grade, yet ongoing political strife and budget deficit forecasted to hit 9% of GDP the suggest these ratings could come under strain.

CDS spreads already junk

The S&P downgrade represents a heavy setback for the country after seven years in the investment grade universe, yet the news will come as little surprise to market observers as Brazil's CDS spread has been trading with a junk implied rating for quite some time. Brazil's sovereign CDS traded with an implied rating of B, a lower grade than even the most pessimistic credit agency rating.

While most of the recent deterioration was already priced in, as evidenced by the tripling of Brazilian CDS spreads in the last 12 months to 371bps as of Wednesday's close, today's announcement saw the country's CDS spread deteriorate even further to a new all-time high of 395.

Dollar bonds dive

Brazil's ongoing issues are also reflected in its dollar denominated sovereign bonds which have slumped to new recent lows according to the Markit iBoxx USD Brazil Sovereigns index. The index's yield has jumped past the 6% mark for the first time since its inception on the 3rd of this month and yielded 6.16% as of Wednesday's close, an all-time high since the index's inception in 2010.

This latest deterioration means that investors are now requiring 1.5% of extra yield to hold Brazilian bonds than at the start of the year. This was driven predominantly by investors requiring more yield over benchmark US treasuries as the index's asset swap spread has jumped to a new all-time high of 359bps.

This deterioration means that the index is down 8.2% on a total return basis, its worst nine month run since 2012.

Real bonds also feeling heat

Domestic real denominated sovereign bonds which make up the Markit iBoxx GEMX Brazil, have also seen their yield surge since the start of the year with the index now yielding 14.3%, a new seven year high.

Interestingly, real denominated bonds already carried a relatively higher yield prior to the recent selloff which has helped ensure that the index has managed to deliver positive total returns for the year. The index has returned 1% of total returns so far this year, despite seeing its yield surge 2.3%.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-credit-brazilian-bonds-sink-prior-to-downgrade.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-credit-brazilian-bonds-sink-prior-to-downgrade.html&text=Brazilian+bonds+sink+prior+to+downgrade","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-credit-brazilian-bonds-sink-prior-to-downgrade.html","enabled":true},{"name":"email","url":"?subject=Brazilian bonds sink prior to downgrade&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-credit-brazilian-bonds-sink-prior-to-downgrade.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brazilian+bonds+sink+prior+to+downgrade http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-credit-brazilian-bonds-sink-prior-to-downgrade.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}