Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 10, 2015

Shorting Abe's third arrow

Japan's Nikkei 225 index bounced 7.7% this week and subsequently fell in the next session after a month of losses in step with an emerging market selloff led by China. Gains of 20% in 2015 have been erased.

- Market value on loan swells by 18%, not giving credence to a market wide short squeeze

- A 10% increase seen in average short interest with top shorts at all-time highs

- Meanwhile short sellers cover positions in resilient watch maker Casio

Investors pin hopes on third arrow(s)

As in Chinese markets, investors in Japan are facing increased volatility in equities ahead of the Bank of Japan's October 30th meeting. Investors are struggling to gauge the impact of hopeful central bank intervention measures after the Nikkei 225's recent bounce. Year to date the index is up by a mere 2.5% after a month long sell off in equities led by Asian and emerging markets.

Short seller's bets increase

The sharp one day rise of the Nikkei 225 on September 9th was perhaps driven by short sellers covering; however Markit Securities Finance data indicates that on average, short interest in fact increased.

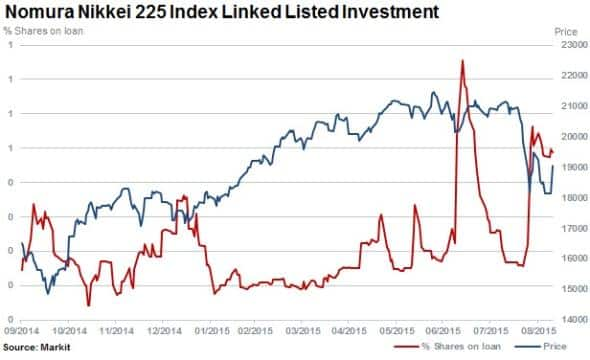

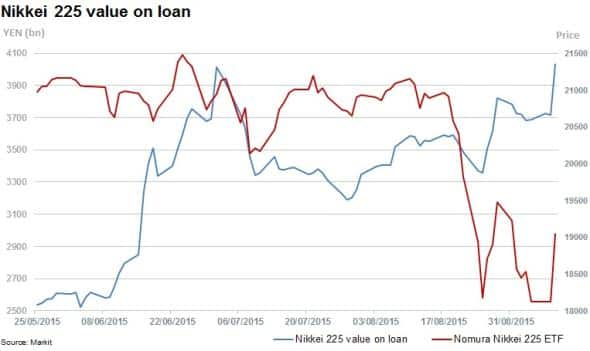

In contrast to Chinese equity markets where short selling in mainland names is prohibitive and short sellers make use of ETFs to gain short exposure - in Japan, year to date, the value of short positions across single names has increased by 18% to $33.45bn or "4031bn. The Nomura Nikkei 225 ETF sees minimal shorting activity.

Prior to recent selloff, the Nikkei 225 was up 20%, in line with an increase in the total value on loan of short sellers. However, the value on loan has continued to increase over the last month, despite the index falling.

Nikkei 225 most shorted

53% of Nikkei 225 firms have seen short interest rise over the last week with the total average increasing 10% to 2.1%. Retail, real estate, technology hardware & equipment sectors contributed the greatest to the recent increase. Overall average short has trended materially higher over the last 12 months, rising 42% from 1.47% to 2.1%.

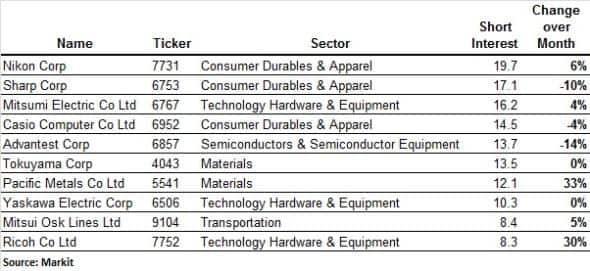

Top ten most shorted

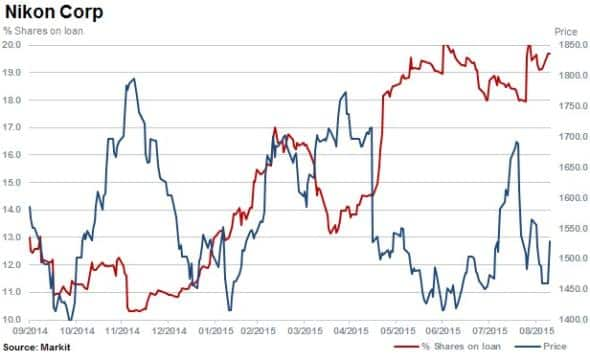

Global consumer electronics makers Nikon, Sharp and Casio remain some of the top most shorted companies in the country along with component maker Mitsumi electronics. Shares outstanding on loan in Nikon have risen to 19.7% hovering near all-time highs of 20%.

Sharp has had a torrid year as a slowdown in China continues to impact demand and the company restructures operations in multiple markets. Short sellers increased positions earlier in the year but have covered in recent weeks with shares outstanding on loan currently at 17.1%.

Sharp is down 45% over the last 12 months and caught the recent rally, rising by 6%.

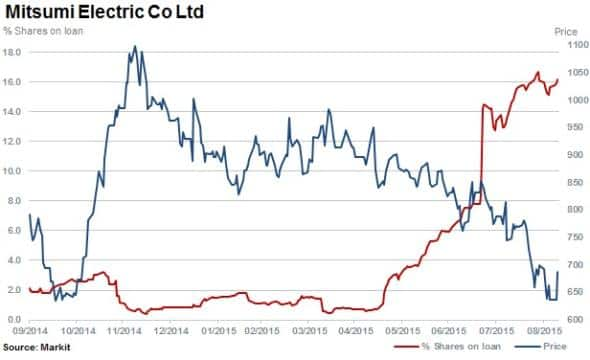

Mitsumi Electric has 16.2% of shares outstanding on loan and the company's' shares have continued to slide, down by 29% in the last six months with shorts sellers increasing positions tenfold.

Short sellers have however covered positions in Casio in the last three months as the resilient watch maker's shares are up 28% over the last 12 months. Consensus forecasts for the company point towards a 30% increase in earnings expected for the 2016 financial year.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-equities-shorting-abe-s-third-arrow.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-equities-shorting-abe-s-third-arrow.html&text=Shorting+Abe%27s+third+arrow","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-equities-shorting-abe-s-third-arrow.html","enabled":true},{"name":"email","url":"?subject=Shorting Abe's third arrow&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-equities-shorting-abe-s-third-arrow.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorting+Abe%27s+third+arrow http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-equities-shorting-abe-s-third-arrow.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}