Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 11, 2016

US treasury returns boosted despite fed hike

Ongoing market jitters has seen US treasury yields decline as investors move towards safer assets, boosting bond returns in the process.

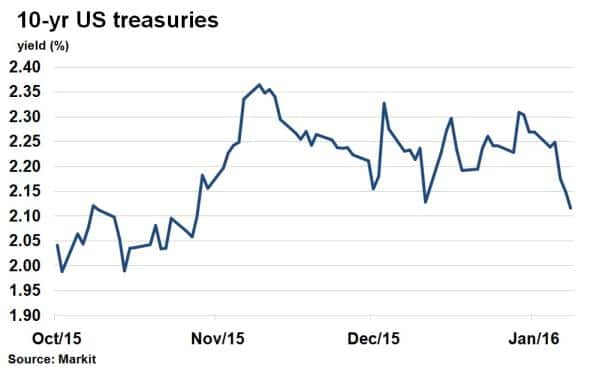

- 10-yr US treasury yields have fallen 18bps since the inaugural rate hike last month

- The Markit iBoxx $ Treasuries index has returned 0.84% so far this month, after three consecutive negative months

- US dollar exposed ETFs saw $2.8bn of inflows last week, with treasury funds leading the way.

Last month saw the US Fed raise its benchmark interest rate 25bps to 0.5% as it began the process of normalising interest rates. It marked an end of an era for easy credit, with expectations of higher future borrowing costs. Consequently, short term 2-yr treasury yields rallied above 1% for the first time in nearly five years.

Conversely, 10-yr US treasury yields have actually fallen 18bps since the hike on December 16th. Market jitters over the past month has seen investors return to safe haven assets such as US treasuries, on the long end where prices are less influenced by short term interest rates. Cross asset volatility arising from China, weak global PMI data to start 2016 and continued downward pressure on oil and commodity prices have all contributed in shifting sentiment away from risky assets and this has been the overriding theme so far this year.

The opposite movements of short term and long term yields has also resulted in a flatter US treasury yield curve, historically a leading indicator of pending economic recessions.

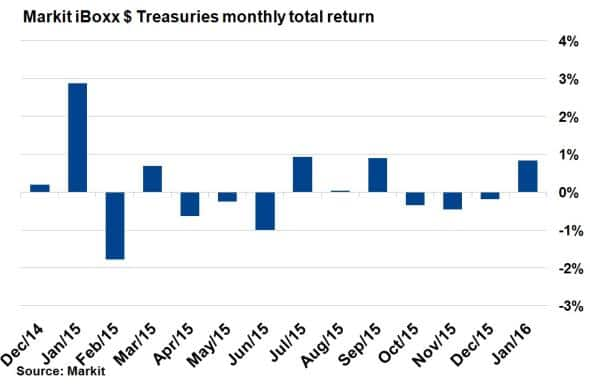

Suppressed long term US treasury yields have however done much to boost returns in the asset class as prices have risen. The Markit iBoxx $ Treasuries index has returned 0.84% so far this month, a welcome change after three consecutive months of negative returns. The index is on course for its best month since last January, when the monthly return was just shy of 3%.

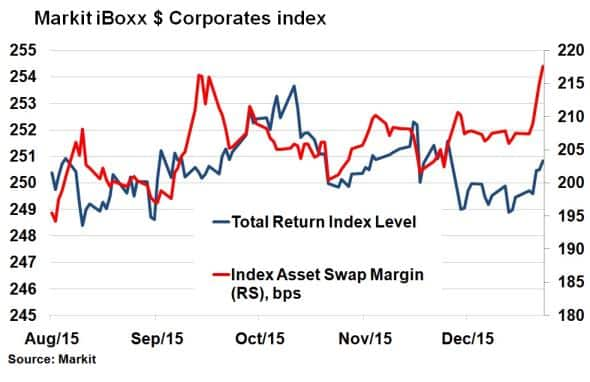

The move away from risky assets has seen corporate bond spreads widen but returns have remained positive thanks to the yield movement on underlying US treasuries.

The index asset swap margin on the Markit iBoxx $ Corporates index has widened 10bps this month to 217bps, while the total return index has risen from 249.5 to 250.8 over the same period. Essentially the positive effect of lower interest rates on returns has outweighed the negative effects of credit deterioration, keeping returns positive.

Investors pile in

Investors are also getting behind this rally as US dollar exposed bond ETFs saw over $2.8bn of inflows last week, the most in over three months according to data from Markit ETP. These flows were predominately tilted toward treasury exposed funds, which took over half of inflows, but investor also added to their corporate bond exposure as the asset class registered $407m of inflows in the first trading week of this year. The Fed may be signalling multiple rate hikes this year but the bond market remains cautious

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012016-credit-us-treasury-returns-boosted-despite-fed-hike.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012016-credit-us-treasury-returns-boosted-despite-fed-hike.html&text=US+treasury+returns+boosted+despite+fed+hike","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012016-credit-us-treasury-returns-boosted-despite-fed-hike.html","enabled":true},{"name":"email","url":"?subject=US treasury returns boosted despite fed hike&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012016-credit-us-treasury-returns-boosted-despite-fed-hike.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+treasury+returns+boosted+despite+fed+hike http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012016-credit-us-treasury-returns-boosted-despite-fed-hike.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}