Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 11, 2015

Some countries see costs rise despite commodity price falls

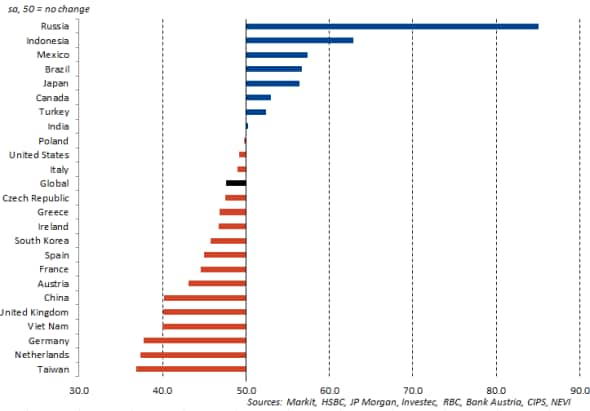

PMI data showed that worldwide manufacturing input prices fell for the first time in 20 months during January, dropping at the sharpest pace in two-and-a-half years. Anecdotal evidence from companies indicates that the reduction reflected the recent falls in the prices of oil and other commodities.

Declines in manufacturing input prices were most marked in Taiwan, the Netherlands and Germany.

However, not all countries are benefitting from the oil price slump: Of the 24 manufacturing economies covered by Markit PMI surveys, eight saw average input prices rise at the start of 2015. By far the sharpest increase in costs was seen in Russia, while marked rises were also recorded in Indonesia and Mexico.

Manufacturing PMI Input Prices Index, January 2015

Russian input prices soar

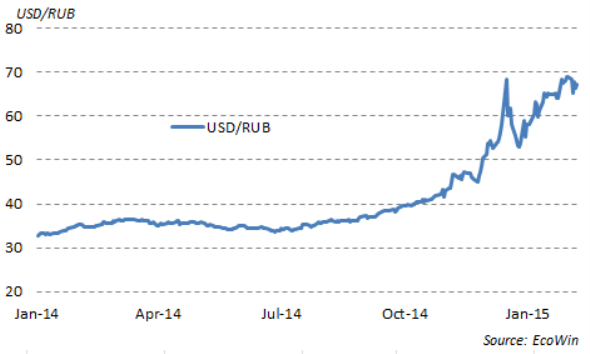

The surge in prices in Russia has gone hand in hand with a marked depreciation of the Russian ruble. A collapse in the oil price alongside the effects of EU trade sanctions has seen the ruble almost halve in value against the US dollar since mid-2014. This has led input costs to soar, with January's PMI data signalling the strongest monthly increase since October 1998. The Russian manufacturing industry has begun to struggle under the weight of these inflationary pressures, and output decreased for the first time in eight months during January.

Sharp depreciation of the ruble

Russian manufacturing output declines

Mexican manufacturing output rises sharply despite cost inflation

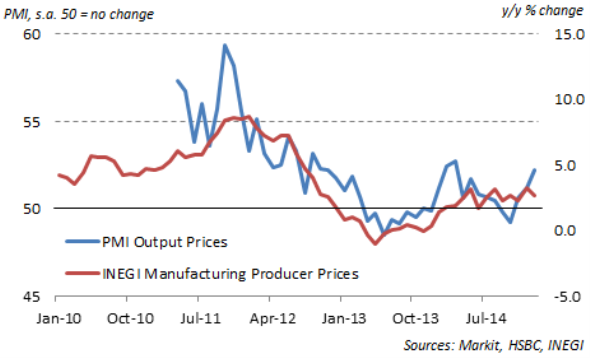

A depreciating currency has also led to accelerating cost inflation in Mexico. The rate at which input prices have increased has strengthened in two successive months, and January saw the sharpest rate of inflation since July last year. Firms have started to pass these rises onto their clients, with output prices rising at the fastest pace in ten months at the start of 2015.

Mexico prices

Where costs have increased, surveyed companies have often linked this to the depreciation of the Mexican peso against the US dollar which has pushed up the cost of imported raw materials. The peso has lost nearly 10% of its value against the dollar over the past three months, linked to falls in the price of oil and subsequent effects on the country's fiscal position.

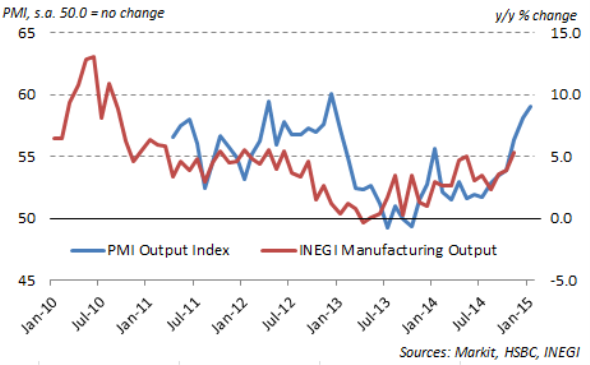

However, strong price rises don't seem to be affecting the ability of manufacturers to secure new business in Mexico. PMI data showed that manufacturing production increased for the fifteenth month running in January, growing at the sharpest pace since December 2012. Growth of output was linked by firms to rising new orders which expanded sharply at the start of the year. The data suggest that the annual rate of growth of manufacturing output has accelerated from the 5.3% rise signalled by official data in November of last year.

Mexico manufacturing output

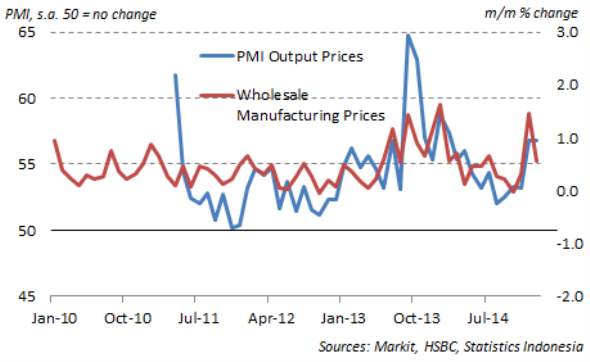

Indonesia see sharp cost rises, but inflation may have peaked

Input costs also rose sharply in Indonesia's manufacturing sector during January.

The removal of state fuel subsidies has meant that the savings from the recent falls in the price of oil have been less in Indonesia than elsewhere. The rate of manufacturing input cost inflation hit a ten-month high in December and remained elevated in January, despite easing slightly over the month. Similarly, the rate at which companies increased their prices charged was unchanged from December's ten-month peak.

Indonesia prices

The authorities in Indonesia will hope that the extent of price rises will moderate in coming months, helping to ease pressure on a sector which has seen output decline for four consecutive months.

While a speedy resolution to the issues facing Russia looks unlikely, Indonesia could potentially see cost inflation ease in the coming months. Meanwhile, any intensification of price rises in Mexico could limit the strong growth of output and new work seen in the manufacturing sector recently. February PMI data covering manufacturers around the world will be released on 2nd March.

For more information please contact economics@markit.com.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-economics-some-countries-see-costs-rise-despite-commodity-price-falls.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-economics-some-countries-see-costs-rise-despite-commodity-price-falls.html&text=Some+countries+see+costs+rise+despite+commodity+price+falls","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-economics-some-countries-see-costs-rise-despite-commodity-price-falls.html","enabled":true},{"name":"email","url":"?subject=Some countries see costs rise despite commodity price falls&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-economics-some-countries-see-costs-rise-despite-commodity-price-falls.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Some+countries+see+costs+rise+despite+commodity+price+falls http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-economics-some-countries-see-costs-rise-despite-commodity-price-falls.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}