Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 11, 2016

Gold shines on mining credit

The market has rekindled its love affair with gold in its quest for safe assets which has driven a wedge between the bonds tied to the commodity's miners and the wider mining sector.

- Investors have piled $4.2bn into gold ETFs ytd as the commodity surged by 16%

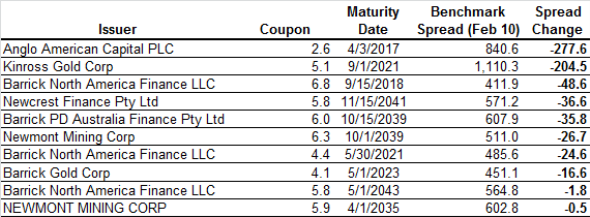

- Gold bonds make up nine of the ten constituents of the iBoxx $ Mining index seeing ytd spread tightening

- Non gold related Rio Tinto, Vale and HBP Billiton have continued to see credit risk climb

The market is in full "capital preservation" mode and gold is regaining its appeal as investors shun all but the safest asset classes.

Investors have piled over $4.2bn into ETFs tracking the asset class since the start of the year and demand shows no signs of slowing down as a quarter of these inflows have come this week alone. This rekindled fondness for the shiny stuff puts gold ETFs on track for their best quarterly inflow since the third quarter of 2012.

Gold's appeal has also seen its price jump by over 16% since the start of the year, propelling the asset class to the top of the global return rankings. This has in turn seen gold producers under a much more favourable light with credit risk across major issuers falling significantly in recent weeks.

CDSs spreads of two of the three largest issuing companies, Barrick Gold and Newmont Mining have fallen significantly in the wake of Gold's recent rally. While both firms currently see their CDS spreads trade wider than the levels seen 12 months ago, the recent tightening is reverting most of the surge in credit risk which was seen at the tail end of last year.

Credit improvement

The improving credit situation is reflected in the wider bond market as nine of the ten constituent bonds of the Markit iBoxx $ Mining index have come from gold mining issuers as they trade with a tighter benchmark spread since the start of year.

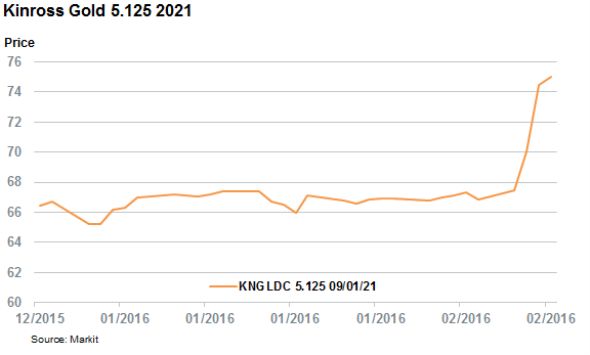

Kinross Gold's 5.125% 2021 bond leads the spread tightening among gold bonds as its price jumped by 8.6 cents on the dollar since the start of the year. The firm offered a bullish outlook for the year ahead in its fourth quarter earnings update as it looks to put its past troubles behind it.

Gold lifts mining bonds

The improving credit sentiment towards gold miners is helping prop up the rest of the mining sector as the $ Mining index has returned 1.2% so far in February.

This comes despite the fact that its three largest constituent issuers, Rio Tinto, BHP Billiton and Vale have seen their credit risk, as tracked by their CDS spreads, surge to new highs. The industrial metals mined by these firms continue to slide as the global growth outlook deteriorates.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022016-Credit-Gold-shines-on-mining-credit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022016-Credit-Gold-shines-on-mining-credit.html&text=Gold+shines+on+mining+credit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022016-Credit-Gold-shines-on-mining-credit.html","enabled":true},{"name":"email","url":"?subject=Gold shines on mining credit&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022016-Credit-Gold-shines-on-mining-credit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Gold+shines+on+mining+credit http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022016-Credit-Gold-shines-on-mining-credit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}